Last week’s review of the macro market indicators which heading into the last week of April saw the Equity indexes were showing signs of rotation out of the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) and SPDR S&P 500 (NYSE:SPY) and into the iShares Russell 2000 (NYSE:IWM). Elsewhere looked for gold (NYSE:GLD) to consolidate in a $30 range while crude oil (NYSE:USO) continued higher. The US Dollar Index (NYSE:UUP) continued to test the bottom of a wide consolidation range while US Treasuries (NYSE:TLT) were biased lower. The Shanghai Composite (NYSE:ASHR) and Emerging Markets (NYSE:EEM) were biased to the downside with risk of the Emerging Market longer term uptrend re-exerting itself.

Volatility (NYSE:VXX) looked to remain subdued and with a bias lower keeping the bias higher for the equity index ETFs SPY, IWM and QQQ, despite the moves the prior week. Their charts were mixed with the IWM just strong all around and the SPY strong on the weekly timeframe but with cracks on the daily. The QQQ was the weakest on the daily and showed consolidation on the weekly. Perhaps the new week would rotate back into the QQQ.

The week played out with gold holding the range but then pushed higher late to end the week up while crude oil continued higher. The US dollar moved lower to the bottom of the consolidation range while Treasuries started the week moving lower but reversed mid-week to end up slightly. The Shanghai Composite spent the week consolidating the move lower, looking like a bear flag, while Emerging Markets started higher but gave it all back and then some to end the week down.

Volatility was steady at the start of the week but ramped up a 1 month high by Friday. The Equity Index ETFs started the week where they left off, with the IWM rising, SPY steady and QQQ falling. But that turned into a party to the downside with all ending the week lower. What does this mean for the coming week? Lets look at some charts.

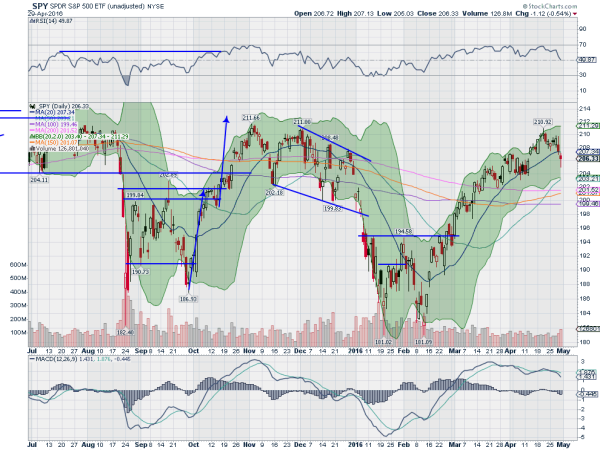

SPY Daily

The SPY started the week with a Hollow Red Hammer candle indicating intraday strength. It followed that up Tuesday with a small move higher confirming a reversal. A bullish engulfing candle Wednesday boded well for another leg higher, but Thursday saw a turn lower to the 20 day SMA and Friday continued lower, closing the gap from earlier in April, and forming another Hammer.

The price is above all the SMA’s except for the 20 day SMA, and there was a Golden Cross, with the 50 day SMA pushing up through the 200 day SMA this week. That is the good news. This has created another lower high. Momentum is fading as the RSI on the daily chart is falling and crossing the mid line. It is still in the bullish zone but deteriorating. The MACD is rolling over as well. Should it reverse next week without first breaking 203.09 it would create a positive RSI Reversal looking for a higher high.

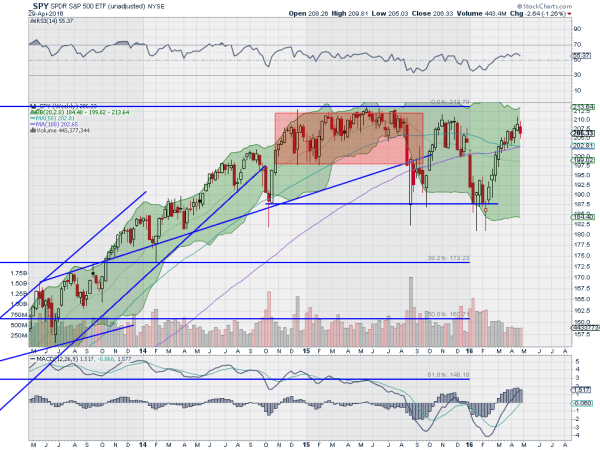

On the weekly chart there is an Evening Star reversal confirmed. The RSI is rolling over as the MACD continues higher. There is resistance above at 207.60 and 208.50 followed by 210.5 and 211.60. Support lower comes at 206 and 203.75 followed by 201.50 and 200. Pullback in the Uptrend.

SPY Weekly

As the calendar turns to May the equity markets are looking worn out and in general better to the downside. Elsewhere look for gold to continue its uptrend while crude oil moves higher as well. The US Dollar Index is on the cusp of a major breakdown while US Treasuries churn with a bias to break to the upside. The Shanghai Composite looks to continue to consolidate along with Emerging Markets but look for the latter to be biased to eventually break that consolidation higher.

Volatility looks to remain subdued but not at the lows keeping the bias higher for the equity index ETFs SPY, IWM and QQQ, despite the moves lower. Their charts are more mixed with the QQQ firmly heading lower, the SPY pulling back in its uptrend and the IWM stalling. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.