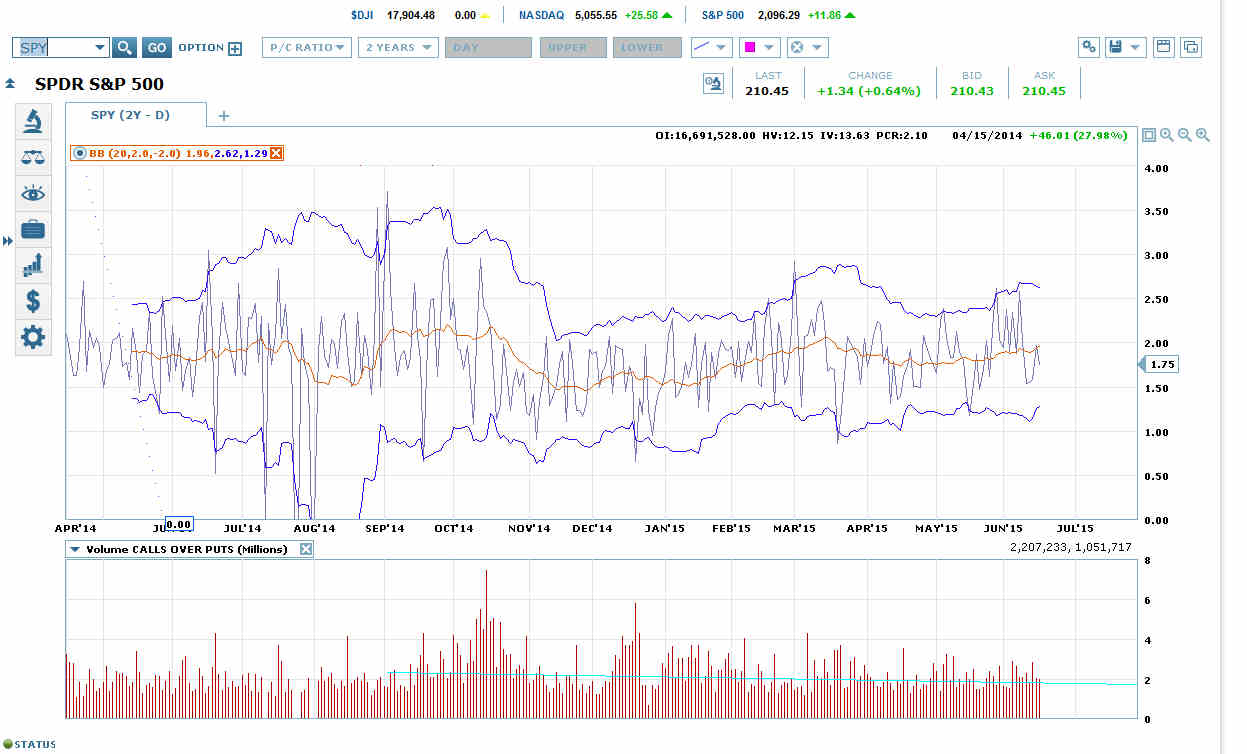

The ARCA:SPY put-call ratio dropped to 1.75 on Tuesday, which is below its 20 dma. This would usually be bearish for the price heading into Wednesday of opex week.

The drop in the ratio happened on a strong rise in open interest. SPY put volume dropped by a modest 5%. SPY call volume rose by 7%.

One thing to keep in mind is that any dip tomorrow will probably get bought, as this is a triple witching week, and you tend to see melt-downs in the SPY put-call ratio on triple-witching Thursdays. This tends to happen in the context of a price rise.

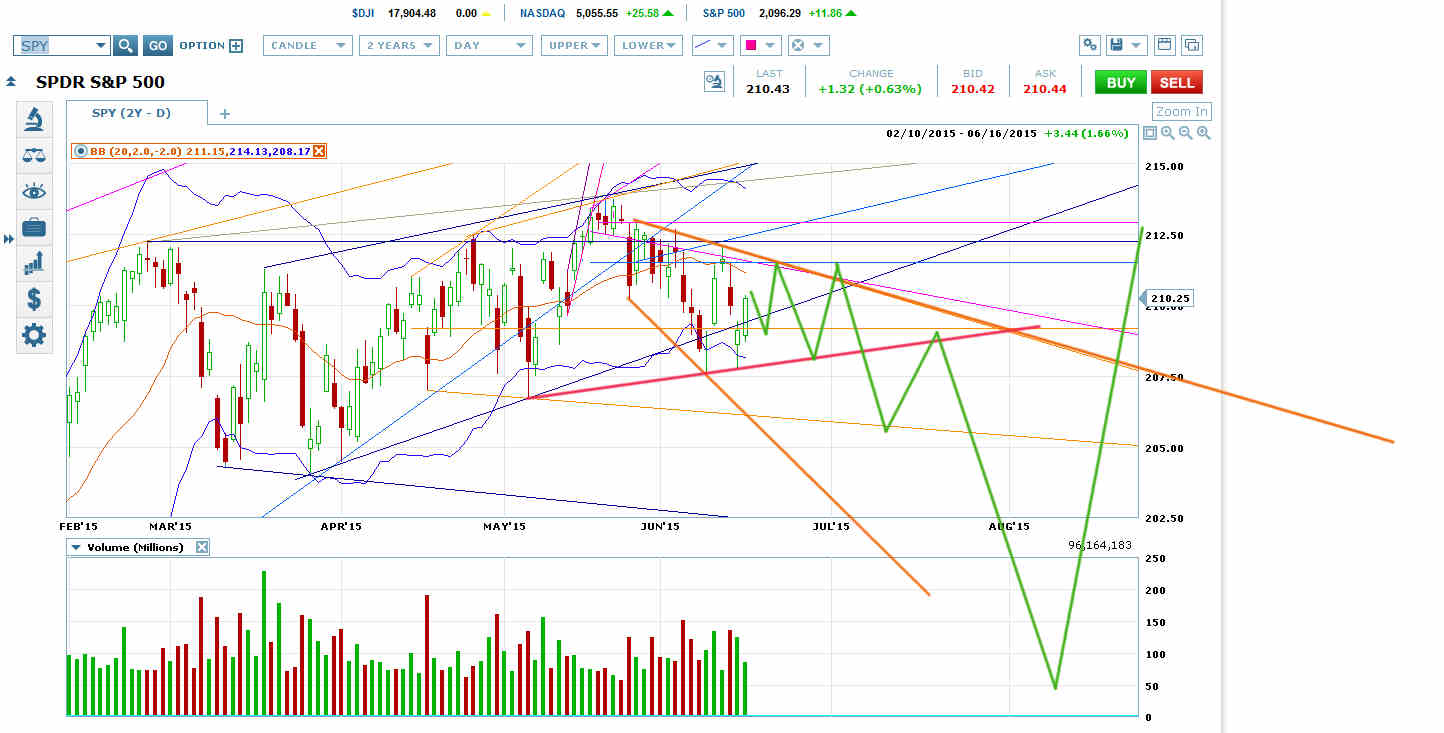

Since the SPX is unlikely to fall enough tomorrow to reach its target of the March low, it is highly likely to be putting in a triangle here:

The potential triangle is forming within a potential falling megaphone (orange). The price would often get all the way to and through the orange falling megaphone bottom on its final wave down, but the move down can also peter out in the middle of the formation.

The failed breakout from the SPX ascending triangle gives a standard minimum target of taking out the March low.