Last week’s review of the macro market indicators suggested, heading into next week the equity markets were becoming bifurcated. Elsewhere looked for Gold to continue in a range along with Crude Oil although the latter had a bias to the upside short term. The US Dollar Index looked to continue to gain strength while US Treasuries were biased lower in the short term in their uptrend. The Shanghai Composite looked weak and was biased lower while iShares MSCI Emerging Markets (ARCA:EEM) were biased to the upside in their consolidation range. Volatility S&P 500 looked to remain quite low keeping the bias higher for the equity index ETF’s S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts were not so enthusiastic though with the SPY the strongest and only looking to continue its consolidation while the QQQ consolidated with a downside bias and the IWM was looking for more downside.

The week played out with Gold continuing in a tight range around 1300 while Crude Oil moved higher and then consolidated. The US Dollar continued higher to resistance while Treasuries found support and launched higher, ending the week with topping candles. The Shanghai Composite started higher but gave back most of it before the end of the week while Emerging Markets continued higher. Volatility made a new two month low before rebounding slightly and then returning lower. The Equity Index ETF’s started the week well but quickly turned back lower with a bounce Friday to end the week on a positive note. What does this mean for the coming week? Lets look at some charts.

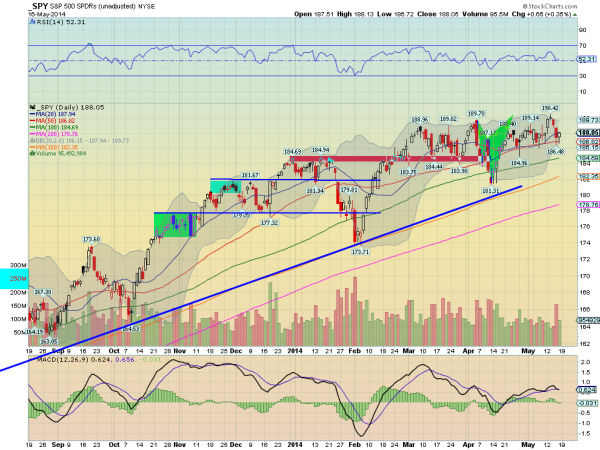

The SPY started higher and made a new all-time high before falling back into the consolidation range. Short term since mid April, there are now a series of higher lows and higher highs in that consolidation. The RSI is holding the mid line and the MACD about to cross down. A mixed message. The 20 and 50 day SMA’s continue to provide support. The weekly chart printed another small body candle at the highs. The RSI is moving sideways in the bullish zone with a MACD that is level after a fall. There is resistance at 188.90 and 190.42. A move over that continues the bullish trend. Support lower comes at 186.75 and 185 followed by 184 and 181.80. Consolidation in the Long Term Uptrend.

Heading into Memorial Day Weekend, and the official start of ‘work 4 days and then head to the Hamptons’ the equity markets have recovered a bit but not turned around fully. Look for Gold to continue its consolidation while Crude Oil remains biased higher. The US Dollar Index and US Treasuries also look higher with Treasuries perhaps ready for another short term pullback. The Shanghai Composite looks to consolidate over 2000 and Emerging Markets are biased to the upside. Volatility looks to subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their individual charts tell a different story with all in consolidation including the SPY, but the QQQ’s biased higher while the IWM is biased lower. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.