The stock market, it seems, is hitting milestones every month but is pulling back into the weekend. Despite the fact that stocks go up and down, no one invested in the market is ever happy when prices are falling. So as the S&P 500 pulls back, moods are getting worse.

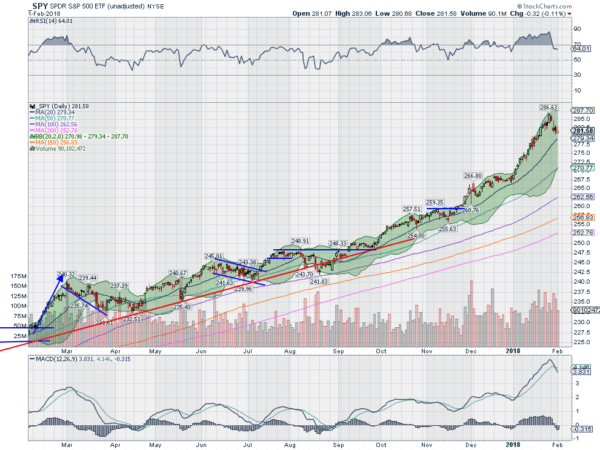

But the pullback, from a technical perspective, is not really a bad thing – yet. Coming into Friday US open, the SPY was closing in on its 20-day SMA. It had been extended with the quick move higher in January. This pullback has allowed momentum indicators to reset. The RSI was deeply overbought and is now back in the strong bullish range. The MACD has come off of its high as well.

Of course every pullback from a top looks benign as it begins, so how is this one different? It may not be. It may continue to move lower. Maybe all the way back to the 50-day SMA at 270. That would mean the SPY retraced the entire month of January gains. The elusive 5% correction would be there. And it still would not have touched the better-than-20% gain from 2017.

No one can tell for sure where a pullback will end. What we do know is that the fundamentals in the market are very good. Companies are beating earnings estimates and then raising their guidance. Interest rates, although rising, are still very low. Inflation is still more of a worry than a real thing. All of this plays a role in how investors perceive the economy, and then what they do with their investments. For now there is a measured pullback underway, with what seems like late-day institutional buying. That could change at any point. If it does this weekend, I will be at the beach.