Last week’s review of the macro market indicators suggested, heading into the Memorial Day Weekend, and the official start of ‘work 4 days and then head to the Hamptons’ saw the equity markets recovering a bit but not turned around fully. It looked for Gold to continue its consolidation while Crude Oil remained biased higher. The US Dollar Index and US Treasuries (ARCA:TLT) also looked higher with Treasuries perhaps ready for another short term pullback. The Shanghai Composite looked to consolidate over 2000 and Emerging Markets (ARCA:EEM) were biased to the upside. Volatility S&P 500 looked to continue to be subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their individual charts told a different story with all in consolidation including the SPY, but the QQQ’s biased higher while the IWM was biased lower..

The week played out with Gold continuing sideways while Crude Oil broke its consolidation and moved up. The US Dollar also broke its flag and moved higher while Treasuries pulled back but found a bottom at a higher low. The Shanghai Composite continued to bounce along the 2000 level while Emerging Markets continued the stair step higher. Volatility fell to a 14 month low. The Equity Index ETF’s responded with the SPY printing a new all time high and the IWM and the QQQ turning back higher. What does this mean for the coming week? Lets look at some charts.

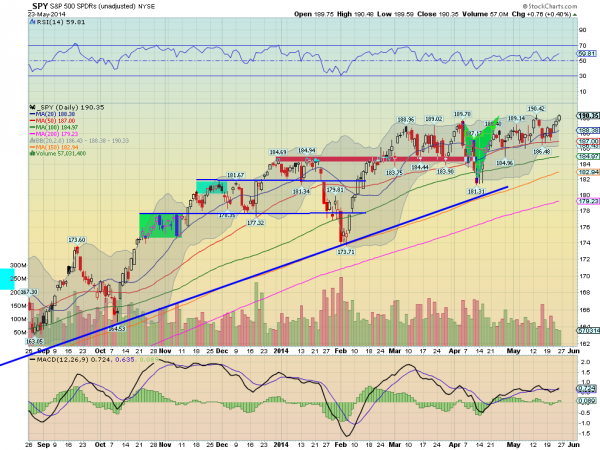

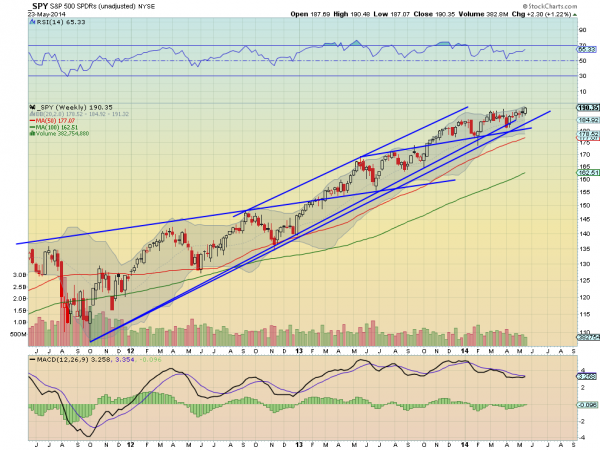

The SPY started the week by confirming the Hammer from last Friday higher but reversed Tuesday. Wednesday through Friday though printed a bullish 3 Advancing White Soldiers candlestick pattern, looking for continuation higher. It ended the week with a new intraday and closing all-time high. The daily chart shows a RSI that bounced off of the mid line and is near a move over 60, that could be very bullish. The MACD has crossed higher, adding to the check marks in the bullish column. The weekly view is also pointing higher. The candle on the week broke the consolidation in a series of small body candles with a beefier real body and closed near the top, virtually no upper shadow unlike the prior 4 weeks. The RSI on this timeframe is firmly in the bullish range and heading higher while the MACD is about to print a bullish cross up as it starts to rise. There is no resistance higher but a Measured Move to 197.30 from the weekly chart. Support lower comes at 188.90 and 186.75 followed by 185. Continued Upward Price Action.

As we kick off summer and head into the shortened Holiday week the equity markets look solid and positive. Elsewhere Gold looks stuck in a holding pattern while Crude Oil continues to rise. The US Dollar Index and US Treasuries are both biased higher. The Shanghai Composite is doing a good job of holding support but showing no signs of strength while the Emerging Markets are biased to the upside. Volatility looks to remain subdued and biased lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts agree with the SPY and QQQ looking strong on both timeframes while the IWM lags on the weekly timeframe. The Dollar, Treasuries and Oil moving higher will cause many to raise caution on equities as they do not all move together in theory. But they can advance for long period before any change. Stick to what the price action is saying. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.