Last week’s review of the macro market indicators suggested, heading into the "Sell in May and Go Away" season that the equity markets were looking better. We looked for Gold to consolidate in its uptrend with a bias higher while Crude Oil continued lower. The US Dollar Index seemed biased lower while US Treasuries ($TLT) were biased higher. The Shanghai Composite and Emerging Markets were both biased to the upside. Volatility ($VIX) looked to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). The indexes themselves all looked better to the upside in the short term with the SPY strongest followed by QQQ and then IWM.

The week played out with Gold starting higher before finding resistance and falling back while Crude Oil found support and bounced slightly. The US Dollar found a bottom and moved slightly higher while Treasuries pulled back from overhead resistance. The Shanghai Composite basically moved higher all week while Emerging Markets continued the drift higher. Volatility continued sideways under the moving averages. The Equity Index ETF’s continued their recent pattern with the SPY and QQQ running in a range, but the IWM continuing lower. What does this mean for the coming week? Lets look at some charts.

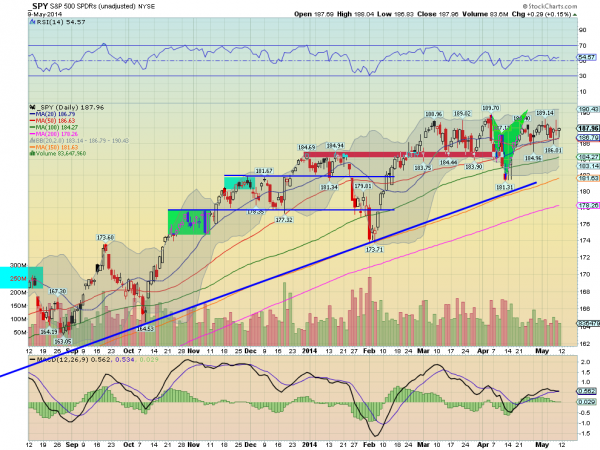

The SPY continued to move sideways on the week, holding over the tightly bound 20 and 50 day SMA’s. Combined with the last 2 weeks the consolidation following the dip lower continues. The daily chart shows that the Bollinger bands, a measure of volatility have remained wider since the dip, despite the VIX at lows not seen since late January. The RSI on the daily chart is moving sideways, holding over the mid line and in the bullish zone with the MACD looking like it will kiss the signal line and bounce instead of cross down. The weekly front shows the consolidation at the highs going on since mid February. The RSI on this timeframe is rising again in the bullish zone while the MACD is flat but under the signal. There is support at 186.75 and 185 followed by 181.80. Resistance comes higher at 188.90, which held it Thursday, and 189.70 before a break out higher. Continued Consolidation in the Uptrend.

Heading into next week the equity markets are becoming bifurcated. Elsewhere look for Gold to continue in a range along with Crude Oil although the latter has a bias to the upside short term. The US Dollar Index looks to continue to gain strength while US Treasuries are biased lower in the short term in their uptrend. The Shanghai Composite looks weak and is biased lower while Emerging Markets are biased to the upside in their consolidation range. Volatility looks to remain quite low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are not so enthusiastic though with the SPY the strongest and only looking to continue consolidation while the QQQ consolidates with a downside bias and the IWM looking for more downside. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.