Equity funds (including ETFs) witnessed their first weekly net inflows in 14 for the Refinitiv Lipper fund-flows week ended Wednesday, November 11, 2020. They attracted some $23.8 billion, their strongest weekly net inflows since the week ended December 27, 2017, and third largest on record.

Investors cheered the announcement by Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) of their successful Phase 3 study of a COVID-19 vaccine, which was reported to have a 90% effective rate of preventing infection. The firms’ plan to request Emergency Use Authorization from the Food and Drug Administration pushed U.S. markets to near-new highs, with the Russell 2000 Price Only Index posting the strongest returns of the broadly followed U.S. indices, returning 7.54% for the fund-flows week.

The vaccine-related rally gave small-cap, value, cyclical, and other out-of-favor issues a boost as investors initially turned their backs on the recently popular “stay-at-home” and technology issues, with the NASDAQ Composite Price Only Index (+1.70%) posting the weakest returns of the group.

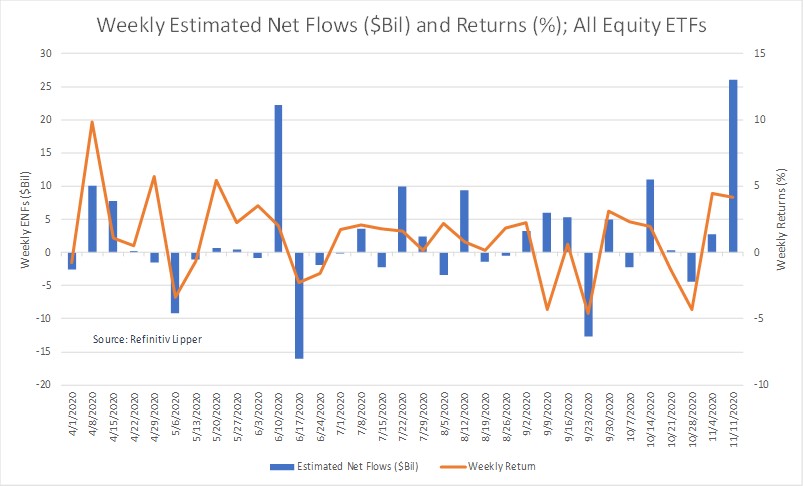

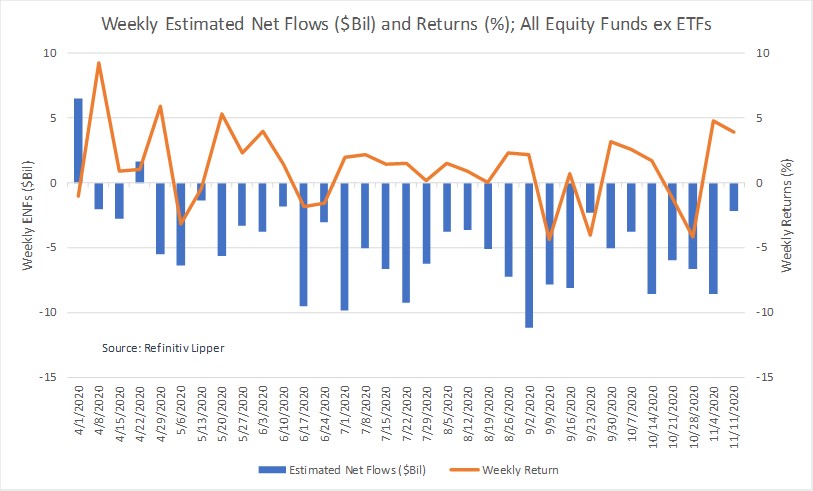

Nonetheless, weekly net flows for equity funds and ETFs remained lopsided, with conventional equity funds (ex-ETF) suffering their twenty-ninth consecutive week of net outflows, handing back $2.2 billion during the week. Lipper’s Large-Cap Growth Funds (-$790 million) classification suffered the largest redemptions of the conventional equity funds classifications for the week.

Conversely, for the second week in a row, equity ETFs attracted some $26.0 billion for the most recent fund-flows week, their largest weekly net inflows since November 16, 2016. SPDR S&P 500 ETF (SPY, +$13.7 billion) took in more than half of the net money for the week of all individual equity ETFs, followed by iShares Russell 2000 ETF (IWM, +$1.3 billion). At the other end of the spectrum, Invesco QQQ Trust 1 (QQQ, -$1.4 billion) experienced the largest individual net redemptions.