First, as expected, November didn't wind to a close with despair… but celebration. The Invesco QQQ ETF (QQQ) – the proxy for the Nasdaq 100 – exited the month with a double-digit gain after setting a new 52-week high. Not only that, but the tech heavyweights ended November with a gain for the eleventh time in the last 12 years.

But December can be a tricky month for the markets. I tend to think of it as a moody, delicate one.

With holiday spending a vital catalyst – a make-or-break moment for many a retailer – there are typically headlines as we race toward the big days that holiday spending will fall short. Though, we already know that it’s off to a record-breaking start.

Americans dropped a record $9.8 billion on Black Friday. That was an increase of 7.5% from 2022. But the spending spree didn’t end there. On Cyber Monday, consumers shoveled out a record $12.4 billion. And during the stretch from 10:00 AM to 11:00 AM EST rang the digital register at $15.7 million per minute.

When all was said and done, for Cyber Week, Americans spent $38 billion, up 7.8% from a year ago. And one of the most important takeaways was foot traffic in stores increased a mere 2%...Meanwhile, smartphones accounted for 51.8% of all sales.

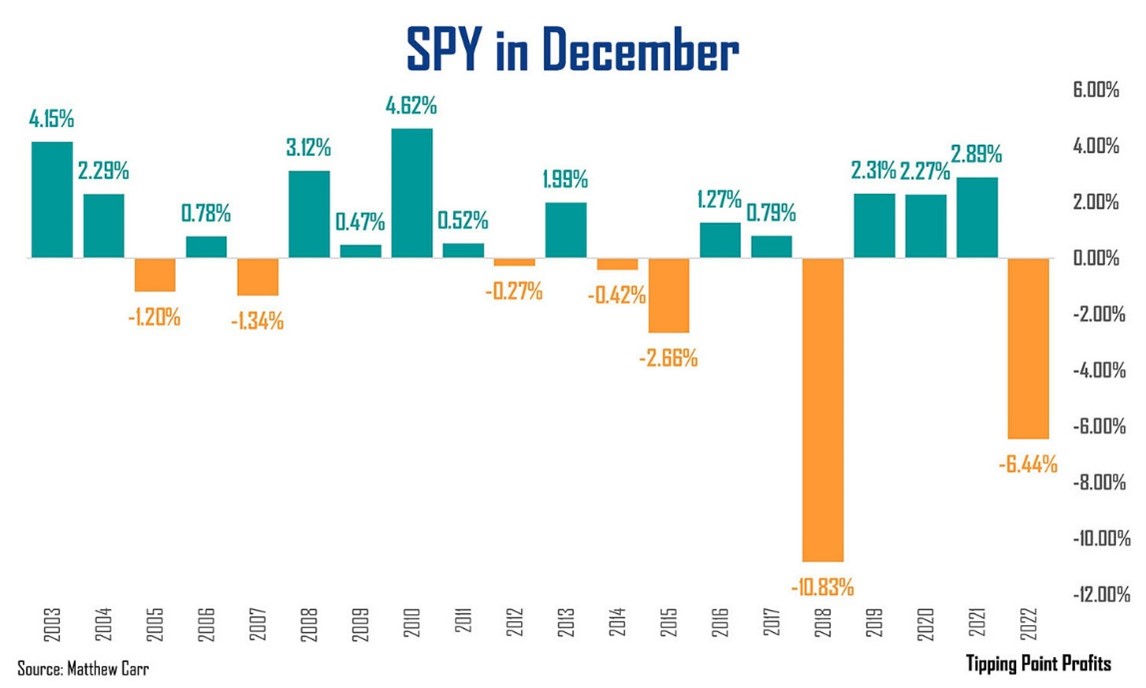

Encouraging. As for the SPDR S&P 500 ETF (SPY (NYSE:SPY)), it has averaged a gain of 0.22% in December. That may not seem like much. But that’s a better performance than January, February, June, August, or September. It ranks as the seventh-best month for blue chips.

Now, the most important aspect of this Christmas Carol is that unnerving swings lower by the S&P during December are rare. And the only real nightmares before Christmas over the last 20 years were the 6.44% drop in 2022 and the notoriously bad 10.83% decline in 2018, which included the worst Christmas Eve session on record.

All-in-all, this equates to a 65% chance of success for the S&P. For comparison, the average chance for a gain for the SPY in any given month during the past 20 years is 64.6%. So, that’s slightly better than average.

And though inflation is still not yet to the level the Federal Reserve would like, we’re not in the same situation in 2022 or mired in a trade war with China as in 2018.

More often than not, December has been a profitable gift for investors to close out the year whether you’re in blue chips or tech. So, don’t expect coal in your stocking this year.