Well, down anyway. An emissions scandal at Volkswagen (XETRA:VOWG) (the world’s largest auto maker), the announcement from Caterpillar (NYSE:CAT), which is laying off 10,000 workers, a 5,000% price increase in a 62-year-old drug, the resignation of the US Speaker of the House and Janet Yellen reaffirming a rate hike before the end of the year… what’s not to be bullish about?!

I find no reason to expect anything more than a slight hesitation in the decline, which began two weeks ago until early next week, Oct 5/6. Oct 5 is exciting as it would be the first low forecast with the Hybrid Lindsay model centered on the bull market high (5/19/15). The intermediate lows of the 1929-1932 bear market were all forecast using this model centered on the bull market high in September 1929. A low on Oct. 5/6 is also forecast with a Middle Section centered on the high of the previous Basic Cycle, 5/2/11.

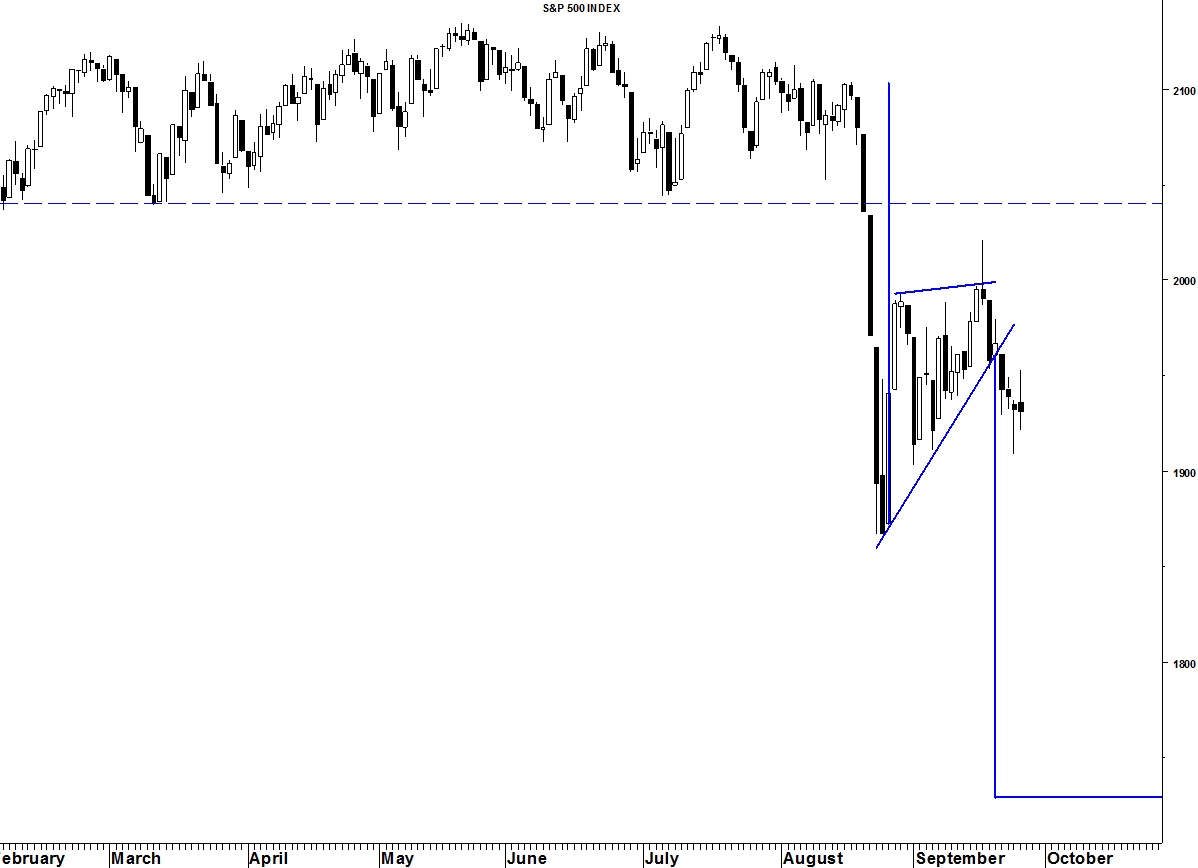

A break of 1,850-SPX opens the door for a return to the Jan’14 low near 1,750, which corresponds to the measured move from the bearish pennant formation.