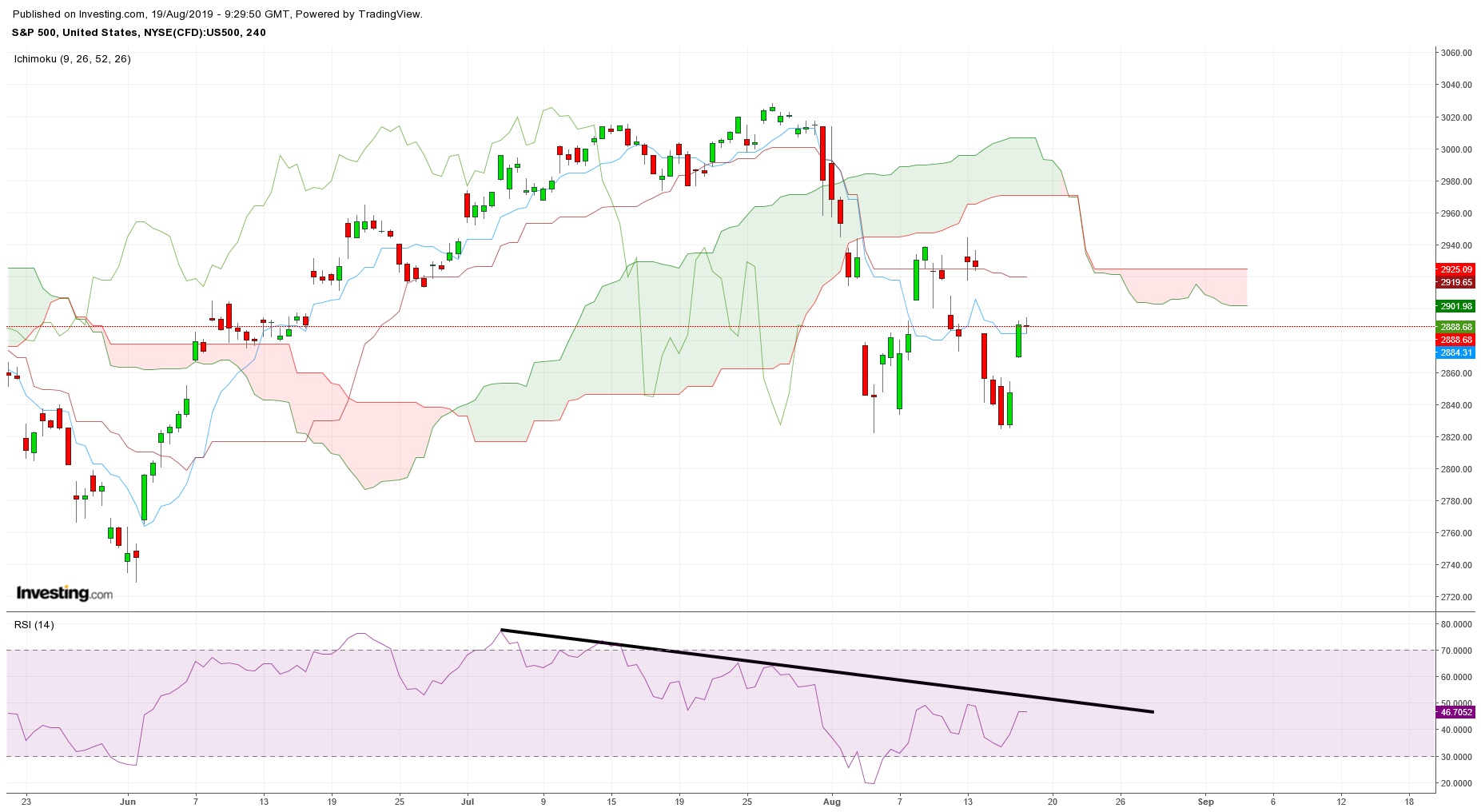

SPX has come back from 2820 back above 2900. Bulls face important resistance here at 2930-2940. They need to break above it. A rejection here would be a bearish sign, which will give me new lows as target below 2820.

The RSI is approaching key resistance trend line once again. The index is trying to break above the cloud. Will it manage to stay above it? Bulls do not want to see price below the cloud again. The spot price chart of SPX gives us different clues and sometimes I tend to keep that chart in more respect than the one of the futures price.

Here key resistance is at 2940-2967. Price needs to break above the cloud in order for any fears for more downside to be erased. A reversal back below 2900 will keep those fears alive. The bearish pattern we explained in a previous post remains intact as long as we do not break above 2940.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.