How Stocks Perform After A Big Influx Of AAII Bulls

As we noted in this week's edition of Monday Morning Outlook, the number of self-proclaimed bulls in the American Association of Individual Investors (AAII) weekly sentiment survey skyrocketed last week. In fact, the bullish tally jumped 15.2 percentage points to 43.1% -- marking the biggest one-week increase in stock market optimism since November 2016, around the presidential election. Below is how the S&P 500 index (SPX) tends to perform after these rare sentiment signals.

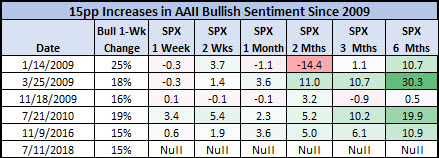

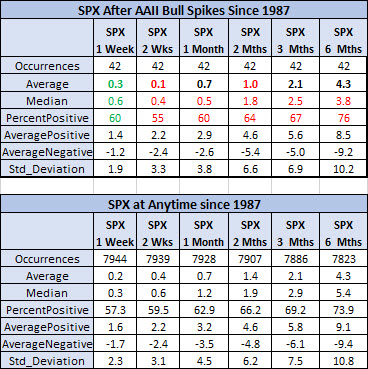

Since 1987, there have been just 42 times where bullish AAII sentiment increased by 15 percentage points in one week (looking at only one signal per month). Prior to the November 2016 signal, the last time this happened was July 2010. The signal also sounded three times the year prior -- including in March 2009, at the stock market bottom -- and the S&P was positive six months later after all of those signals, per data from Schaeffer's Quantitative Analyst Chris Prybal.

Looking at SPX performance after all signals since 1987, it seems the index tends to slightly outperform one week after big spikes in AAII bulls. Specifically, the S&P averaged a one-week post-signal gain of 0.3%, compared to an average anytime one-week gain of 0.2%, looking at returns since 1987.

However, at the rest of the "checkpoints" after a signal, the SPX was either in line with the norm, or underperforming. Most notably, two months after a sharp spike in AAII bulls, the S&P averaged a gain of just 1%, compared to an average anytime return of 1.4%. Meanwhile, the median returns after a signal are lower at nearly ever marker, as is the percentage of positive returns vs. anytime.

Still, as alluded to earlier, the five most recent signals didn't deter the S&P from its long-term path higher. In fact, the SPX went on to rally 10.9% six months after the last signal, and surged nearly 20% after the 2010 spike in AAII bulls. Since 2003, only two of these signals have preceded six-month losses for the SPX: in January 2006 and in April 2008, just before the financial crisis.