Calling for Donald Trump’s impeachment intensified after the President fired FBI’s director James Comey on May 9th in a move resembling Richard Nixon’s firing of special prosecutor Archibald Cox, who was appointed to investigate the Watergate scandal in 1973. A week later, as if to make things even worse, Trump allegedly revealed highly classified information to Russian officials. “As a result” – mainstream media claims – volatility returned to the stock market, causing the S&P 500 to plunge from 2406 to as low as 2346 as of this writing. People call it the Trump-selloff now.

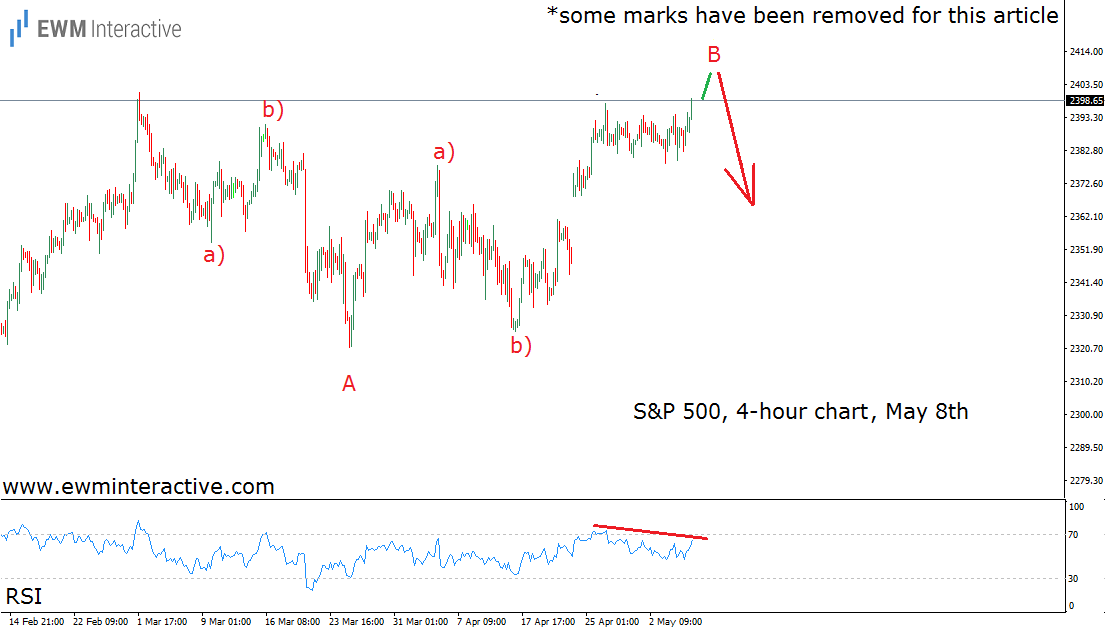

As traders, we are much more interested in the price action, so let’s leave politics aside and ask the following question: could the current stock market decline be anticipated prior to the news about Donald Trump’s mischief? Well, Comey was fired on May 9th and the rest of the mess became public several days later. The following Elliott Wave chart, on the other hand, was sent to clients before the market opened on Monday, May 8th.(some marks have been removed for this article)

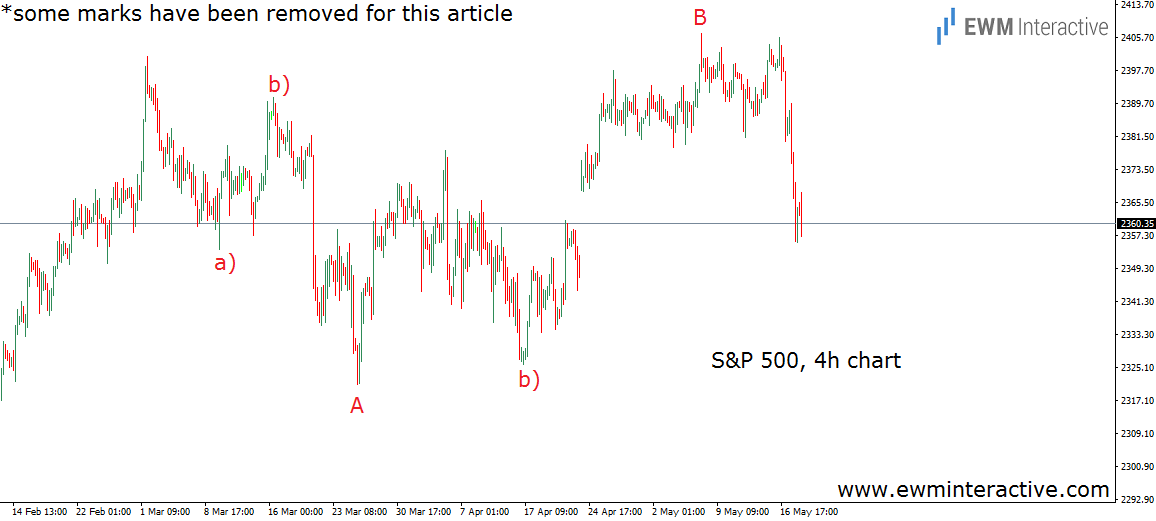

Technically, it was May 7th when the analysis was made. As visible, nearly two full days before Comey’s firing, the Wave Principle, combined with a bearish RSI divergence, suggested that instead of buying the S&P 500 near all-time highs, traders should stay aside, because a significant slump was likely. Ten politically tense days later, here is how the S&P 500 looks like today.

2407 turned out to be the best the bulls were capable to achieve. Their second attempt to push the benchmark higher failed at 2406, where the bears stepped in. In this respect, the events surrounding the White House could not be considered to be the reason for a crash, which was supposed to happen anyway. In our opinion, Trump is far more unpredictable than the market. That is why we prefer to rely on the Elliott Wave principle and stay ahead of the news.