Yesterday in our report we said the market is getting “Frothy” per the CBOE Put/Call ratios in yesterday’s report. Above is CNN’s Fear & Greed index which helps to point out the “Frothiness” in another way. Upside is limited for now and market needs to burn off this frothiness before it can move higher. Market declines don’t usually begin until the McClellan Oscillators closes below “0” (current reading is +66.25). Being patience for now. Follow us on twitter. @OrdOracle.

The point of the above chart is to show that market declines usually don’t start with the McClellan Oscillator above “0”. The top window is he NYSE McClellan Oscillator (traditional) closed yesterday at +66.25. Next window down is the Common stock only McClellan Volume Oscillator with a reading of +43.41. Second window up for the bottom is the Common stocks only McClellan Oscillator, which closed at 34.25; all these McClellan Oscillators are above “0”. We have circled in red at the May and July SPX highs and notice that the all the McClellan Oscillators are below “0” and the market move lower afterwards. Market is frothy here but not set up for a decline at least not yet. Being patience for now. Join us on twitter. @OrdOracle.

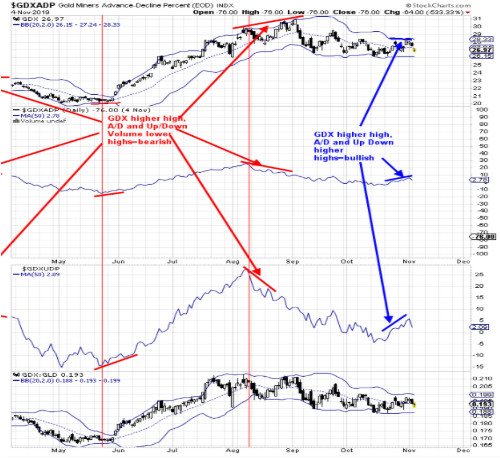

We showed this chart yesterday but this one goes back 7 months instead yesterday’s one year. Yesterday we said, “The second window down from the top is the VanEck Vectors Gold Miners ETF (NYSE:GDX) Advance/Decline Percent with a 50 day average. This indicator has been useful for reversal in GDX when there is a divergence. A divergence showed up at the late March and September highs where GDX made higher highs and Advance/Decline Percent made lower highs. The next window down is the GDX Up Down Volume percent with a 50 day average. This indicator works the same as the GDX Advance/Decline percent; when there is a divergence the market is nearing a reversal. Last week GDX produced a test of a previous high of the previous week. This test produced a higher high on the Advance/Decline percent as well as the Up Down Volume percent, showing the market is stronger on the second high and a bullish divergence. According to both indicators GDX should move higher short term.” NEM earnings came out today and missed their estimate and stock fell near 4%. NEM represents 11.26% of GDX holdings. The internals for GDX look generally good. We don’t have it shown, but the Bollinger® Band Width is setting at a four month low and suggests a trending move in GDX is not far off. The pattern that appears to be forming on GDX is a bullish “Falling Wedge”. This pattern has an upside target to where the pattern began, which in this case is near the 31.00 level. Long GDX on 1/29/19 at 21.97. ord-oracle.com. New Book release "The Secret Science of Price and Volume" by Timothy Ord.