- SPX Monitoring purposes; Monitoring purposes; Sold long SPX 9/7/18 at 2871.68=loss 1.03%: long 2901.52 on 8/31/18.

- Monitoring purposes Gold: Long VanEck Vectors Gold Miners (NYSE:GDX) at 18.72 on 8/17/18

- Long-term Trend SPX monitor purposes; Sold long-term SPX 7/16/18 at 2798.43= gain 2.95%; Long 6/29/18 at 2718.37.

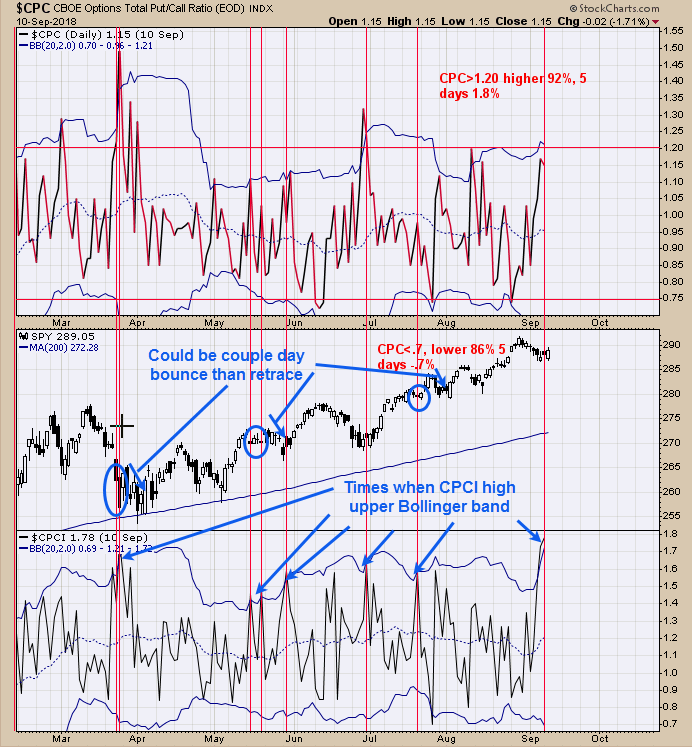

The bottom window is the Index Put/Call ratio (CPCI). When this ratio hits the upper Bollinger® band the market at least bounces. There are three times the market bounced after CPCI hit the upper Bollinger band then retraced back down and those times where are March, May and July. Market can bounce here but probably will not go far and most likely will at least tests the recent lows again. Could end up with a sell signal if market does bounce. Ask for 30 day trial. Follow us on twitter. @OrdOracle.

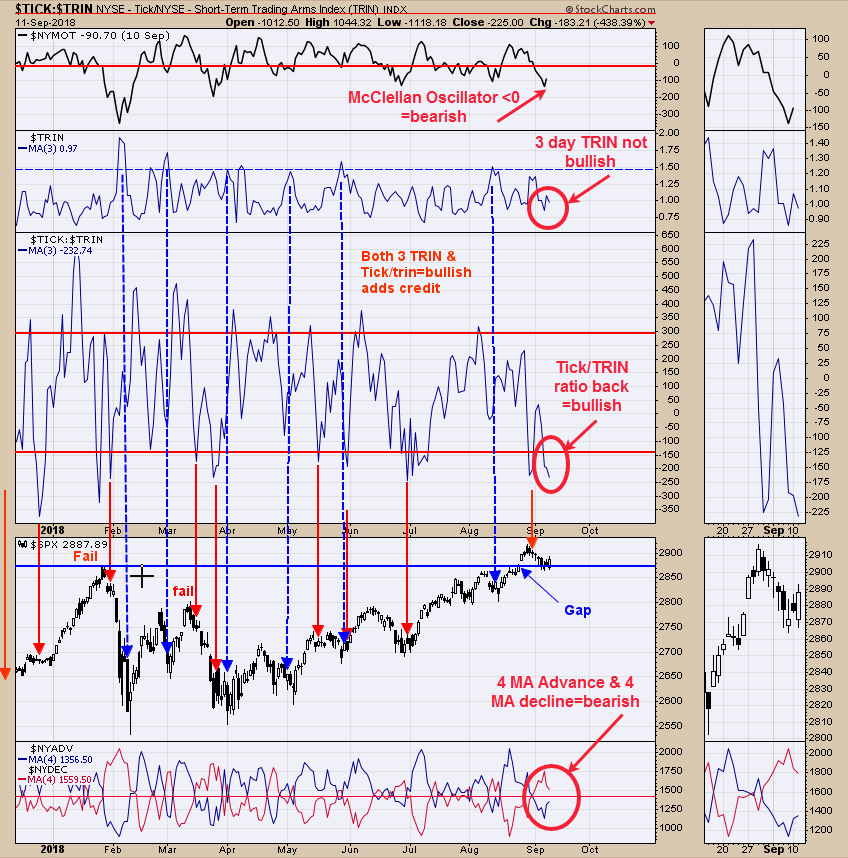

The top window is the McClellan oscillator and readings1.50 and the 3 MA of the Tick/TRIN ratio

We updated this chart from yesterday. The bottom window is the 18 MA of the Advance/Decline and above that the 18 MA of the Up Down Volume and both indicators broke to new recent highs and made higher lows as GDX was making lower lows. We went back to all majors lows in GDX going back to the January 2016 low and found that they all showed major bullish divergences like we are having now. I might point out that a more ideal signal for a long position is when the Advance/Decline and Up Down volume indicators both close above “0” and that has not happen here, at least not yet. The COT commercial report for gold published last Friday, showed that gold commercials are not now net long 6525 contracts; the last time the commercials where net long came back at the 2001 gold bottom. Long GDX at 18.72 on 8/17/18. New Book release "The Secret Science of Price and Volume" by Timothy Ord.