- SPX Monitoring purposes; Sold long SPX on 5/13/19 at 2811.87 = loss 2.05%; Long 5/9/19 at 2870.72.

- Monitoring purposes Gold: Long VanEck Vectors Gold Miners ETF (NYSE:GDX) on 1/29/19 at 21.96.

- Long-term Trend SPX monitor purposes; Sold long SPX on 5/6/19 at 2932.61= gain 5.96%:

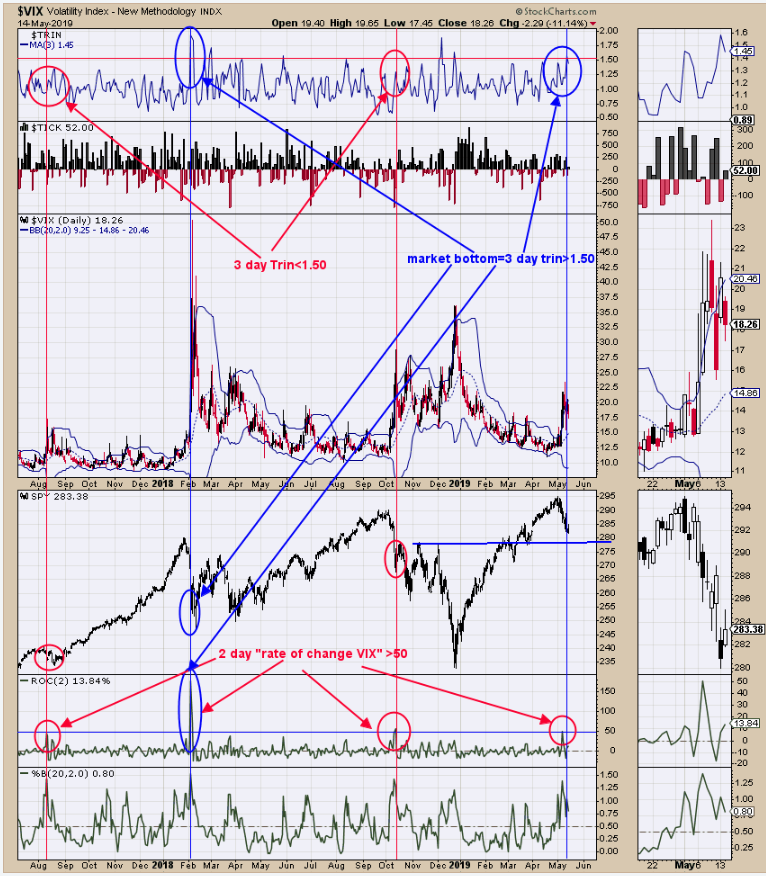

Yesterday’s low had higher volume than the day before suggests yesterday’s low needs testing on lighter volume before a final low is in. Today’s rally tested yesterday’s high on lighter volume which implies resistance and a pull back is in order. The “3 day TRIN” did reach in bullish levels yesterday. Support comes in November and December 2018 highs and the 200-day moving average which comes in the range of 275 to 277 SPY (NYSE:SPY) range and an area to what for a bullish setup. Join us on twitter. @OrdOracle

Couple of days ago we had this chart shown. At the time we where looking for a bounce than testing lower. The bounce came but short lived and we didn’t get out. Now the testing will most likely produce a bounce that could last. The top window is the 3 day trin and when it hits above 1.50 a lasting rally usually follows and yesterday we hit above 1.50. The second window up from the bottom is the Rate of change for the CBOE Volatility Index and when it hits above 50% which is did a bottom is not far off. Today’s rally tested yesterday’s down gap on lighter volume which imply resistance and yesterday’s low had high volume which is usually tested. Don’t believe the final low is in but is very near. Testing below 2800 on the SPX may produce more panic readings in the tick and trin. Follow us on twitter. @OrdOracle.

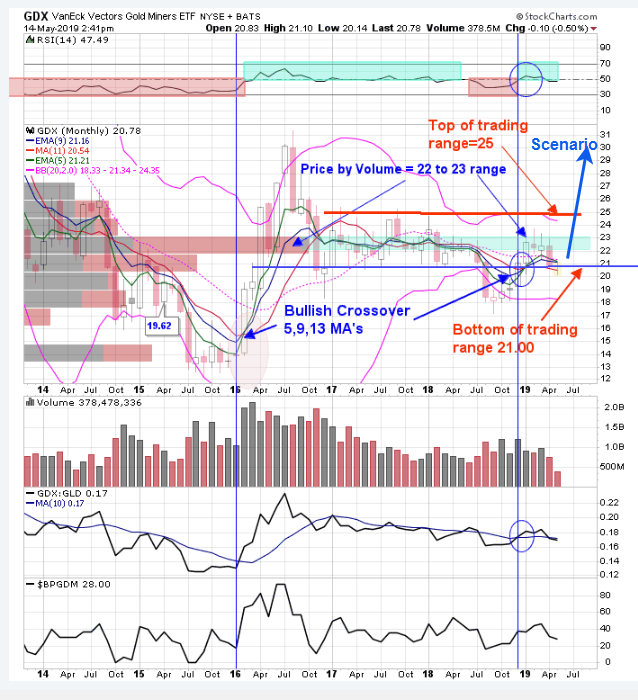

Above is the monthly VanEck Vectors Gold Miners ETF (NYSE:GDX) chart. We have a 5, 9, 13 period moving average on the monthly GDX chart going back to 2014. A bullish crossover occurred back in January which is still in force. The bottom of the trading range in 2017 comes in near 21.00 range. GDX fell below this level in August 2018 and than closed above it in December 2018 creating a bullish “Shakeout” (false breakout). When a down side “Shakeout” occurs the market normally breakouts to the top side, which would imply a break above the top of the trading range near 25.00. GDX is now back testing the support near 21.00 and appear to be finding support. There is a “Price by Volume” level between 22.00 to 23.00 range which GDX run into in February and March which stopped the advance. Once through this level it should provide support. GDX has been in a low volatility state since 2017 and bigger swings should start to develop in the coming months. After the current back test is completed, an impulse wave higher may begin that could last into October. Long GDX on 1/29/19 at 21.97. ord-oracle.com. New Book release "The Secret Science of Price and Volume" by Timothy Ord.