- SPX Monitoring purposes; Sold SPX 3/28/19 & 2815.44= gain .61%; Long 2798.36 & 3/25/19.

- Monitoring purposes Gold: Long VanEck Vectors Gold Miners ETF (NYSE:GDX) on 1/29/19 at 21.96.

- Long-Term Trend SPX monitor purposes; Long SPX on 10-19-18 at 2767.78

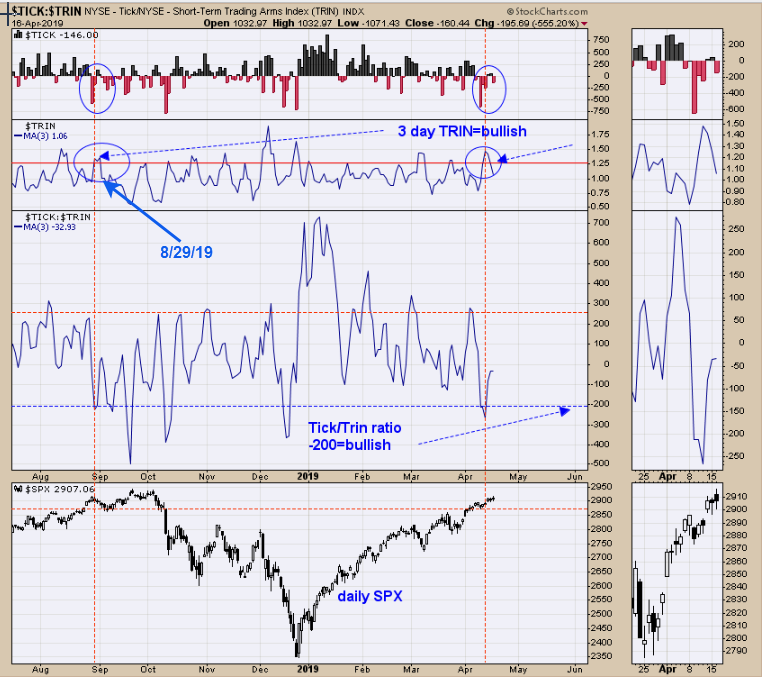

The second window down from the top is the 3 period moving average of the Trin. Readings above 1.30 are normally bullish if they come after a decline in the market. If the 3 ma Trin readings come when the market has rallied than that can be a bearish sign; and that is what we have here. Its rare during a rally that the 3 ma of the Trin reaches above 1.30 and the last time it has done that came on 8/29/18. The pull back back than was modest and the same modest pull back may materialize here. A possible better setup would be if the market does pull back, wait for the next bullish setup. Join us on twitter. @OrdOracle Ask for Free 30 day trail.

The 100 hourly ma, 30 hourly ma and cumulative tick are acting a lot like the August 29, 2018 time period. Back then, the hourly 30 ma of the tick was trading below “0” as SPX was topping out just like now and the cumulative tick fell below its moving average just like now. The 100 hourly Tick was holding above “0” last August just like now. And both time periods produced 30 hourly ma of the TRIN above 1.60. The pull back wasn’t great back in August and if there is a pull back here it to should be shallow also. Seasonality is very foravorable right now and the ticks are showing weakness and not an ideal setup for a trade. Also might add that both the Total Put/Call and Equity Put/Call reached bearish levels last Friday and suggests weakness over the next five days. Remain bullish intermediate term and neutral short term. We have been posting this phase on the last several reports, “Fun statistics, is that with VIX under +16 and SPX up +10% last 3 months, April is higher 90% of the time averaging 2.75% gain.” This could mean if there is a pull back it should be shallow and a bullish setup could form next week. Follow us on twitter. @OrdOracle

Above chart is the daily Gold chart, which is updated after the close and bottom window is the ETF for Gold (GLD (NYSE:GLD)) with current updated prices. Yesterday we said, “Gold appears to be drawing a “Triangle pattern”. “Triangle Pattern” usually follows the direction that preceded it, which is up in this case. Its also common for “triangles” to have a “False” breakout before reversing higher and it could happen here.” It appears a false breakout is occurring on GLD. We mention on past reports that there is a cycle low due mid April to early May and we are in that time zone now and a pull back into that timeframe would suggests an important low is near. So far the pull back on Gold has only retraced 38.2% and if the retracement in general holds that Fibonacci level, it bodes well for the longer term as it would mean the current consolidation would mark the half way point of the move up. This would give a target near 1460 range for gold. If gold goes up so will gold stocks and GDX. Long GDX on 1/29/19 at 21.97. New Book release "The Secret Science of Price and Volume" by Timothy Ord.