- SPX Monitoring purposes; Neutral

- Monitoring purposes Gold: Short GDX on 3/6/18 at 22.02.

- Long Term Trend SPX monitor purposes: Long SPX 3/14/18 at 2749.48.

Above is the Equity Put/Call ratio. We went to the CBOE and got the current days reading which was Puts at 995781 and Calls at 1210983 which works out to be .822. Equity Put/Call ratio .75 and higher predict will be higher within five days 88% of the time with an average gain of 1.3%. Tomorrows FOMC meeting could be the catalysis to setup the rally phase. Signal still incomplete but the statistics are leaning bullish. Neutral for now. Follow us are twitter. @OrdOracle.

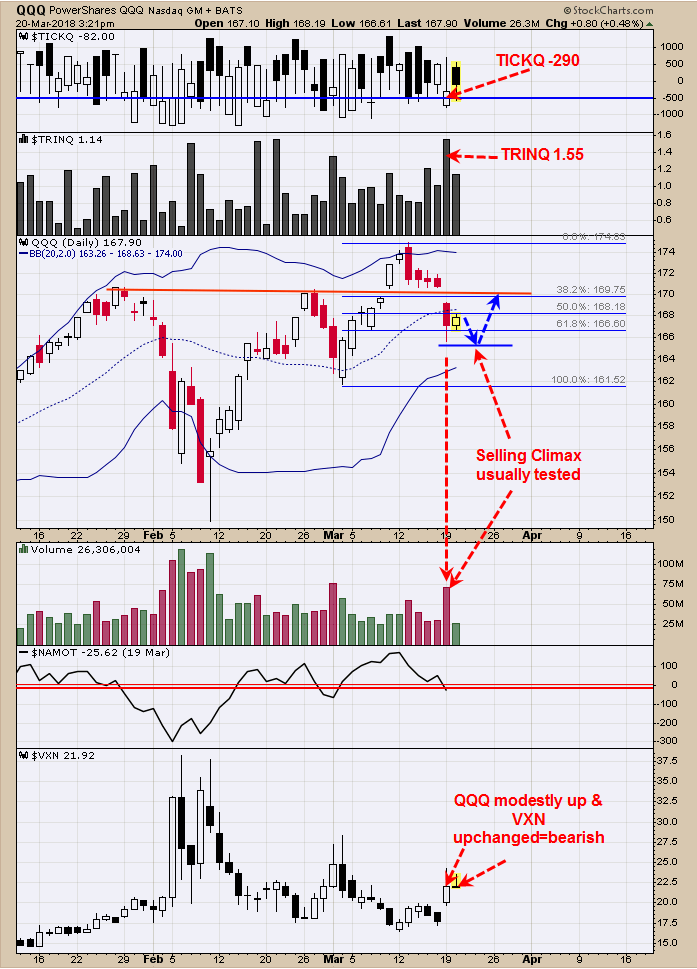

Yesterday the TRINQ closed at 1.55 and the TICKQ -290 which is a bullish combination. The TRIN closed at 1.89 and Ticks at +75 which is not a bullish combination. Tomorrow at 2:00 eastern is the FOMC announcement and maybe what the market is waiting for. Yesterday in the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) a bullish “Selling Climax” formed and most are tested before heading higher. With the TRINQ and TICKQ in bullish levels the market may attempt a bounce after yesterday’s low is tested. The bottom window is the VXN (NDX VIX) and today’s modest rally in QQQ did not produce a pull back in the VXN; suggesting the “Selling Climax” low could be tested. A buy signal setup for the SPX could form in the next couple of days on a test of yesterday’s low.

The bottom window is the Up Down Volume indicator which is < 0 and bearish. Next window up is the Advance/Decline indicator which is also below 0 and bearish. Next window up is the GDX/GLD ratio, which made a higher low as GDX made a lower low and minor bullish divergence. Today’s decline in GDX produced the highest volume in the past couple of weeks and suggests the decline can continue. The top window is the RSI for GDX. RSI reading above 50 is a bullish sign for GDX and below 50 bearish. RSI has been trending below 50 since early February. For very short term it appears the market will continue lower. Short GDX on 3/6/18 at 22.02. New Book release "The Secret Science of Price and Volume" by Timothy Ord.