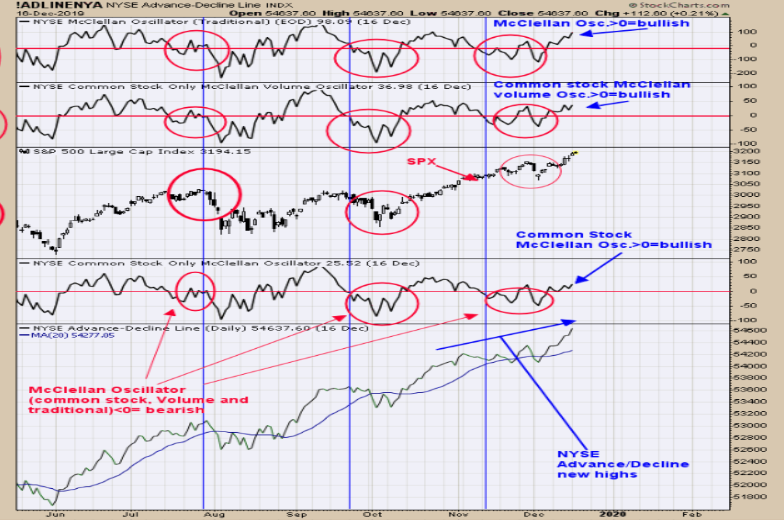

We updated this chart from yesterday. (Bottom window) Advance/Decline closed higher then yesterday and at another new short term high. The NYSE Common stock only McClellan Oscillator, NYSE Common stock only McClellan Volume Oscillator and NYSE McClellan Oscillator all closed higher then yesterday and all above “0” which suggests the trend is up. CNN fear & Greed index is at 81 (Extreme Greed) so rally may not last long. Should get signs that rally is coming to an end when the McClellan Oscillators (the three above) approach the “0” level. Next Tuesday is December 24 and the anniversary of last years low. Important highs and lows of the past can mean important reversal in the future. Nest Tuesday is important if market continues to rally into that timeframe. Long SPX on 12/13/19 at 3168.80. Follow us on twitter. @OrdOracle.

This week is December option expiration week which has a 78% of time being higher. Today’s rally marks the fifth day in a row higher. Five days up in a row predict the market will be higher within five days by an average gain of 1%, 87% of the time. Five trading days from now is next Tuesday and would give a target near 323.20 on the SPY (NYSE:SPY) and 3230 on the SPX. Anniversary of last year low was December 24. Yearly anniversaries of important highs and lows can mark important reversals. Next Tuesday is December 24. Join us on twitter. @OrdOracle.

The top window is the 10 period moving average of the Bullish Percent index for the Gold Miners index. Readings above 40% (current reading is 72%) suggest market is in an uptrend. The second window down from the top is the Bollinger Band width for GDX (NYSE:GDX). When the Bollinger band start to pinch than the Bollinger Band width moves to a low level. A low level in the Bollinger Band width suggests a large move in the market is not far off (in this case it would be for GDX) and at a level where GDX had large moves in the past. Since the 10 day average for the Bullish Percent index for the Gold miner’s index is bullish, it suggests the move will be up. We don’t have it shown, but Precious metals index has a bullish Seasonality in January and part of February of Elections years. Our thought is that most of the gains will come early next year. Long GDX on 1/29/19 at 21.97. ord-oracle.com. New Book release "The Secret Science of Price and Volume" by Timothy Ord.