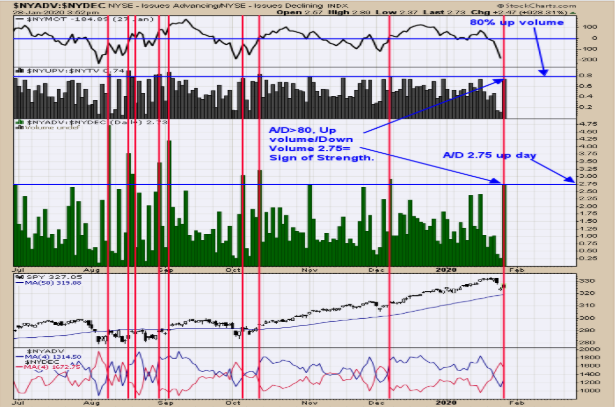

Yesterday we had signs of exhaustion and today we have signs for a “Sign of Strength”. Today’s bounce in the SPDR S&P 500 (NYSE:SPY) (SPX) produced a Advance/Decline ratio of 2.75 and also an Up volume/Down Volume ratio near 80% both of which suggests a “Sign of Strength” (SOS) right off a bottom. The red vertical lines on chart above show previous instances when an SOS was present. Yesterday two-day trin added up to 4.46. We have noted in the past when a two day trin adds up to 5.00 the market is at a bottom. The 4.46 trin reading suggest the market is sold out. A test of the recent low is possible. Long SPX on 1/28/20 at 3276.24. Follow us on twitter. @OrdOracle

Panic happens at bottoms and we look for indicators that have reached panic levels. The top window in the chart above is the RSI for the CBOE Volatility Index. When the RSI reaches above 75 (Yesterday’s close 75.10) the market was near a bottom. This chart goes back two years and shows the times (red lines) when the RSI of the VIX reached 75; which is fairly rare. There could be backing and filling short term, but in general the market should work higher in the coming days. Join us on twitter. @OrdOracle.

The top window is the 10 period Bullish percent index for the Gold Miners index which stands at 81.08 (81.08% of the Gold Miners index stocks that are on Point and Figure buy signals). Its considered an index is in a bullish move with a reading above 40%. Next window down is the ®Bollinger Band width for GDX (NYSE:GDX). When Bollinger Band width is at a low level than that suggests the Bollinger Band Width for GDX is Pinching. A Pinching of the Bollinger Bands suggests a consolidation is nearing an end and an impulse wave is about to begin. Since the Bullish Percent index is above 40%, its suggests the impulse wave move will be up. We have marked previous times with blue vertical lines when the Bollinger Band width was near current levels. The move may start around the FOMC meeting announcement, which is tomorrow. January is Seasonal bullish for gold and gold stocks during Election years, which are this year. Long GDX on 1/29/19 at 21.97. www.ord-oracle.com. New Book release "The Secret Science of Price and Volume" by Timothy Ord.