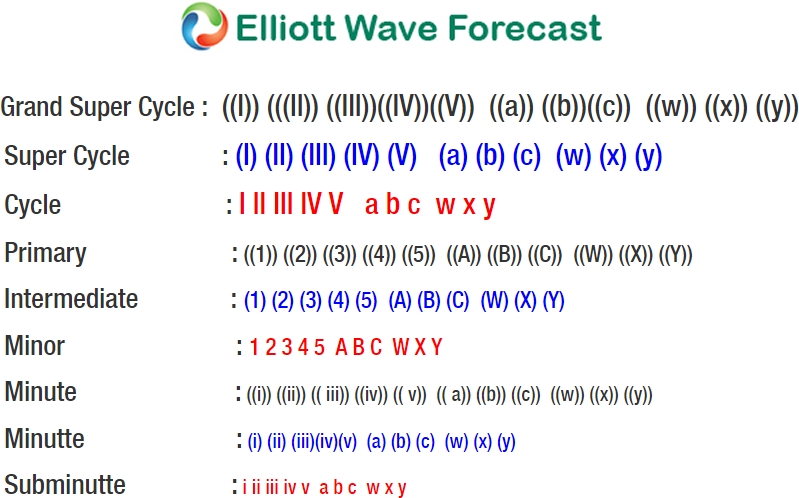

Short Term Elliott Wave view in SPX suggests the rally from 3/27 low (2322.2) is unfolding as a leading diagonal Elliott Wave structure where Minute wave ((i)) ended at 2378.36, Minute wave ((ii)) ended at 2328.95, Minute wave ((iii)) ended at 2398.16, and Minute wave ((iv)) ended at 2379.75. The Index has broken above previous Minute wave ((iii)) and thus it has met the minimum requirement in the number of swing to end cycle from 3/27 low as a leading diagonal. Although the cycle from 3/27 low is already mature, another leg higher can’t be ruled out as far as pullbacks stay above 2380. Near term, Minute wave (v) is proposed to be unfolding as a zigzag Elliott Wave structure where Minutte wave (a) ended at 2403.8 and Minutte wave (b) ended at 2392.4. While pullbacks stay above 2392.4, and more importantly above 2380, Index has scope to extend one more leg higher. We don’t like selling the Index and chasing the last leg higher here is also a bit risky. Expect cycle from 3/27 low to end soon with or without one more leg higher and Index to do larger degree pullback in 3, 7, or 11 swing to correct cycle from 3/27 low before the rally resumes.

S&P 500 1 Hour Elliott Wave Chart