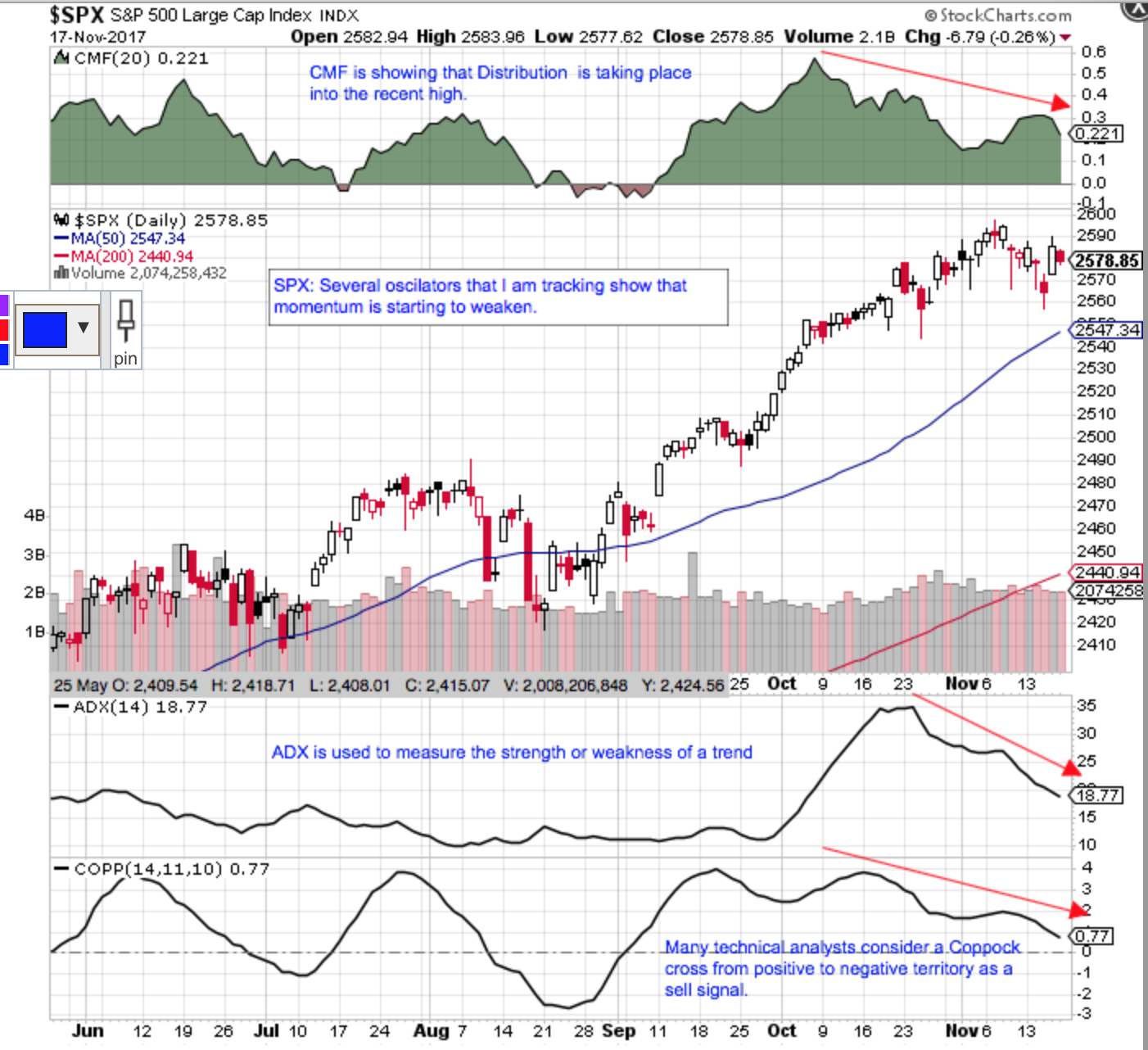

I have the S&P 500 on just day two of a new short term Trading Cycle but many of the technical indicators I watch are showing signs that the momentum of the SPX’s longer 5-6 month Intermediate Cycle (IC) are starting to stall near the 3 month mark of the current IC Uptrend. My first Daily chart shows volatility has returned and we often see this at cycle turns. Yes we are on day 2 out of a TCL/DCL but my second chart also shows 3 key TA indicators that may be signaling a top forming on the SPX’s longer Intermediate Cycle.

One of our subs pointed out that there was an extremely large WSJ Selling on Strength on the SPX on Thursday’s surge out of the TCL (over 700 million in large block trades). My expectations are still that stocks will likely retest the recent highs at the very least in the next week or so but I plan to keep a tight leash on my positions based on my 4 charts below.

While I do not believe this is the top of this Bull market just yet, stocks likely need a normal Intermediate Cycle Low (ICL) to reset investor sentiment to bearish for the next leg up in 2018. My 3rd chart is a 3 Year weekly showing you that the SPX is in my timing band to find its next Yearly Cycle Low (YCL). Lastly, my 4th chart shows that the last two ICLs were very mild and did not even have a failed short term Trading Cycle (TCL). My expectations are that this will change back to the Cycle Nom if we are to find the next YCL near the 5-6 month mark. If I am correct, the lower blue uptrend lines in my last two charts should break down during the move into the YCL.