From my past analysis here and here I was focusing more on the S&P 500's bearish scenario, BUT price never broke down our support levels at 2445 or 2258. Price has risen now above 2480 and the bullish scenario has become the favorite one. However I would like to remind that even if I see 2510 or higher as possible target for the move from 2420 to complete, the bigger view remains bearish for a move below 2400.

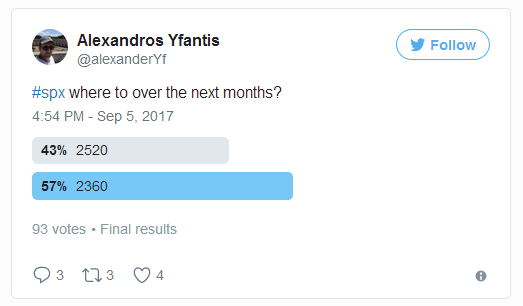

In my twitter poll bears won….but in real life they are still losing….

The downward move from its all time highs looks corrective in Elliott wave terms. Only an impulsive move would make the bearish scenario stronger.

The price formation on a daily basis looks rather bullish and bears should at best expect a pull back….The good thing for one with no position right now is that we have a clear support area at 2420-2450, that has been tested several times and produced a pattern of higher highs and higher lows. So what I see now happening? As long as price is above 2450 I see this….

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.