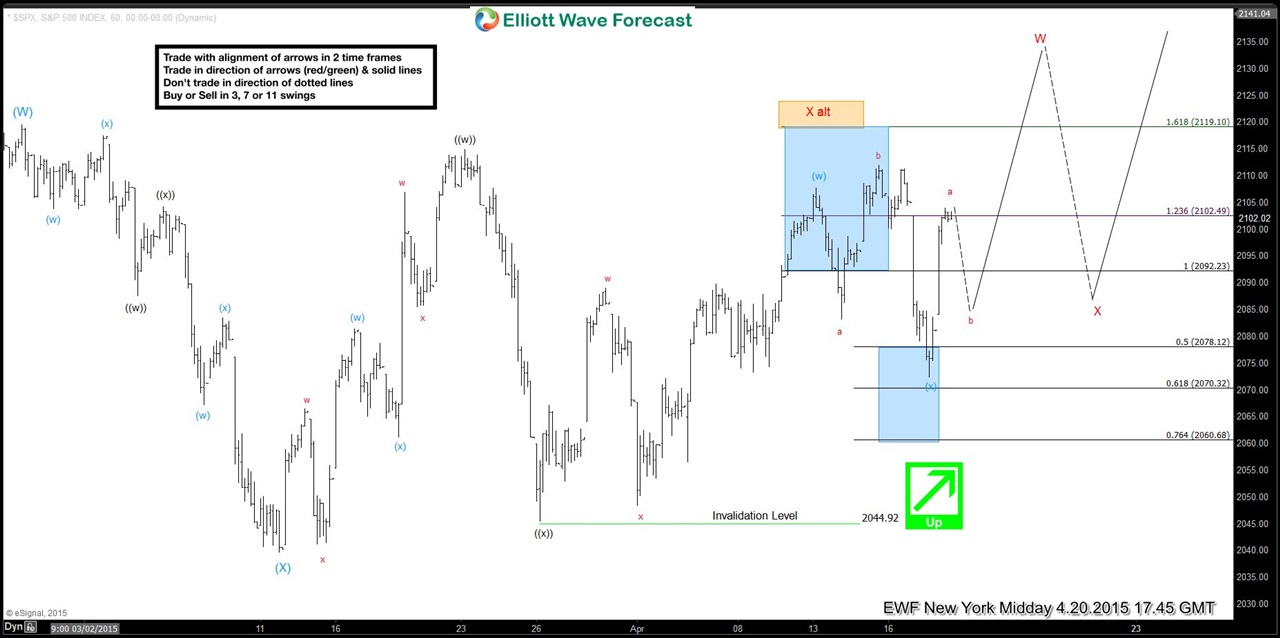

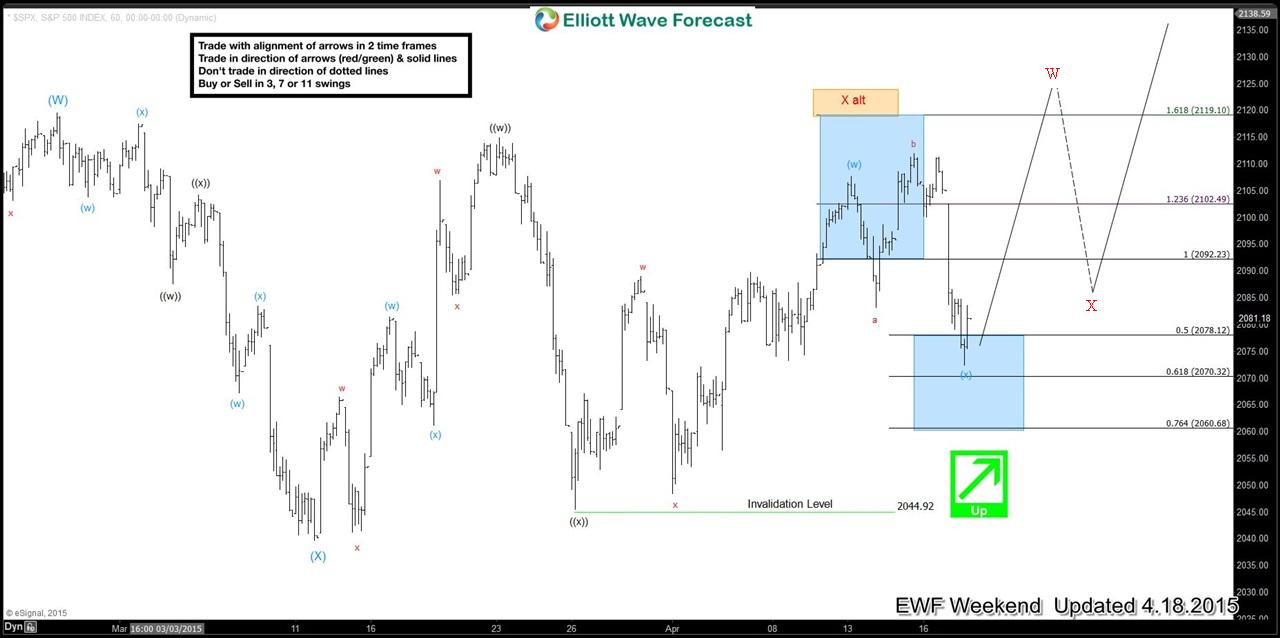

SPX500 dropped sharply on Friday in 5 waves. A 5 wave move doesn’t always mean that trend has reversed as a 5 wave move could be part of an Elliott Wave FLAT correction as well which we think was the case here as our bullish pivot at 3/26 (2044.92) low never gave up. As this weekend updated charts shows, we were expecting the rally to resume to new highs as per the primary view.

As the updated chart below shows, we have seen a good reaction higher from the lows supporting the view that dip on Friday completed an Elliott wave FLAT correction. Preferred view now calls for a pull back in wave “b” to hold above 2072 low and continuation higher. We don’t like selling the Index in proposed wave “b” pull back and as far as 2072 low remains in place, we would expect more upside toward 2121 -2138 area to complete wave “W” before another 3 wave pull back in wave “X’ is seen.

Until 4/15 (2112) high doesn’t break, another leg lower can’t be completely ruled out but the best part is traders who bought the dip on Friday (after 5 waves down from 2112) high should now be in a risk free position. If it makes another low below 2072, then it would be a simple a-b-c down from 2112 high and should still turn higher as far as pivot at 2044.92 low remained intact in our system. Only a break of this pivot would open another extension lower.