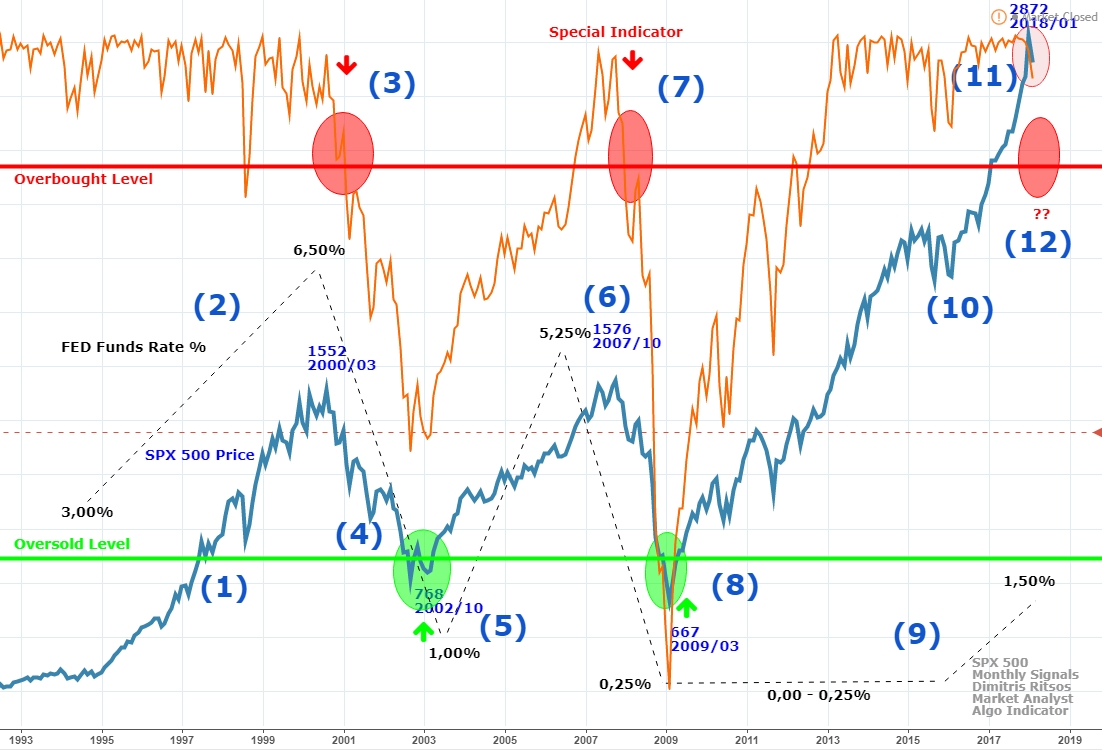

S&P 500 AND SIGNALS

I provide some interesting signals on a monthly basis from 1993 to 2018:

(1) At the beginning of 1995 the S&P 500 of 450 points reached 1552 in March 2000.

(2) The interest rate of 3,00% climbed to 6.50%.

(3) Special index was in overbought area giving SELL signal in February 2001.

(4) It followed a downward trend until October 2002 to 768 points.

(5) Prices at this level were found to be attractive and the interest rate dropped. 1.00% gave a new purchase time. It is important that the special indicator did not reach an oversold area.

(6) The rally peaked in October 2007 at 1576 points, in July 2006 the interest rate climbed at 5.25%, very expensive repayment of mortgage loans.

(7) In January 2008, the special indicator gives a SELL signal.

(8) The fall in prices found the S&P 500 in March 2009 at 667 points in an attractive land for BUY orders, special indicator in the oversold area gives BUY signal, Fed decreased interest rate until December 2008 to 0.25%.

(9) Interest rate from the beginning of 2009 to October 2015 remained at 0.25%, in December 2015 it rose to 0.50% and is on the upward trend until today to 1.50%.

(10) The very low borrowing of money has triggered a rally throughout this period so that prices from the beginning of 2017 until today are in overbought area making it currently historically high in January 2018 at 2872 points.

(11) Special indicator for this rise is in a pro-purchased area and above the prices. On January 24, he cuts down on prices giving a SELL signal for a limited time correction. (12) Today, special index has not provide SELL signal below the overbought area as you see in the chart.

Dimitris Ritsos

Market Analyst