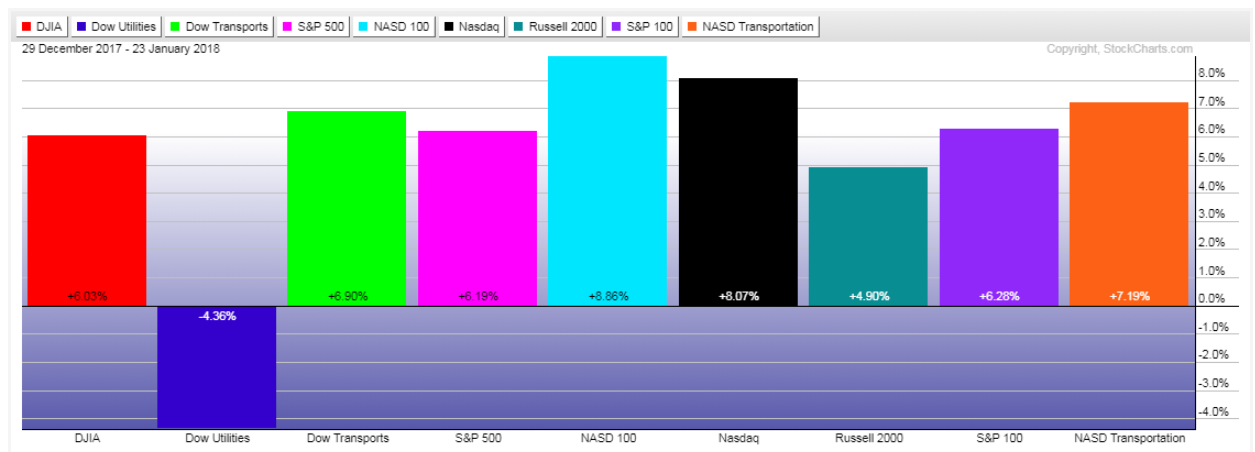

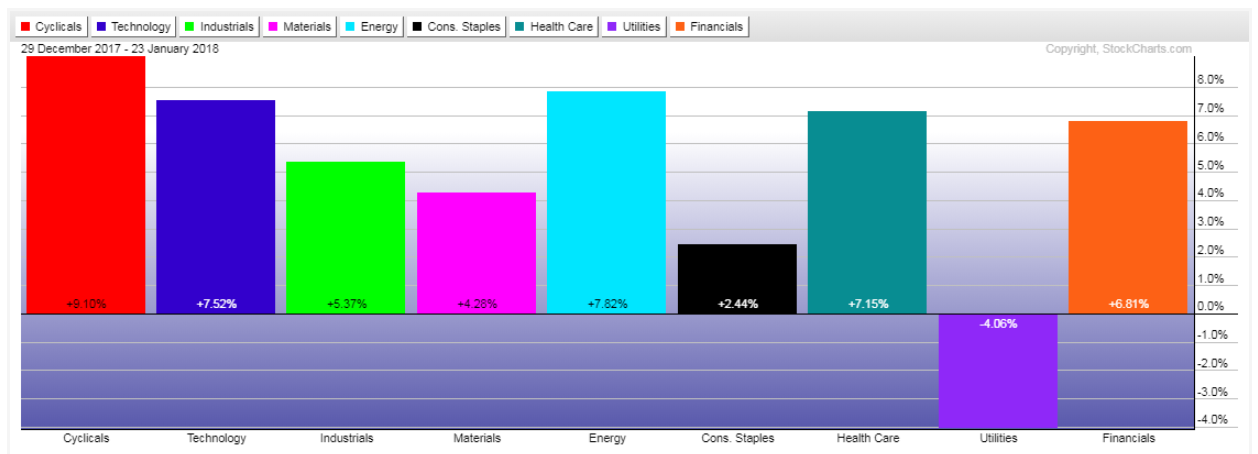

Year-to-date gains/losses made in the 9 Major Indices and 9 Major Sectors are shown on the graphs below...amazing gains for the S&P 500 after only 15 trading days.

The SPX is already over half-way to the 10% target I had forecast in this post for the entirety of 2018.

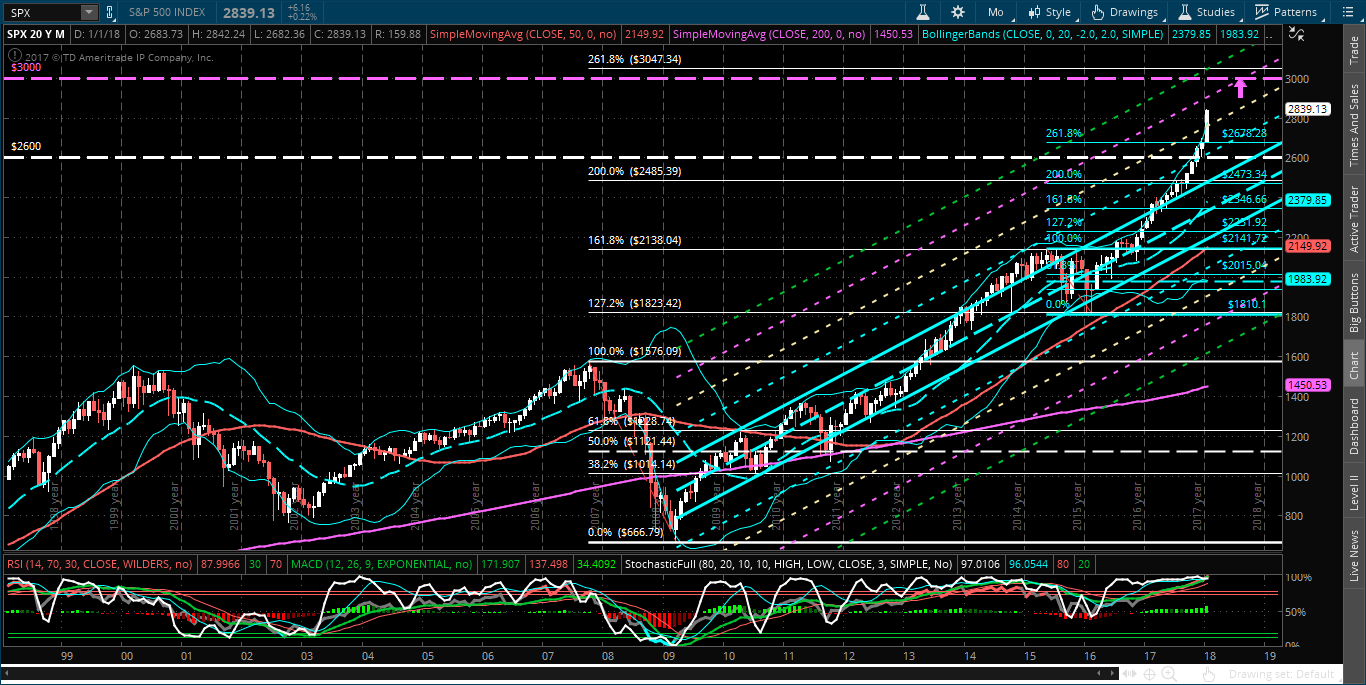

An extended outlook for the SPX sees major resistance at 3000 (its the next 'Big Round Number'), which is confluent with two external Fibonacci retracement levels (2984 and 3047), as shown on the monthly chart below.

When would it hit that level? It's anyone's guess, as anything seems possible in the current buoyant market environment. The momentum indicator is still rising on this long-term timeframe and is making new all-time highs in the process. Another 5% gain would send it up to that price, so we could be looking at a year-end target date to bring total gains of 11% by then...not an unreasonable expectation.

Another scenario is that it could reach that level around August of this year (pinpointed at the pink arrow shown on the second monthly chart below), which would put it at the +4 standard deviation level of a very long-term upward-sloping regression channel (beginning from the March 2009 low). That would give it plenty of "wiggle room" to allow for some price dips in between now and then. At the moment, price is in between the +3 and +4 standard deviation levels.

Other factors to monitor, in this regard, are outlined in my above-referenced market forecast post.