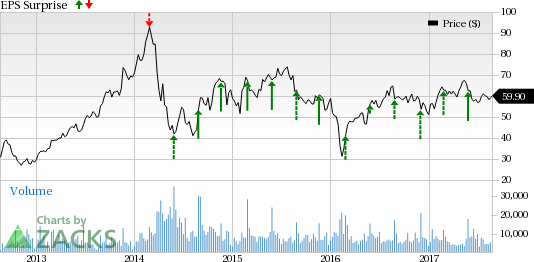

Splunk Inc. (NASDAQ:SPLK) is scheduled to release fiscal second-quarter 2018 results on Aug 24. Let’s see how things are shaping up for the upcoming announcement.

Factors to Consider

Splunk has been strengthening its product pipeline to benefit from the growing data and analytics market. Over the past few years, the cloud and data analytics market has seen strong growth especially in the enterprise domain, which is a positive for the company. In the last reported quarter, revenues from cloud more than doubled to $17.7 million.

Also, the company has been seeing an increase in the numbers of customers. In the first quarter, the company added 500 new customers and stated that it remains on track to have a customer base comprising 20K customers by fiscal 2020.

However, increasing investments in research and development coupled with higher operating costs are anticipated to be a drag on profitability. As Splunk continues to explore and expand into new markets, sales and marketing expenditures are also predicted to rise significantly, thereby hurting margins.

Also, growing competition from established players such as International Business Machines (NYSE:IBM) , SAP, Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT), all of which are vying to get a bigger share of the market, is a concern.

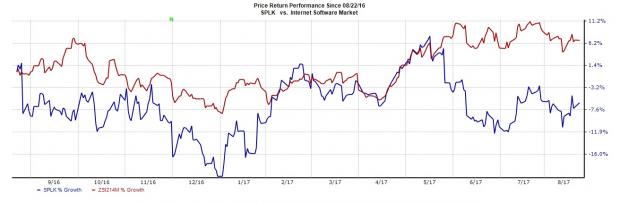

In the past one year, shares have vastly underperformed the industry. While the industry rallied 6.8%, its shares have declined 6.2%.

For the second quarter, Splunk expects revenues in the range of $267 million to $269 million and non-GAAP operating margin of 4%.

Currently, Splunk carries a Zacks Rank #3.

A Stock Likely to Beat Estimates

Per, our proven model a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to beat the Zacks Consensus Estimate.

Here’s a stock that you may want to consider as our model shows that it has the right combination of elements to post an earnings beat this quarter. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

VMware Inc. (NYSE:VMW) with an Earnings ESP of +2.12% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Splunk Inc. (SPLK): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Original post

Zacks Investment Research