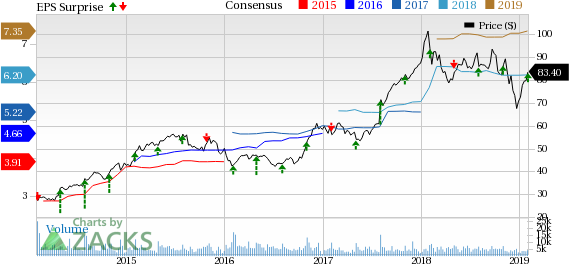

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) reported fourth-quarter 2018 adjusted earnings of $1.85 per share, which surpassed the Zacks Consensus Estimate of $1.78 by 4%. Year over year, the bottom line registered an improvement of 40%.

Barring one-time adjustments, the company reported GAAP earnings of $1.68 per share compared with $1.07 in the year-ago quarter.

For 2018, Spirit AeroSystems’ earnings came in at $6.26 per share, which outpaced the Zacks Consensus Estimate of $6.20 by 1%. The full-year bottom-line figure also improved 17% from the prior-year number.

Highlights of the Release

Total revenues of $1,835 million missed the Zacks Consensus Estimate of $1,858 million by 1.2%. However, the top line rose 7% on a year-over-year basis.

Backlog at the end of fourth quarter 2018 was $48 billion, in line with the prior quarter’s number.

For 2018, Spirit AeroSystems generated revenues of $7.22 billion, which marginally missed the Zacks Consensus Estimate of $7.25 billion. Year over year, the full-year revenues improved 3%.

Segment Performance

Fuselage Systems: Revenues at the segment grew 10% to $1,017 million from $918.7 million registered in fourth-quarter 2017. Higher production deliveries on the Boeing 737 program and increased non-recurring Airbus A350 activity drove top-line growth.

Propulsion Systems: The segment recorded revenues of $442.9 million in the reported quarter, up 6.6% from $415.5 million a year ago. The uptick can be attributed to higher propulsion deliveries on the Boeing 737 program.

Wing Systems: Revenues at the segment dropped 0.7% to $374.4 million from $377.1 million in the prior-year quarter. The downside was due to lower revenue recognized on the Boeing 787 program as a result of the adoption of ASC 606, lower production deliveries on the Boeing 777 program and lower defense-related activity.

Financial Position

As of Dec 31, 2018, Spirit AeroSystems had $773.6 million in cash and cash equivalents compared with $423.3 as of Dec 31, 2017.

At the end of 2018, long-term debt (excluding current portion) totaled $1,864 million compared with $1,119.9 million at the end of 2017.

Cash flow from operating activities increased to $769.9 million at the end of 2018 from $573.7 million at the end of 2017.

Capital expenditures summed $271 million in 2018 compared with $273 million in the prior year.

Guidance

For 2019, Spirit AeroSystems issued financial guidance. The company currently expects adjusted earnings per share in the range of $7.35-$7.60 on revenues of $8.0-$8.2 billion.

Additionally, management projects adjusted free cash flow in the $625-$675 million band for the current year.

Zacks Rank

Spirit AeroSystems has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Raytheon Company (NYSE:RTN) reported fourth-quarter 2018 earnings per share (EPS) of $2.93 from continuing operations, outpacing the Zacks Consensus Estimate of $2.89 by 1.4%. The bottom-line figure improved a massive 117% from the year-ago quarter’s figure of $1.35.

The Boeing Company (NYSE:BA) reported adjusted earnings of $5.48 per share for fourth-quarter 2018, beating the Zacks Consensus Estimate of $4.52 by 21.2%. The bottom line reflected an improvement of 8% from $5.07 in the year-ago quarter.

Teledyne Technologies (NYSE:TDY) reported adjusted fourth-quarter 2018 earnings of $2.33 per share, which surpassed the Zacks Consensus Estimate of $2.19 by 6.4%. The bottom line also improved 27.3% from the year-ago quarter’s figure of $1.83.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

The Boeing Company (BA): Get Free Report

Teledyne Technologies Incorporated (TDY): Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research