Plenty of interesting moves in the markets lately. Top of every investor's mind is the Turkish lira and its ongoing slide. Also, the Russian ruble, Mexican peso, and the South African rand are making massive movements.

Some experts are calling it an emerging market currency rout. The thing is, emerging market currencies shouldn't necessarily correlate with each other.

The only thing they really have in common is that they're traded against the US dollar. This lends to the theory that the entire story is actually driven by the US Federal Reserve. As Jerome Powell is forced to react to rising inflation at home, other economies that rely on dollar stability are bearing the brunt.

Today's Highlights

Japanese Spillover

Look at the lira

Emerging Cryptos

Please note: All data, figures and graphs are valid as of August 13th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

To think, this situation with the Turkish lira started with Trump imposing sanctions on August 1st, in relation to a detained pastor who Erdogan refuses to release.

Now it seems that neither is willing to back down and the showdown is affecting most major currencies. The most major of which is the Japanese yen, which is being seen as a safe haven from this currency conundrum.

With the yen gaining, the Nikkei 225 is taking a hit as a stronger yen tends to harm Japanese exports.

Look at the lira

Earlier this morning, the Turkish central bank did come out with some strong words to try and minimize the damage.

This type of rhetoric can sometimes have an impact on sentiment. Most famously when Mario Draghi stated that they would do "whatever it takes" to save the euro in 2012. However, investors today were looking for a bit more than words from the central bank.

Later today we'll also hear from the new finance minister. This recently appointed figure is actually the son-in-law of Recap Tayyip Erdogan. So he will have to put on a helluva show if he's to impress anyone.

As I write, we see the USD/TRY testing 7.

Those of you who are avid readers will recall that this whole thing started with a strong break above 5 liras to the dollar.

So similarly, if we get a break of 7, things could get even uglier.

Crypto Spillover

As we've stated before, crypto-assets tend to correlate most closely with high-risk markets. So it would stand to reason that a sell-off in stocks, might have a negative effect on crypto.

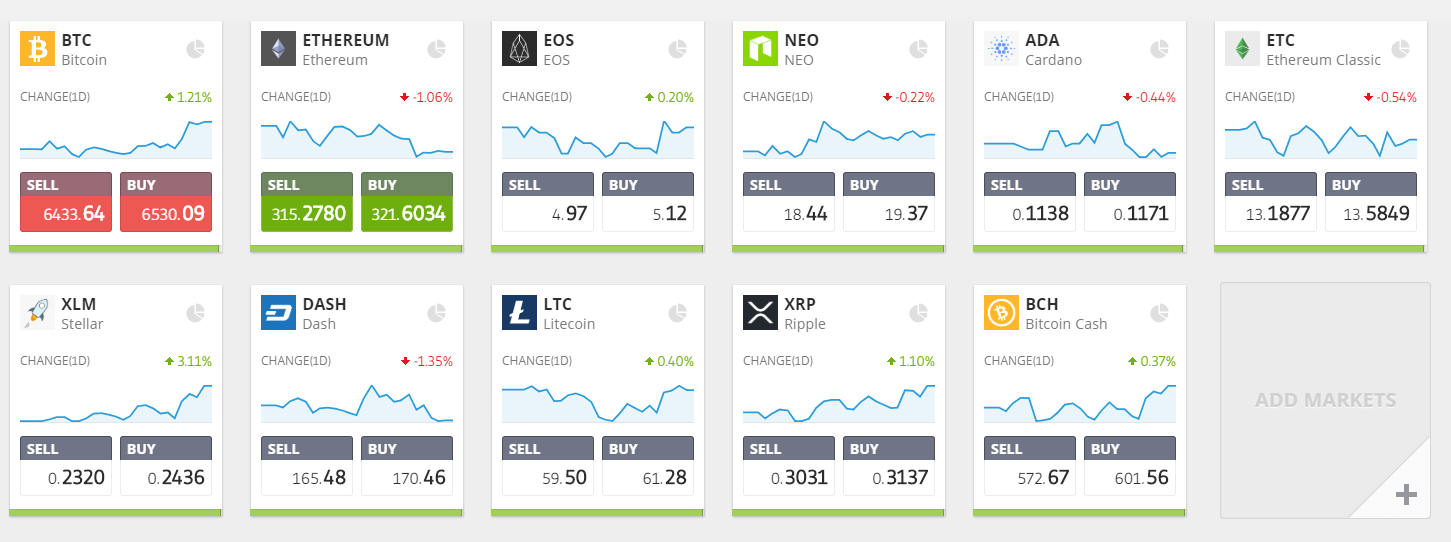

Looking at the numbers, however, it seems the crypto markets are rather unaffected by the emerging market currency rout and are showing a mixed performance.

Crypto-enthusiasts now want to know if Turkish citizens are turning to crypto as a stable store of value in the face of a rapidly depreciating currency.

Well, it seems there have been some sources that seem to indicate this is the case.

Indeed, some Turkish exchanges are reporting that their volumes doubled in the last few days. Still, as they weren't trading at incredible volumes to begin with, an increase of 100% somehow doesn't seem to me to be a massive increase that would indicate mass adoption.

No doubt there are some who have turned to bitcoin. Many citizens are doing their best to get their wealth out of lira's by any means possible and there are even reports of large queues at luxury shopping malls.

Because it's not clear how Turkish people access bitcoin, it will be difficult to verify if there has been any uptick in adoption. What I'm waiting for are the weekly stats from coin.dance, that should come out over the next few days.

Let's have an excellent week ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.