Policy divergence has officially begun, yet markets face the interesting possibility of an Australian dollar (N:FXA) that refuses to weaken further against the U.S. dollar for now.

The Australian dollar may be done going down for now post-Fed

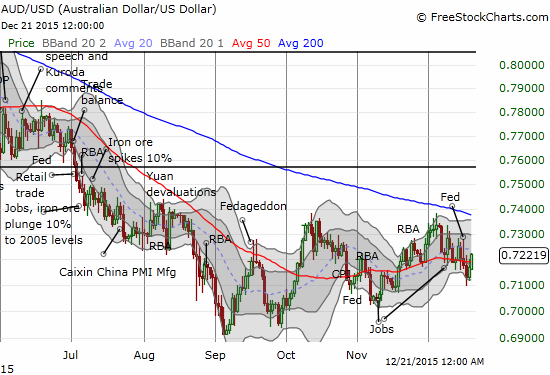

Source: FreeStockCharts.com

The above chart shows that the Australian dollar weakened for just one full day in the wake of the rate hike from the Federal Reserve. AUD/USD has now bounced back and is trading above its 50-day moving average (DMA) again. AUD/USD has even reversed most of its post-Fed losses. Moreover, the Australian dollar is nowhere near its recent lows; the current bounce marks a third higher low from September’s multi-year low. The main outstanding question now is whether overhead resistance will hold at the Oct/Dec double-top and/or the declining 200DMA.

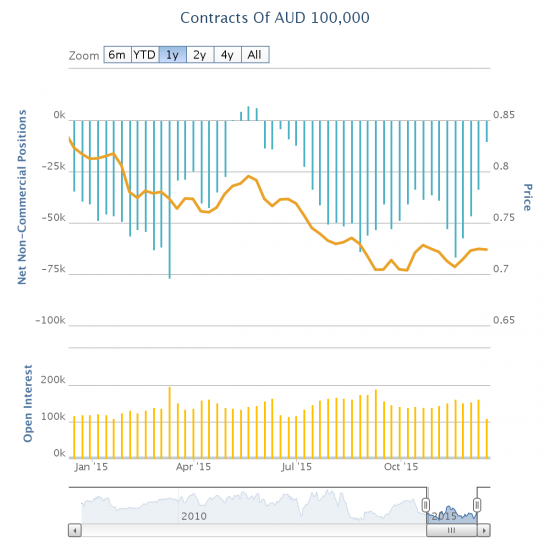

Speculators may be supporting this resilience. These traders have been in retreat on their net short positions against the Australian dollar since peak bearishness in mid-November. Now, traders are essentially net neutral.

Speculators have spent the last month or so retreating from net bearish positions against the Australian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

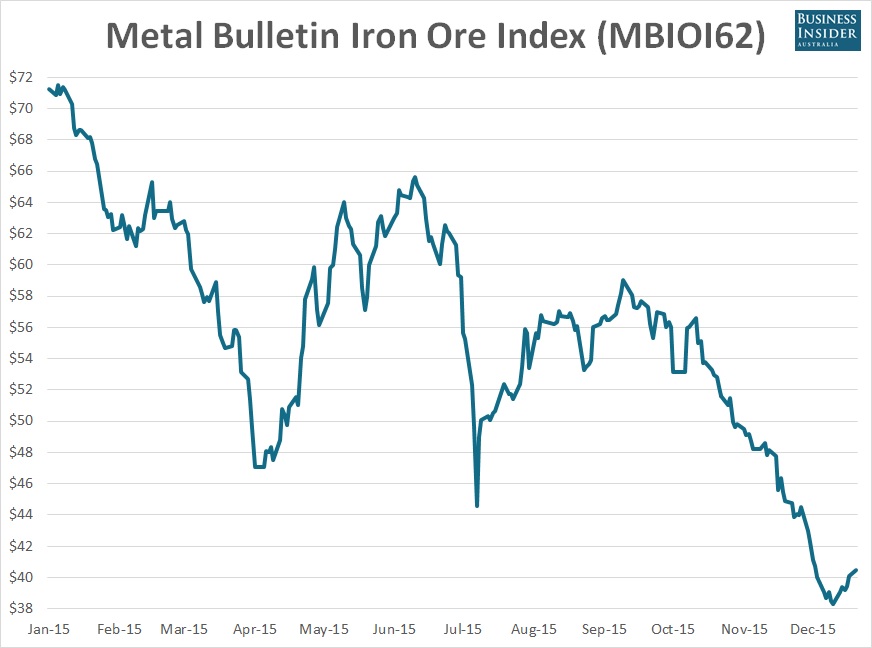

On top of this retreat, iron ore prices are now bouncing off multi-year (historic) lows set on December 11th. Iron ore is back to prices last seen on December 3rd. For example, see “Iron ore has risen again” from Business Insider Australia:

The bounce in iron ore is but a blip but could be sufficient to further support for more positive sentiment toward the Australian dollar.

Source: Business Insider Australia

All these moves set up the Australian dollar for a “mild” end to the year. However, I fully expect that the new year will bring back strategic and even longer-term positioning in preparation for an eventual fresh downward run for the Australian dollar. The Reserve Bank of Australia (RBA) has already made its dovishness clear. The RBA has not been as direct and forthright as other dovish central banks about the desire to ride policy divergence to a weaker currency against the U.S. dollar, but the Bank appears to expect Fed rate hikes to do some of their heavy lifting of currency devaluation. Australia still needs this devaluation to counter-act the on-going decline in the terms of trade from plunging commodity prices.

Full disclosure: net short the Australian dollar