The Reserve Bank of Australia (RBA) rolled out the copy and paste machine for its December statement on monetary policy. I found just two snippets of differences from the November statement that are worth noting:

- This time around, the RBA fingered weaker demand as a driver of lower commodity prices. In the last statement, supply, including Australian supply, was listed as a sole culprit. Could this be the RBA hinting it sees sustained weaker demand ahead?

- When talking about housing prices, the RBA specifically called out Sydney and Melbourne – Australia’s hottest housing markets – as cities with moderating price gains. This change in pricing dynamics will help bolster the RBA’s claim that inflation gives the Bank “scope for further easing of policy.”

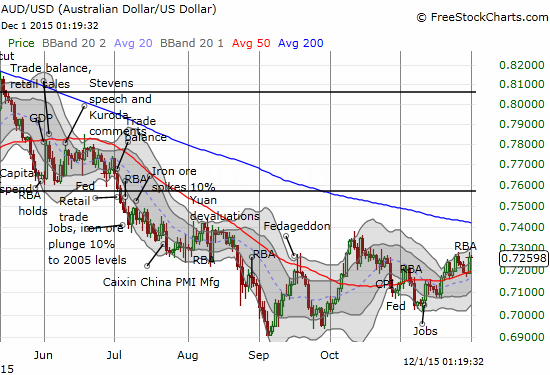

So, overall, all arrows remain clearly biased toward dovish policy from the RBA. The December statement barely budged the Australian dollar (N:FXA) which has spent much of its time going into this meeting in rally mode.

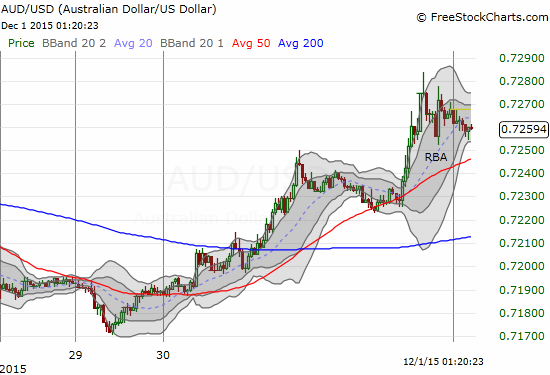

The Australian dollar barely reacted to the RBA’s December statement on monetary policy, but rallied going into the meeting.

The daily chart shows an extended rally going into the RBA December meeting.

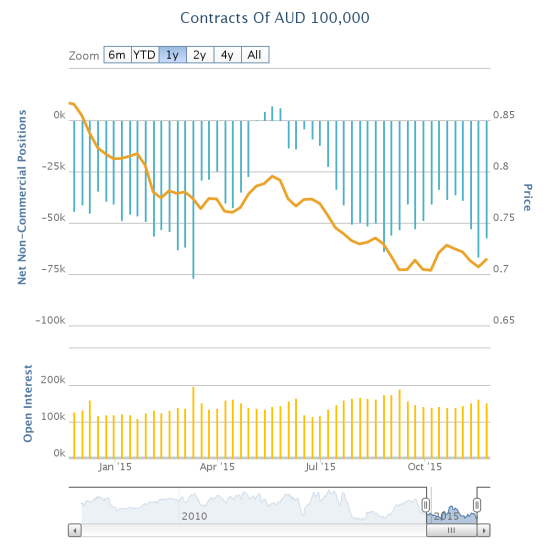

The Australian dollar’s counter-trend rally is occurring despite a heavy presence of net short positions from speculators.

Net shorts against the Australian dollar are around the highs of the year even as the Australian dollar has failed to crack fresh lows.

The recent strength of the Australian dollar against the U.S. dollar also curiously contradicts expectations for the launch of policy normalization from the U.S. Federal Reserve. Assuming no surprises from the Fed, I still see this rally as setting up great opportunities for adding to or starting new short positions against the Australian dollar.

Be careful out there!

Full disclosure: short Australian dollar