Spectrum Brands Holdings, Inc. (NYSE:SPB) is all set to report third-quarter fiscal 2017 results on Jul 27, before the opening bell.

The question lingering in investors’ minds is, whether this leading consumer products company will be able to come up with a positive earnings surprise in the to-be-reported quarter. The company’s earnings missed the Zacks Consensus Estimate by 5.6% in the fiscal second quarter. However, it has delivered an average positive earnings surprise of 0.7% in the trailing four quarters.

Let's see how things are shaping up for this announcement.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show earnings beat for Spectrum Brands this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Spectrum Brands has an Earnings ESP of -1.56%. This is because the Most Accurate estimate is at $1.89, while the Zacks Consensus Estimate is pegged higher at $1.92. Although the company’s Zacks Rank #3 increases the predictive power of ESP, we need a positive Earnings ESP in order to be confident about an earnings surprise.

What to Expect?

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate of $1.92 and $5.82 for the fiscal third quarter and fiscal 2017, respectively, has declined by two cents each in the last seven days.

Furthermore, analysts polled by Zacks expect revenues of $1.38 billion and $5.08 billion for the said quarter and the fiscal year, respectively.

Per the latest Earnings Preview, the earnings growth for the Consumer Staples sector looks decent. While total earnings for the sector are estimated to rise 3.1%, revenues are projected to improve 1.2%.

Factors Influencing the Quarter

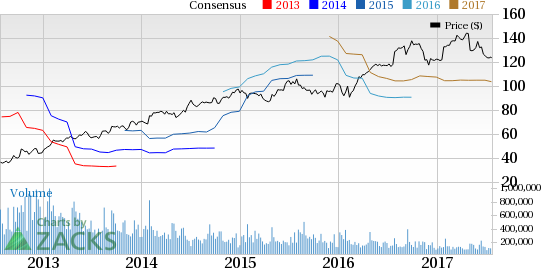

Spectrum Brands’ shares have declined 14% in the last three months, wider than the industry’s loss of 3.1%. In contrast, the Zacks categorized Consumer Staples sector gained 2% and is currently placed at top 13% of the Zacks Classified sectors (2 out of 16).

We note that the company’s top line has lagged estimates in four of the last seven quarters, including the last reported quarter. Moreover, its sales have been declining since the last three quarters, primarily due to soft sales recorded at the Global Batteries & Appliances, Global Pet Supplies and Global Auto Care segments. In fact, sales decreased 3.3% and 0.6% in the second and first quarters of fiscal 2017, respectively. The same had slumped 4.5% in the final quarter of fiscal 2016.

Further, Spectrum Brands continues to battle adverse foreign currency effects, which is likely to mar its results in the near term. Management expects net sales for fiscal 2017 to include about 100–150 basis points impact from currency headwinds.

However, on the positive front, we remain encouraged by the company’s innovative products in all categories and persistent leverage of its global infrastructure and shared services. Also, it is making acquisitions and exiting underperforming businesses to improve profitability, margins and free cash flow. So let’s wait and see if Spectrum Brands can counter the hurdles and be able to pull off a positive earnings surprise in the upcoming quarter with these initiatives.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Clorox Company (NYSE:CLX) has an Earnings ESP of +0.67% and a Zacks Rank #2. You can see You can see the complete list of today’s Zacks #1 Rank stocks here.

Tyson Foods, Inc. (NYSE:TSN) has an Earnings ESP of +1.64% and a Zacks Rank #2.

Church & Dwight Co., Inc. (NYSE:CHD) has an Earnings ESP of +2.56% and a Zacks Rank #2.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Spectrum Brands Holdings, Inc. (SPB): Free Stock Analysis Report

Church & Dwight Company, Inc. (CHD): Free Stock Analysis Report

Clorox Company (The) (CLX): Free Stock Analysis Report

Original post