In my review of the iShares Core High Dividend ETF (NYSE:HDV), I mentioned that all the major fund managers—State Street, Vanguard, Schwab, and iShares—offer a lineup of dividend-focused ETFs. Typically, there’s a high-yield option, a dividend-growth option, and occasionally a hybrid of the two.

Today, we’re heading to (State Street Global Advisors (SSGA) to examine their high-yield dividend offering from the SPDR ETF lineup: the SPDR Portfolio S&P 500® High Dividend ETF (NYSE:SPYD);.

Here’s what I like—and dislike—about it

SPYD: What I like

Each major ETF provider typically has a low-cost lineup designed as building blocks for investor portfolios. BlackRock iShares has its "Core" lineup, and SPDR offers the "Portfolio" lineup.

SPYD belongs to SPDR’s Portfolio series, making it a cost-effective choice for income-focused investors. It charges a 0.07% expense ratio, meaning you’d pay just $7 in annual fees for every $10,000 invested. It’s also well-capitalized, with $6.7 billion in AUM, so there’s no risk of it shutting down anytime soon.

While I have plenty to critique about SPYD’s methodology later, it does have its merits—it’s extremely simple to understand. Here’s how it works:

- Start with S&P 500 stocks, which must meet criteria such as a minimum $18 billion market cap, being U.S.-based and generating at least 50% of revenue domestically, positive earnings over the last quarter and trailing four quarters, sufficient public float, liquidity, and some oversight from a committee.

- From that universe, select the 80 highest-yielding stocks based on dividend yield.

- Equally weight those stocks and rebalance semi-annually.

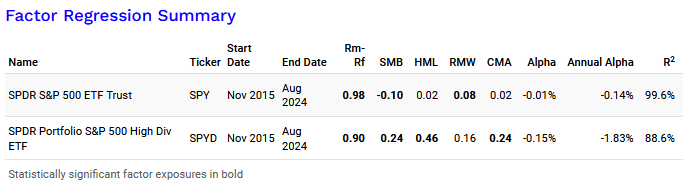

It’s straightforward. The S&P 500’s built-in earnings screen provides a basic level of quality, while the dividend yield screen creates a value tilt. As a result, SPYD tends to load on the Value (HML) and Investment (CMA) factors.

Lastly, if you’re after high income, SPYD delivers. As of December 20, it offers a 4.42% 30-day SEC yield, with quarterly distributions.

SPYD: What I dislike

Remember that simple index methodology SPYD uses? Sure, it’s transparent and easy to understand, but it’s also fundamentally flawed in several ways.

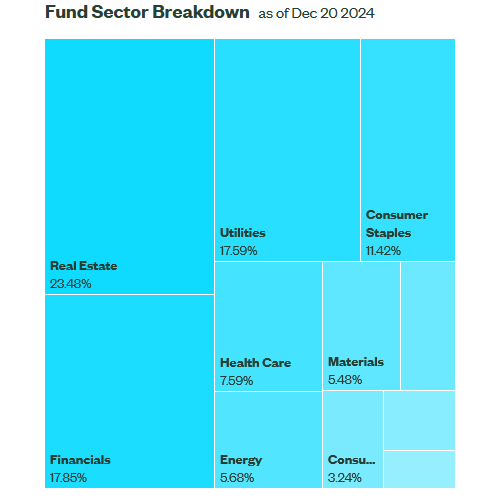

First, there’s no sector cap. If you just pick the 80 highest-yielding S&P 500 stocks with no limits, you end up with skewed sector exposures. Right now, SPYD’s biggest sector allocations are real estate (23.48%), financials (17.85%). And utilities (17.59%)

This is vastly different from the broad market and leaves you exposed to sectors with poor momentum in the hunt for yield (and, by extension, value). On top of that, the heavy concentration in REITs ensures a good portion of SPYD’s distributions is taxed as ordinary income, which is less tax-efficient than qualified dividends.

Now, SPYD’s strategy might work better if its index didn’t use equal weighting. Unlike WisdomTree ETFs, which weight holdings by annual dividend amount. SPYD weights them equally. This is arbitrary and creates headwinds against performance. Why?

Twice a year, SPYD takes the 80 highest-yielding S&P 500 stocks (often ones that have underperformed and now sport high yields), equally weights them, and rebalances six months later. The issue? Many of these stocks haven’t had time to recover before being replaced, which can drag on performance. Morningstar reports a high 43% annual portfolio turnover rate.

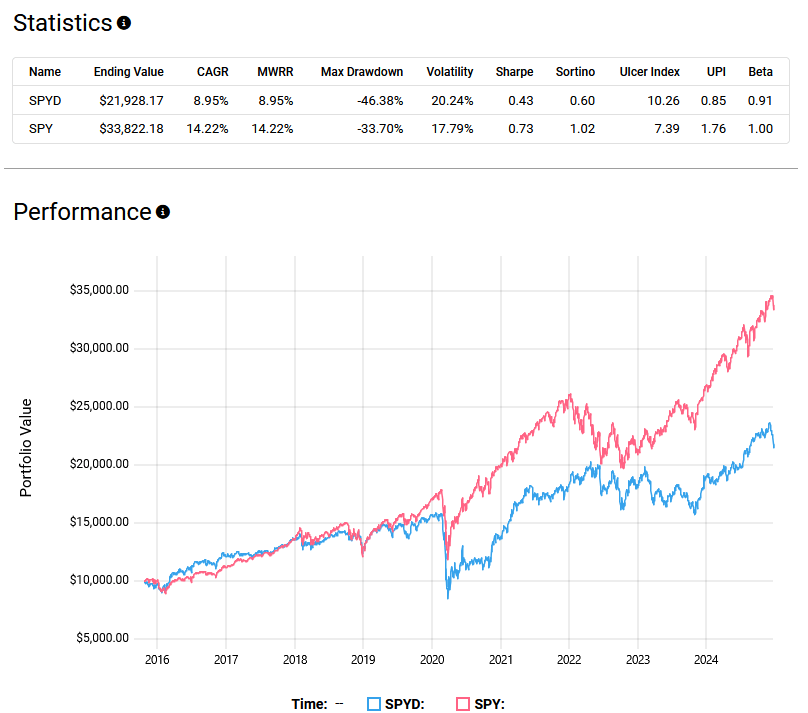

You can see this in the backtest from October 22, 2015, to December 20, 2024. Even with perfect reinvestment of its high yield, SPYD only delivered an 8.95% CAGR. By contrast, the SPDR S&P 500 Trust (SGX:SPY) delivered 14.22% over the same period.

SPYD also had higher volatility, with a 20.24% standard deviation compared to SPY’s 17.79%. The drawdowns were even worse—SPYD suffered a -46.48% drawdown, while SPY’s was only -33.70%. Unsurprisingly, SPY crushed SPYD on risk-adjusted returns, with a Sharpe ratio of 0.73 versus 0.43 for SPYD.

While SPYD has its merits for income-seeking investors, I think these structural drawbacks have consistently held it back in both total returns and risk-adjusted performance.

SPYD: My verdict

SPYD gets a 5/10 from me, making it average overall—but it’s not a uniform average.

The yield is definitely attractive, and the low expense ratio is a big plus. Drawing from the S&P 500 also ensures a baseline level of quality, which many investors appreciate.

However, these positives are offset by some significant drawbacks: an ineffective index methodology, lower tax efficiency, poor historical total returns, and sector concentration risk.

My takeaway? If you’re going to invest in high dividend yield ETFs, look for ones with:

- A quality screen for metrics like return on equity (ROE) and return on assets (ROA), which measure profitability and operational efficiency.

- A sector-neutral framework to avoid concentration risks.

- An approach that excludes the highest decile of yielding stocks, which are often the riskiest.

In short, I believe there are better high-yield dividend options out there for long-term investors.