World markets have been blazing but some moving faster than others. And there are some places like Spain where the political drama may be keep investors appetite at bay. Catalonia’s Declaration of Independence has muddied the waters in Spain. Questions abound as to whether Spain will just let it happen or use force to make sure it does not happen.

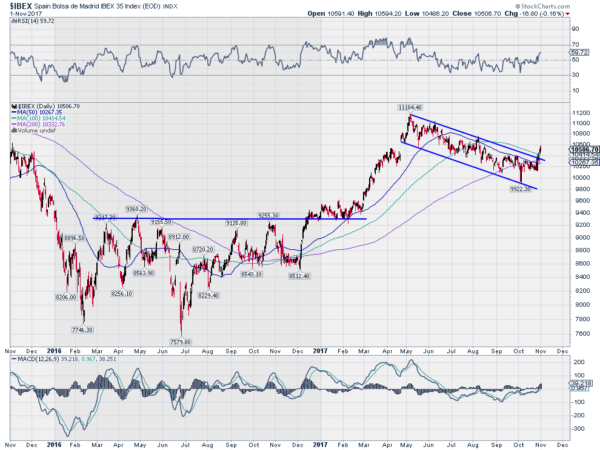

I do not have any idea how this will play out. But what I do know is that the Spanish stock market, measured by the IBEX 35 Index, has been lagging other European markets and is now starting to move higher. The chart below tells the story. It shows the IBEX over the last 2 years.

Notice that it stabilized against resistance for most of 2016 after a pullback. In December 2016 it started higher off of its 200 day SMA and moved through that resistance only to consolidate, holding the break out, through March. It shot higher again then reaching a peak in May. Since then it had pulled back in a channel to that 200 day SMA in September, and bottomed below it in October.

This week it broke above the channel. This took it above its 50, 100 and 200 day SMA’s for the first time since August and set a target on an AB=CD pattern near 12,000. Momentum supports the path higher with the RSI pushing above the mid line and the MACD crossing up. If you can not participate in the Spanish market directly the Spanish Index Hedged ETF, iShares Currency Hedged MSCI Spain (NYSE:HEWP), gives a similar look in a US market instrument.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.