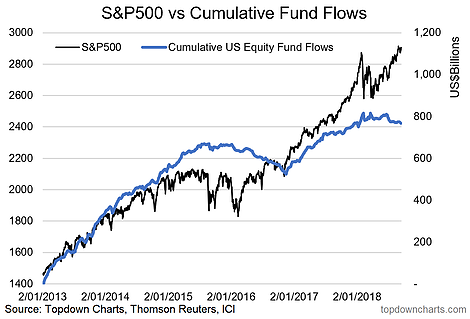

A curious divergence has opened up between the level of the S&P 500 and the cumulative level of fund flows into US equity funds (mutual funds and ETFs). The last time in recent history that we saw a similar type of divergence was in the wake of the 2015/16 twin corrections where fund flows tapered off and then after the election it was game on.

So the open question is whether this divergence in flows vs price will be followed by a similar type of 'onwards and upwards'. The counter argument might be that this is actually smart money flows... and a second correction is imminent. Either way, it's clear that investors are *not* throwing caution to the wind.

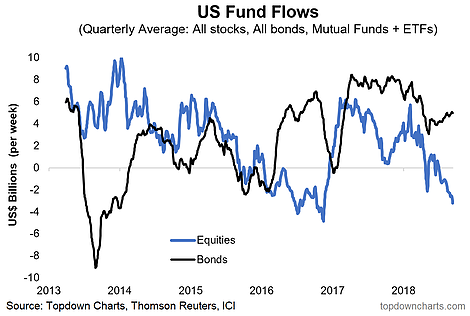

BONUS CHART: That last point is further highlighted in the rolling flows picture below. You can see investors continued to pile into bond funds (defensive assets) and continuing to withdraw money from equity mutual funds and ETFs. This is risk aversion in action. Time will tell whether this is the right move, or simply a wall of worry, particularly as short term seasonal risks loom.