S&P 500 Momentum Valuation And Long-Term Perspective

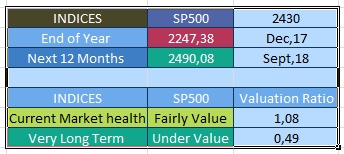

About 2 years ago i gave a crazy outlook according to some of my followers when i gave my valuation report on the S&P 500 at 2490. That report was backed by interest rates, sentiment and intermarket technical analysis using volatility pricing to give all angle valuation that supported the S&P would be at 2490.

The S&P 500 has achieved my target. Setting that aside, How is the outlook on the S&P 500 in the short term as well the long term? At the present, S&P 500 is fairly valued from an intrinsic point of view, stocks, DVD yields and bond yields are at even, since the DVD yield on the S&P is about 2.03% while the benchmark bonds yield are at 2.19% approximately, making the bond market a better choice to rotate some capital and digest the gain in the S&P 500. On the very long term the S&P 500 still has a lot of room to go since it is a long way to get overvalue because stock earning yields are 2 times better than bonds. In the short term the S&P 500 is due for a correction from its high. Please see the chart on the valuation on the S&P500.

End of year and next 12-month EPS used