The Fed chairman’s speech before the Congress drew up the indexes of S&P 500 and USD

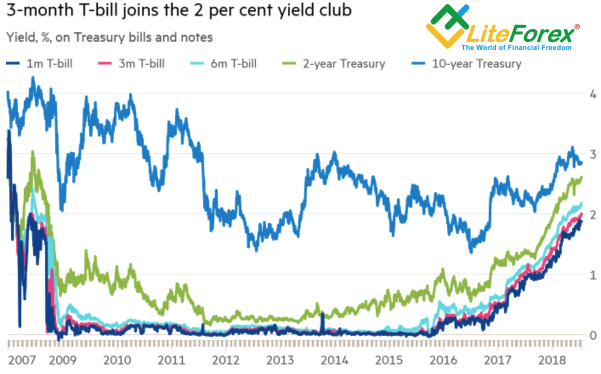

The markets hear what they want to hear. Jerome Powell’s reference to the US economy's steady growth, due to the massive fiscal stimulus, that might be hindered by only trade wars, increased global risk appetite. The US stock indexes went up, bonds -down, which resulted in the 3-month Treasury bills surge above 2% for the first time since June, 2008. Short-term bond rates have been above S&P 500 dividend yield (1.92%) for the first time since February, 2008.

Dynamics of the yield on US Treasury bills and notes

Source: Financial Times

According to TD Securities, Jerome Powell hinted at the Fed’s willingness to leave open the possibility of a slower monetary normalization in case of trade conflicts. Their influence on the US GDP, according to the central bank’s chairman, hasn’t yet been identified. He drew the Senate's attention to the fact that countries, not applying import tariffs, as a rule, developed faster due to high incomes and productivity. The states, applying protectionism, on the contrary, performed worse. In addition, Powell emphasized that the Fed doesn’t make trade policy. It is determined by the Congress and the US administration.

So, the markets are again dwelling upon the Donald Trump’s antiglobalism objectives. If the US president’s policy seeks to cancel tariffs all over the world, it is one matter, and it a completely different matter with the opposite targets. The signing of the agreement on free trade between the EU and Japan proves the first variant. The European export will be relieved by a reduced burden of €1 billion, and Japan’s export will get even more preferences.

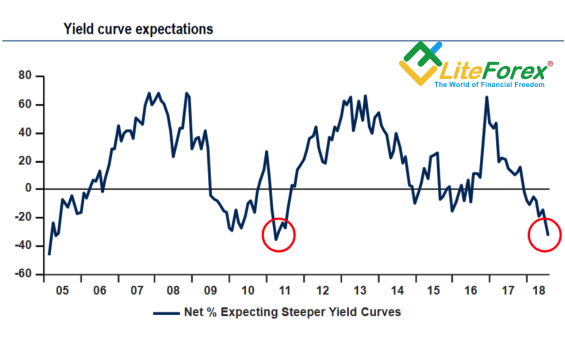

Jerome Powell is not the only person in the world who expresses concerns about trade wars. According to BofA Merrill Lynch survey of managers of assets worth of $542 bn, 60% of respondents think this factor to be the main threat to the financial markets. In June, it was about 31%. The bank also notes a higher probability of the yield curve inversion in the next 12 months up to 33%, which is the highest since 2011. Remember, according to the FOMC doves, the Fed should suspend the process of monetary normalization due to the historical link between the yield curve entering the red zone and economic recession.

Dynamics of the probability of yield curve inversion

Source: Bloomberg

It is remarkable that CME derivatives responded to Jerome Powell’s speech before the Congress with higher chances at 63% for four monetary restrictions by the Fed in 2018, so supporting the US dollar. It continues moving in the same direction as the US stock indexes, proving its status of the most risky, in terms of yield, G10 currency.

According to BofA Merrill Lynch, in the current year, the greenback is quite strong at the US Forex session, while yen is sold more and more often at the Asian trading sessions. Bears go on targeting EUR/USD, and sellers are going to test the support at 1.158.