S&P 500 Futures Non-Commercial Speculator Positions:

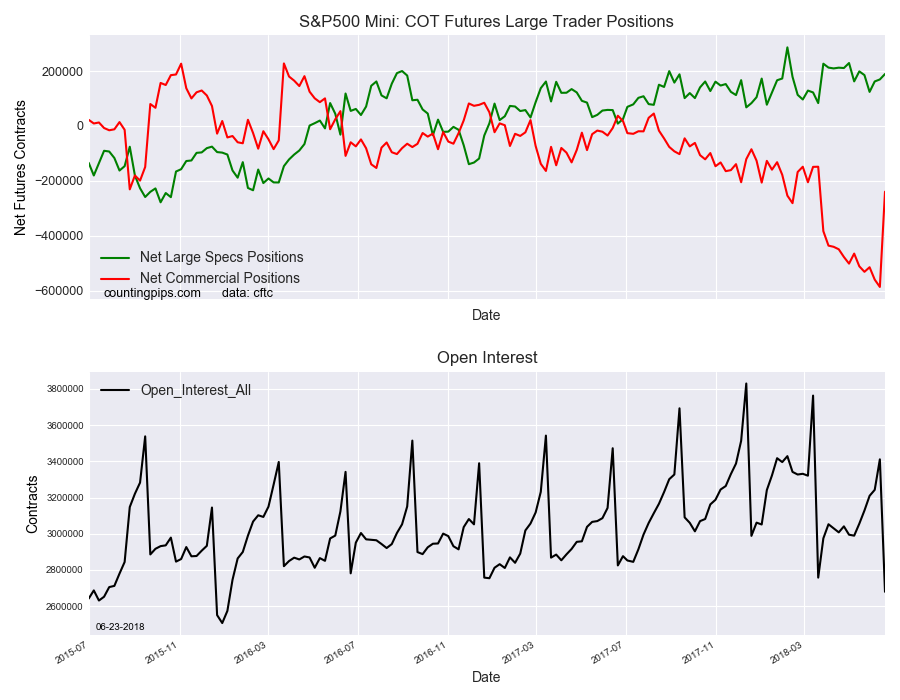

Large stock market speculators lifted their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P 500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 189,219 contracts in the data reported through Tuesday June 19th. This was a weekly lift of 19,789 contracts from the previous week which had a total of 169,430 net contracts.

Speculative bets increased for the third straight week this week to the highest level in five weeks.

Despite the speculative increase, the action in this market this week was mostly in the other trader positions as small traders cut last week’s hugely bullish position (+417,131 contracts) by -366,793 contracts to a current standing of +50,338 contracts this week (not shown in charts). Mostly offsetting that decline by the small traders was a jump in buying by the commercial traders by +347,004 contracts.

S&P 500 Mini Commercial Positions:

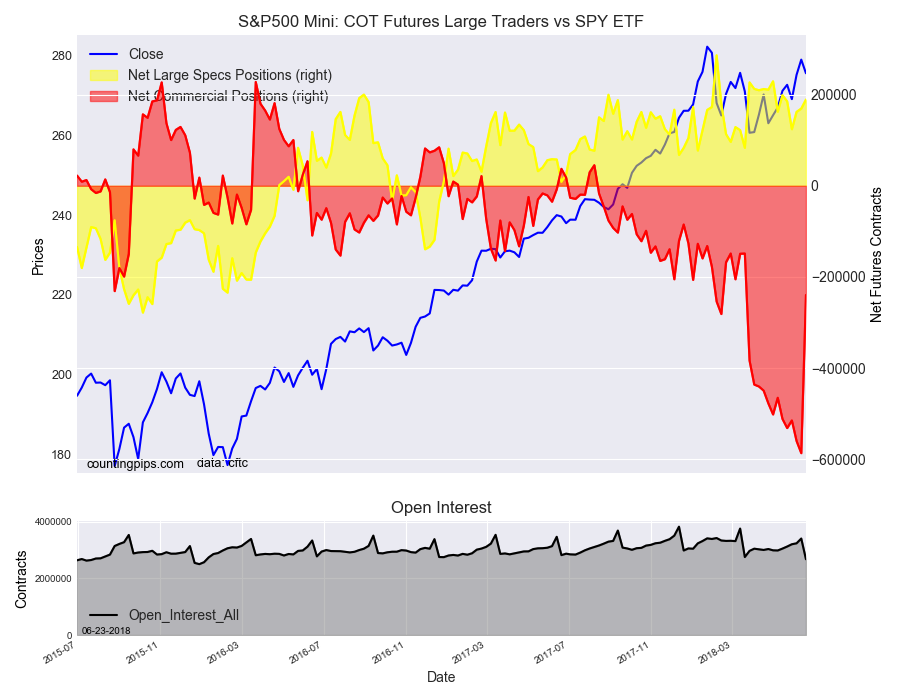

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -239,557 contracts on the week. This was a weekly boost of 347,004 contracts from the total net of -586,561 contracts reported the previous week.

Commercial positions cut back on their highest bearish position on our records (back to 1997) with the highest one-week gain on record. Despite the huge cutback this week, the overall standing remains very bearish for commercials with a current level of -239,557 net contracts.

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P 500 Index, closed at approximately $275.5 which was a loss of $-3.42 from the previous close of $278.92, according to unofficial market data.