S&P 500 Futures Non-Commercial Speculator Positions:

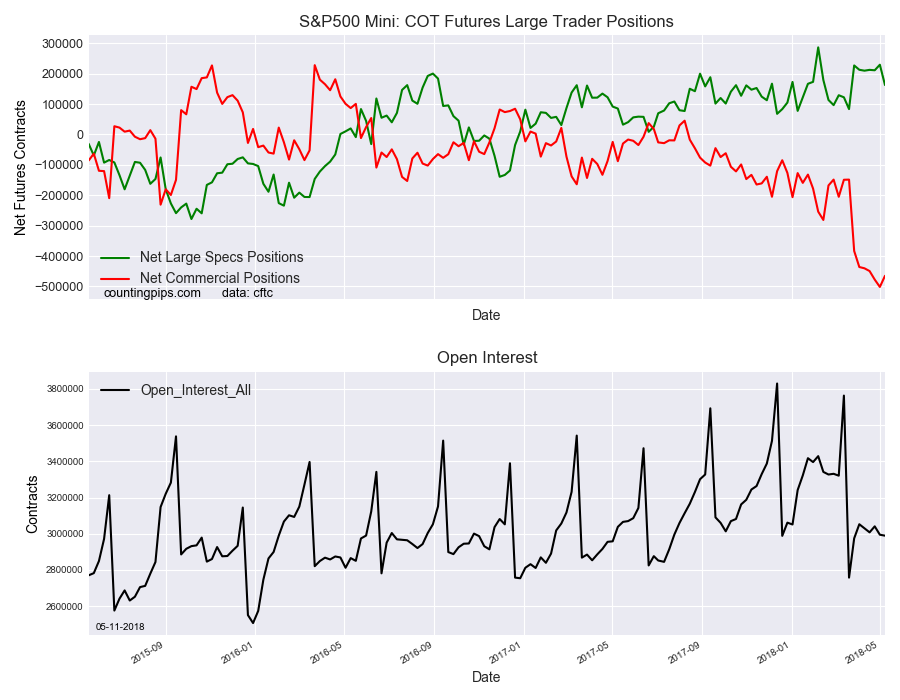

Large stock market speculators sharply decreased their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P 500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 162,355 contracts in the data reported through Tuesday May 8th. This was a weekly decline of -66,878 contracts from the previous week which had a total of 229,233 net contracts.

Speculative positions saw the largest one week drop since February 13th when positions fell by -107,214 contracts. Overall, the spec position fell below the +200,000 contract threshold for the first time in seven weeks and now reside at the the lowest level since March 20th when net positions totaled +83,293 contracts.

S&P 500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -465,004 contracts on the week. This was a weekly gain of 36,580 contracts from the total net of -501,584 contracts reported the previous week.

The commercials had increased their bearish positions for six straight weeks and pushed bearish bets to the largest level since 1997 last week before this week’s turnaround.

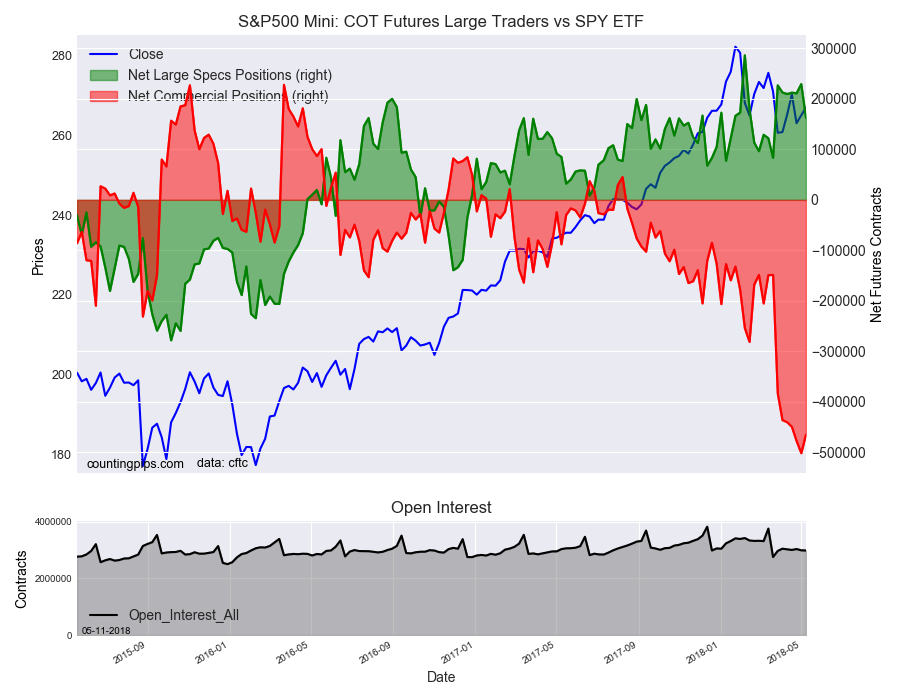

SPDR S&P 500 ETF (NYSE:SPY):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P 500 Index, closed at approximately $266.92 which was an uptick of $1.94 from the previous close of $264.98, according to unofficial market data.