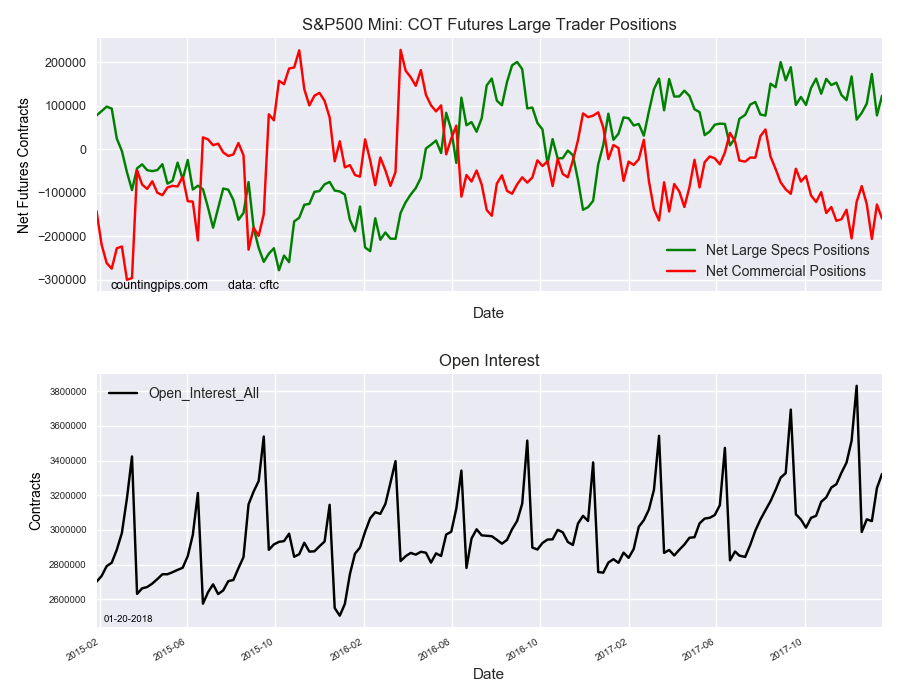

S&P 500 Mini Non-Commercial Speculator Positions:

Large stock market speculators increased their bullish net positions in the S&P 500 Mini futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P 500 Mini futures, traded by large speculators and hedge funds, totaled a net position of 122,450 contracts in the data reported through Tuesday January 16th. This was a weekly rise of 45,037 contracts from the previous week which had a total of 77,413 net contracts.

Speculative positions in the mini contracts have now gained for four out of the last five weeks after seeing a sharp decline last week (fall of -95,188 contracts). The overall net position is back above the +100,000 net contract level after falling below last week.

S&P 500 Mini Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -159,265 contracts on the week. This was a weekly shortfall of -32,047 contracts from the total net of -127,218 contracts reported the previous week.

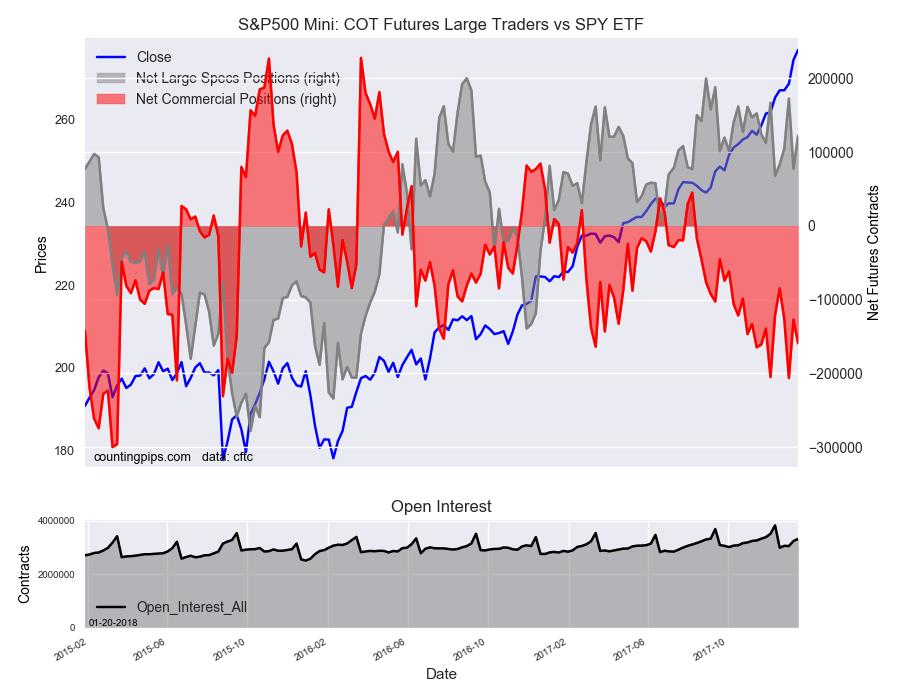

SPY (NYSE:SPY) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P 500 Index, closed at approximately $276.97 which was a gain of $2.43 from the previous close of $274.54, according to unofficial market data.