The once unstoppable S&P 500 finds itself on shaky ground ahead of today’s NFP report, where a firm NFP print could give it another boot ahead of the weekend.

A host of strong data and hawkish comments from the FED finally took its toll as stock markets remembered that hikes can impact growth, earnings and therefor, stock prices.

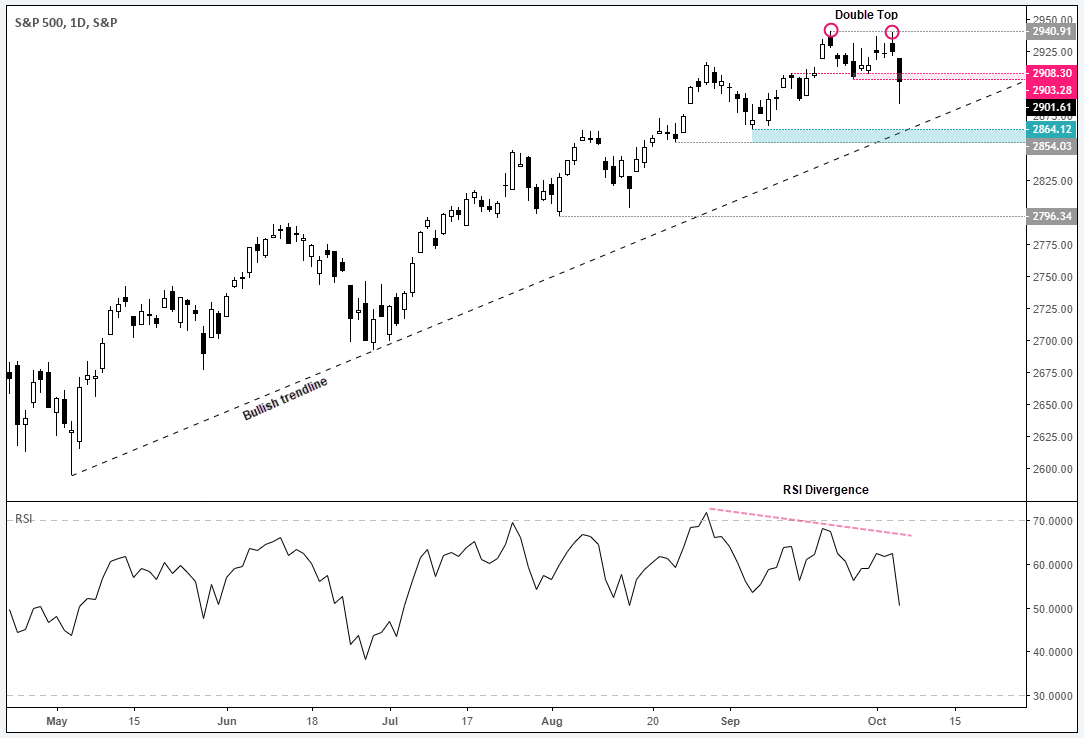

We can see on the daily chart that a bearish RSI divergence has been forming since the end of August which warned of weakness to the trend. A double top has appeared at the 2940.91 high which projects an approximate target near the 2864.12 low. Furthermore, the three candles which formed the second ‘top’ are all Dojis which, by failing to test the all-time high, managed to squeeze in lower-high by a cats-whisker.

Given yesterday’s sell-off was its most bearish session in three months, momentum clearly favours bears over the near-term. And although prices retraced about 50% of yesterday’s rout, the close beneath the 2903.28 breakout level may provide a decent entry level for counter-trend traders.

Looking at the weekly chart, if today closes at or below current levels, we could have a bearish engulfing week on our hands. However, things could become more interesting if we see a break beneath the January highs as it also invalidates the bullish trendline on the daily chart.

For the avoidance of doubt, we’re not calling the mother of all tops. But that doesn’t mean a deeper correction can’t unfold. Whilst trading such a move during a clear up-trend may not suit most, it can at least serve as a warning to step aside until the picture becomes clearer once again. And such a cue might be prices stabilising at support levels which provide a springboard for bullish momentum to return.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.