Although the midterms elections haven’t always been viewed as a major event for markets, there is an argument to be made that this one could spark more volatility than usual.

If the polls are to be believed, the Democrats are likely to take the house. If they’re to surpass expectations and take the senate as well, it could provoke a knee-jerk (and bearish) reaction from US stocks as Democrats would be in an even stronger position to block or alter major policy changes or even move to impeach Trump.

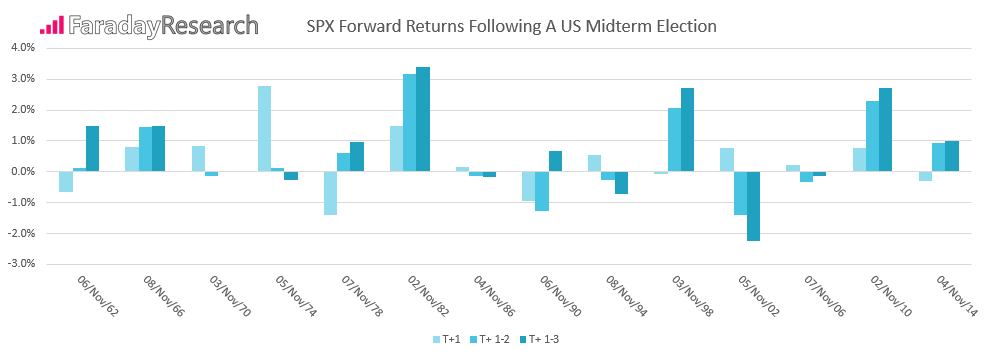

However, the polls had it hopelessly wrong ahead of the 2016 elections, so if the Republicans are to retain both the house and senate, then stocks could be in for quite a relief rally. What could also help is that since 1962, the S&P 500 has tended to rise on the days following a midterm election even though the ruling party almost always loses seats. Over the past 14 midterms, the ruling party has lost seats on 12 occasions, shedding -22.3 house seats and -2.9 senate seats on average. So, it’s hard to argue stocks should fall if Democrats only take the house. Still, the S&P 500 chart is teasing us with a potential leg lower in spite of this.

Looking at the daily chart we can see the S&P 500 has bounced from its lows since our previous post. The 200-day average is capping as resistance and it’s interesting to note last week’s high stopped just shy of the broken trendline from the March 2016 low. Furthermore, Friday produced a bearish outside day to warn of a swing high below the resistance cluster.

At time of writing index futures are trading lower and we could find that investors remain cautious ahead of the midterms, so upside potential remains capped. Therefor we’re going to keep a close eye on Friday’s range as a break either side of it could signal its next directional move.

A break of 2700 brings the structural lows back into focus and provides an adequate reward/risk ratio for short trades. However, we’d prefer to see a break above 2816.94 before becoming bullish on the index as the trend structure remains bearish whilst beneath it.