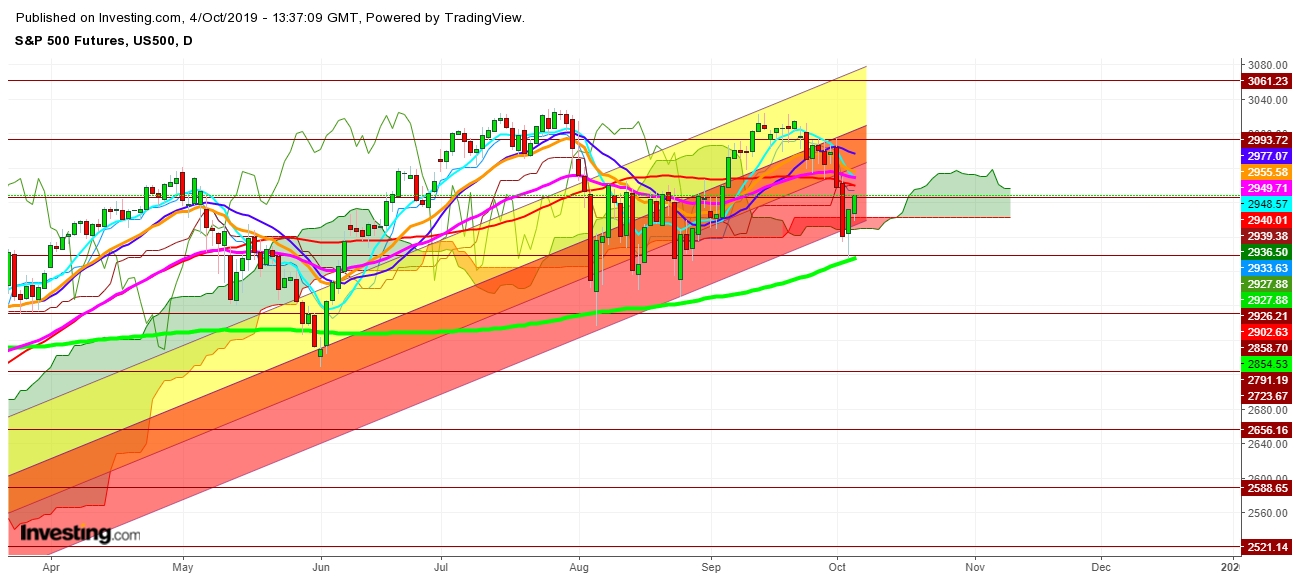

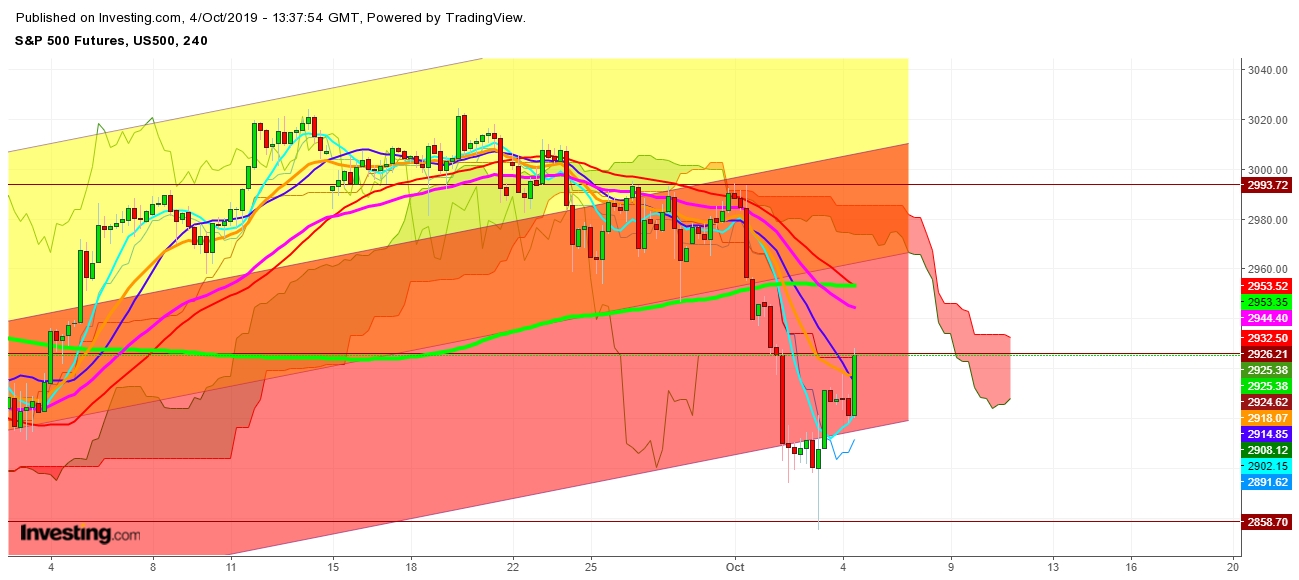

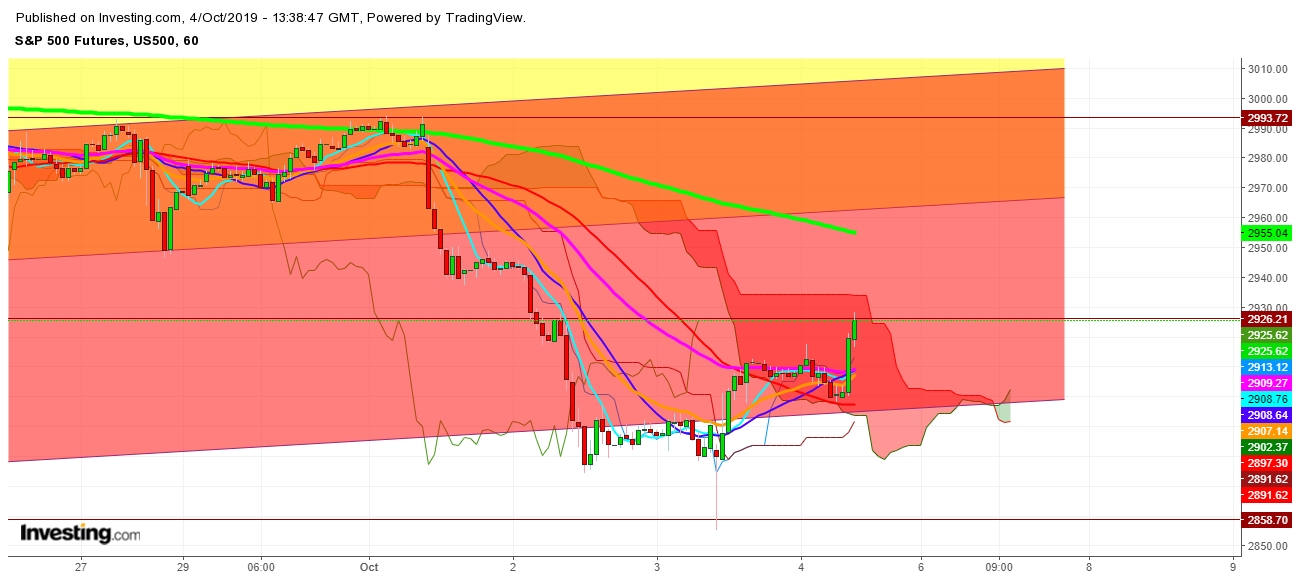

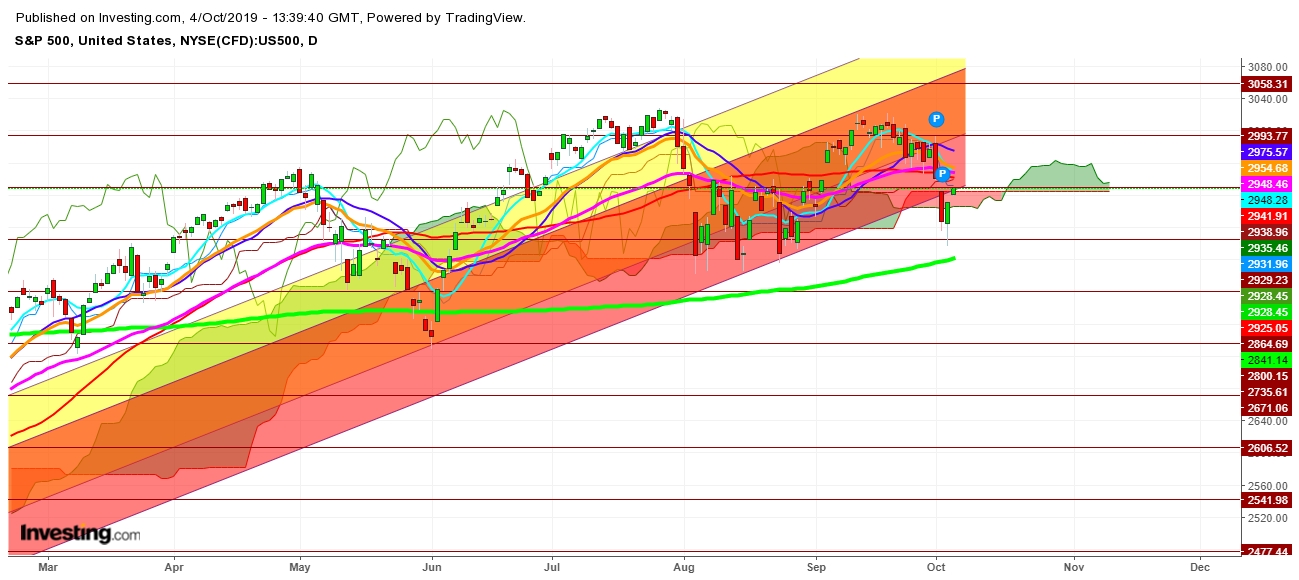

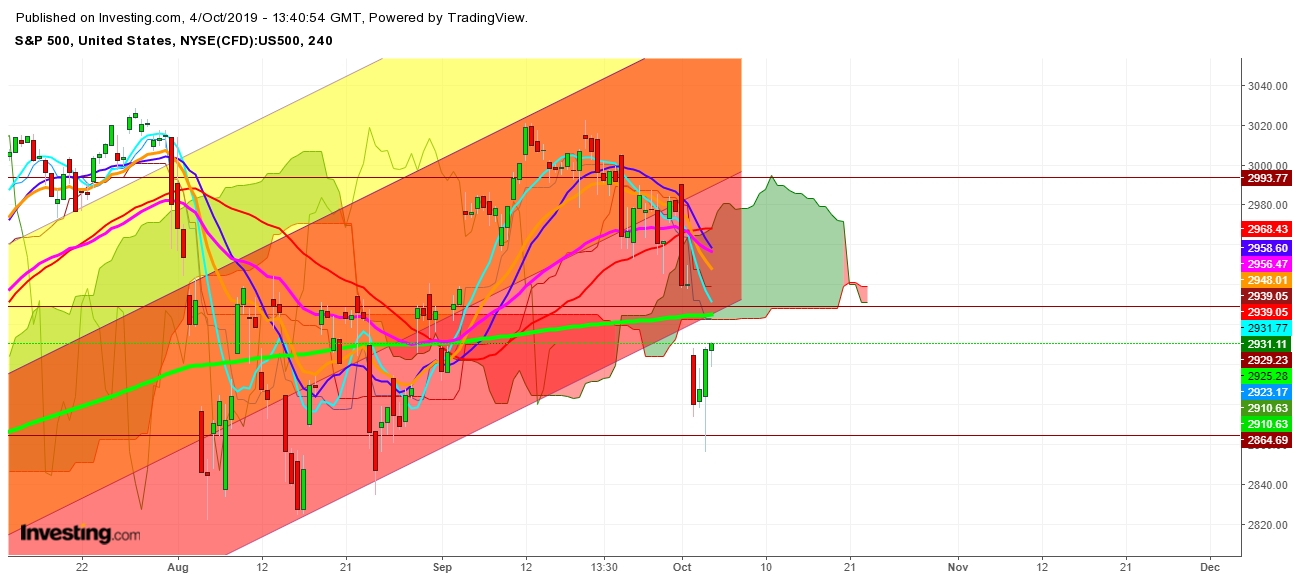

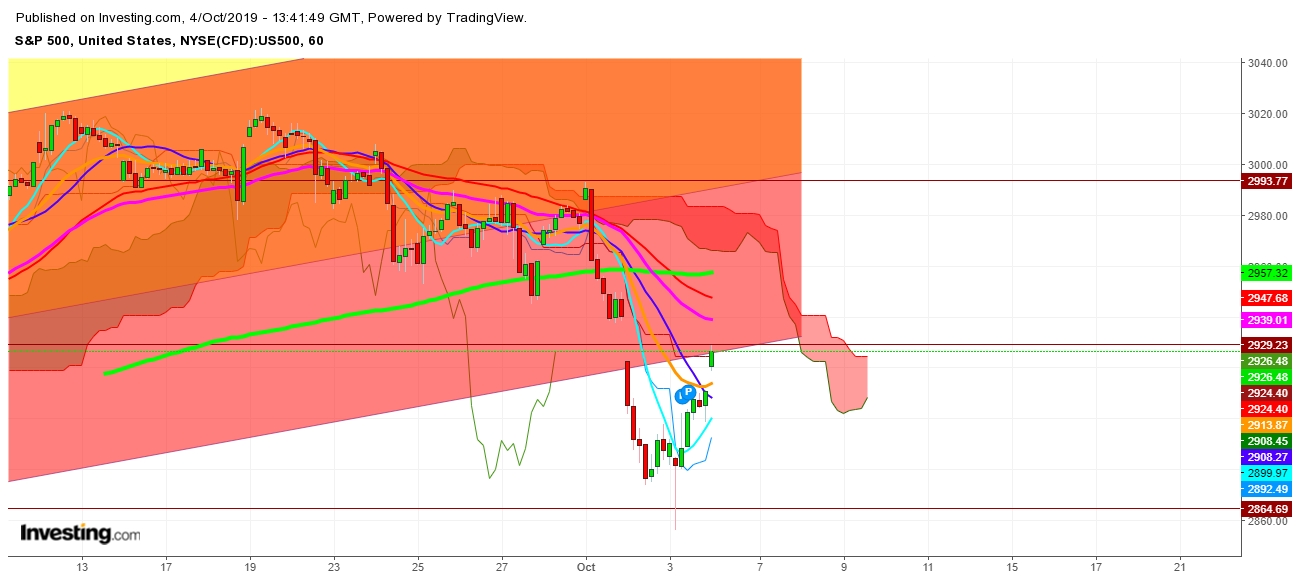

On analysis of the movements of S&P 500 Futures, in different time frames, I find that the lesser job creation of 136,000 jobs in September, down from an upwardly-revised 168,000 in August; looks evident enough to reflect the growing damaging impact of tariff tussle of the United States with China. I find that the first bumping move from the level of 2904 up to 2919, after the announcement of Jobs Data, shows an immediate upward move before Fed’s decision on Interest Rate cut. No doubt that the earnings growth slowed to a standstill as trade uncertainty and the fading effects of President Donald Trump's tax cuts took its toll. I find that an immediate reactionary move shown by S&P 500 Futures may result in higher opening of S&P 500, but Fed’s reluctance on Interest Rate cut may extend the prevailing exhaustion in S&P 500.

Finally, I conclude that the growing uncertainty with the step taken by the United States on European tariff issue seems to disrupt a little progress on Sino-U.S. tariff trade front, which is supposed to be taken care of in October’s upcoming meet between the United States and China; have capped the upper side of S&P 500 at 2959, whereas the downside looks open up to 2828 during the upcoming week. I find that the S&P 500 Futures will have to face stiff resistance at the level of 2929 before moving upward; but 200 DMA at the level of 2959 will definitely provide strong resistance.

Trading Strategy: Short Position

Entry Level: 2949 – 2959

Stop Loss: 2969 - 2989

Target: 2849 - 2959

Profit Probability: 100 points

Loss Probability: 20 points

Risk/Reward Ratio: 1:5

S&P 500 Futures

S&P 500

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.