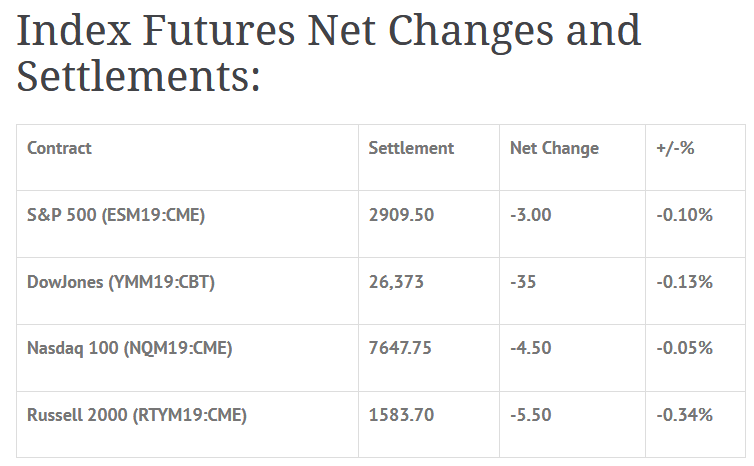

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +2.39%, Hang Seng +1.07%, Nikkei +0.24%

- In Europe 9 out of 13 markets are trading higher: CAC +0.09%, DAX +0.71%, FTSE +0.48%

- Fair Value: S&P +3.88, NASDAQ +20.48, Dow -4.65

- Total Volume: 949k ESM & 95 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes 8-Week Bill Settlement, Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, Housing Market Index 10:00 AM ET, and Robert Kaplan Speaks 2:00 PM ET.

S&P 500 Futures: The Life Of A Predator Algo, Take No Prisoners

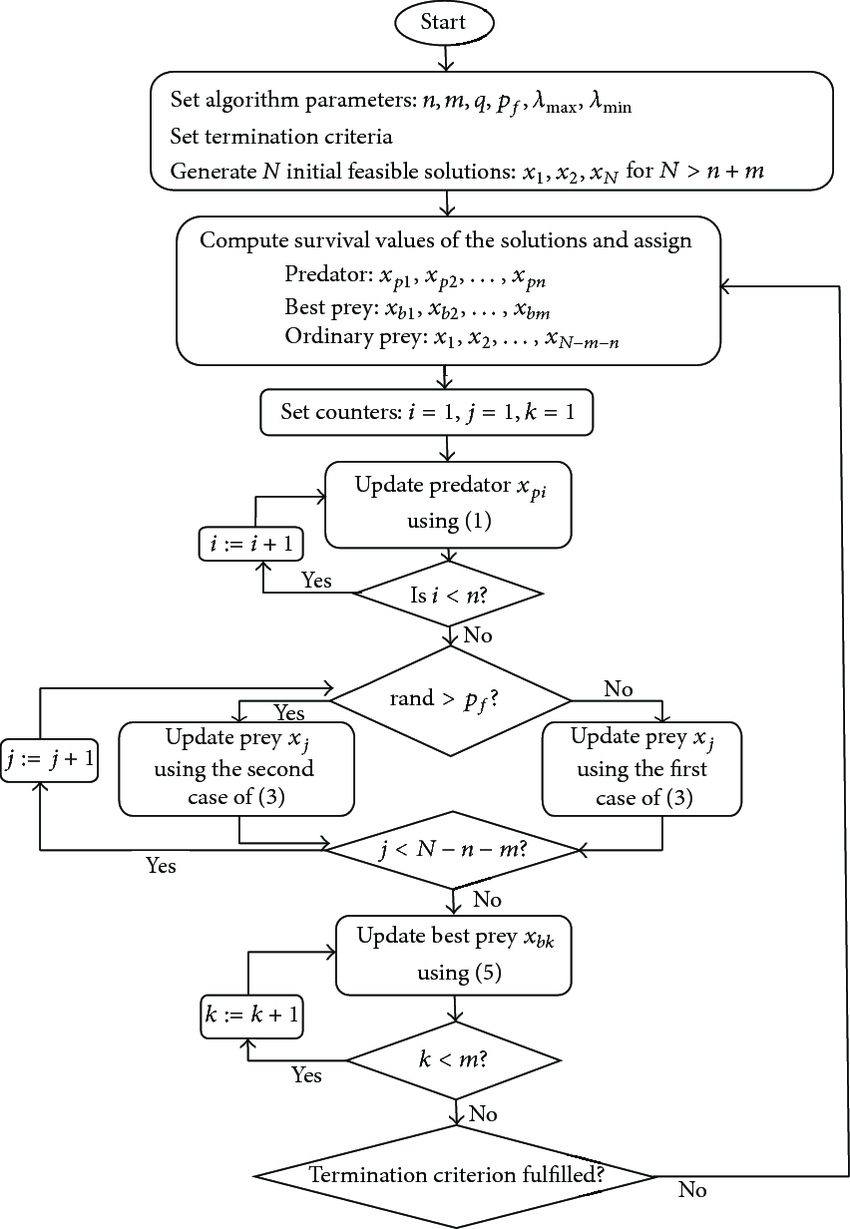

While the price action of the S&P has been pretty balanced, the predator algos love knocking down the #ES and then running it back up. Early on the weakness in the NQ was very visible, and it took the ES down for the ride, but didn’t take long for the algos to push the markets back up. As we have learned, it’s a much easier to trade with the algos than going against them.

During Sunday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 1914.50, a low of 2909.25, and opened Monday’s regular trading hours at 2912.25.

After the 8:30 CT bell the ES turned weak almost immediately, first trading down to 2906.25, then down to 2900.50. Once the early low was in, the futures started to recover a little, and by 10:15 had rallied back up to 2907.00. From there, the ES pulled back to test the low, but only made it down to 2901.25 before again turning higher.

By 2:00 the futures had traded up to 2910.75, and when the 2:45 cash imbalance reveal came out showing over $312M to buy, was trading at 2908.00. Going into the close the ES was hovering around the highs, and went on to print 2910.00 on the 3:00 cash close, and 2909.75 on the 3:15 futures close.

In the end, the overall tone of the ES was fairly balanced. In terms of the days overall trade, when you take out the 145,000 contracts from Globex and subtract it from 949k, only around 800k contracts traded in the day session.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.