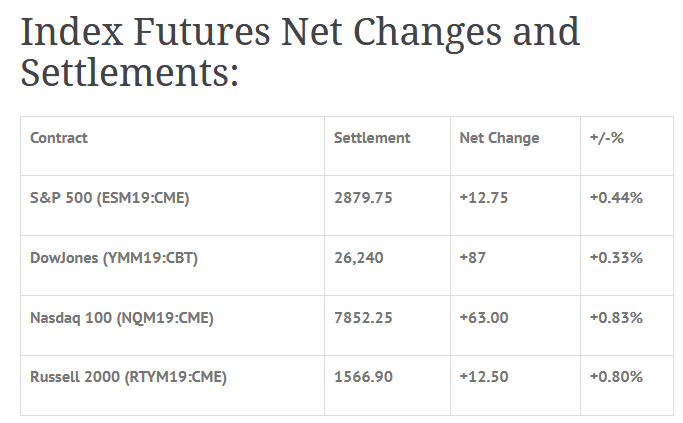

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.94%, Hang Seng -0.17%, Nikkei +0.05%

- In Europe 12 out of 13 markets are trading lower: CAC -0.29%, DAX +0.08%, FTSE -0.50%

- Fair Value: S&P +3.79, NASDAQ +25.49, Dow +5.72

- Total Volume: 1.23m ESM & 106 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, John Williams (NYSE:WMB) Speaks 9:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Loretta Mester Speaks 1:00 PM ET, Patrick Harker Speaks 1:00 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

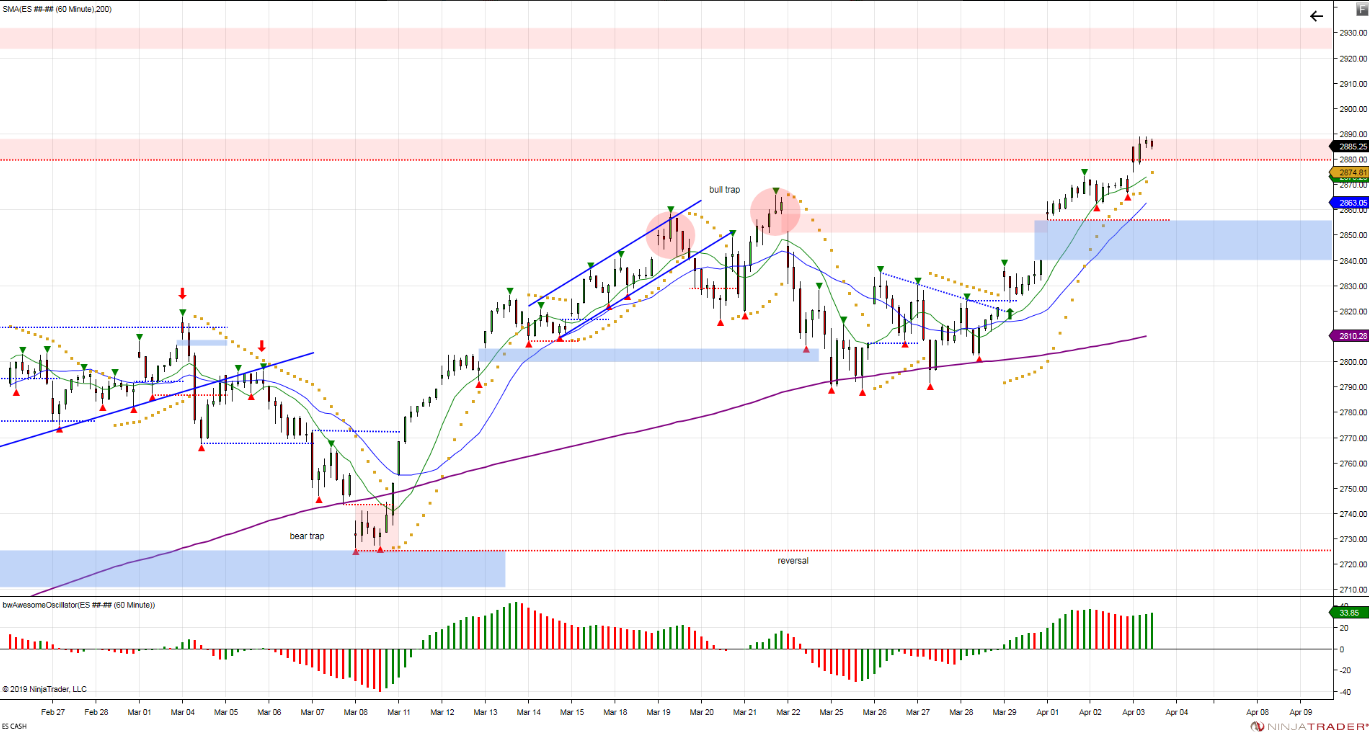

S&P 500 Futures: October 2887 Gap Fill

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Oct 9th gap 2887 filled, recovering breakdown from last October. Next upside gap @ 2931, Oct 3rd.

During Tuesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2886.25, a low of 2865.25, and opened Wednesday’s regular trading hours at 2884.75.

The ES was weak coming out of the gate, selling off immediately after the 8:30 CT bell, and by 9:00 had traded down to 2875.00. After that, buy imbalances began to show up, and the futures turned around to head higher. By 11:00 the ES had topped out at 2889.25, then began to slowly drift lower again.

At 12:30 the selling started to pick up, and by 1:00 the futures had printed a new low at 2874.25, just 3 ticks below the morning low. After a small rally, several sell programs triggered, pulling the futures down to another new daily low at 2869.00. Once the low was in, the MiM flipped from $150 million to sell to $146 million to buy, and the ES began to trade higher again.

Buyers showed up heading into the close, and on the 2:45 cash imbalance reveal the ES traded 2876.00, as the final MiM showed $715 million to buy, then traded 2876.50 on the 3:00 cash close, and ended the day at 2880.00 on the 3:15 futures close, up +13 handles, or +0.45% on the day.

In the end, the overall tone of the ES was weak early in the day, and strong late in the day. In terms of the days overall trade, total volume was higher than Tuesday, with 1.2 million futures contracts traded.

The ES posted its fifth consecutive advance, after earlier climbing as much as 0.7%. It has now rebounded 15% in 2019, and is at its highest level since early October. It is also less than 3% away from last year’s all-time high.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.