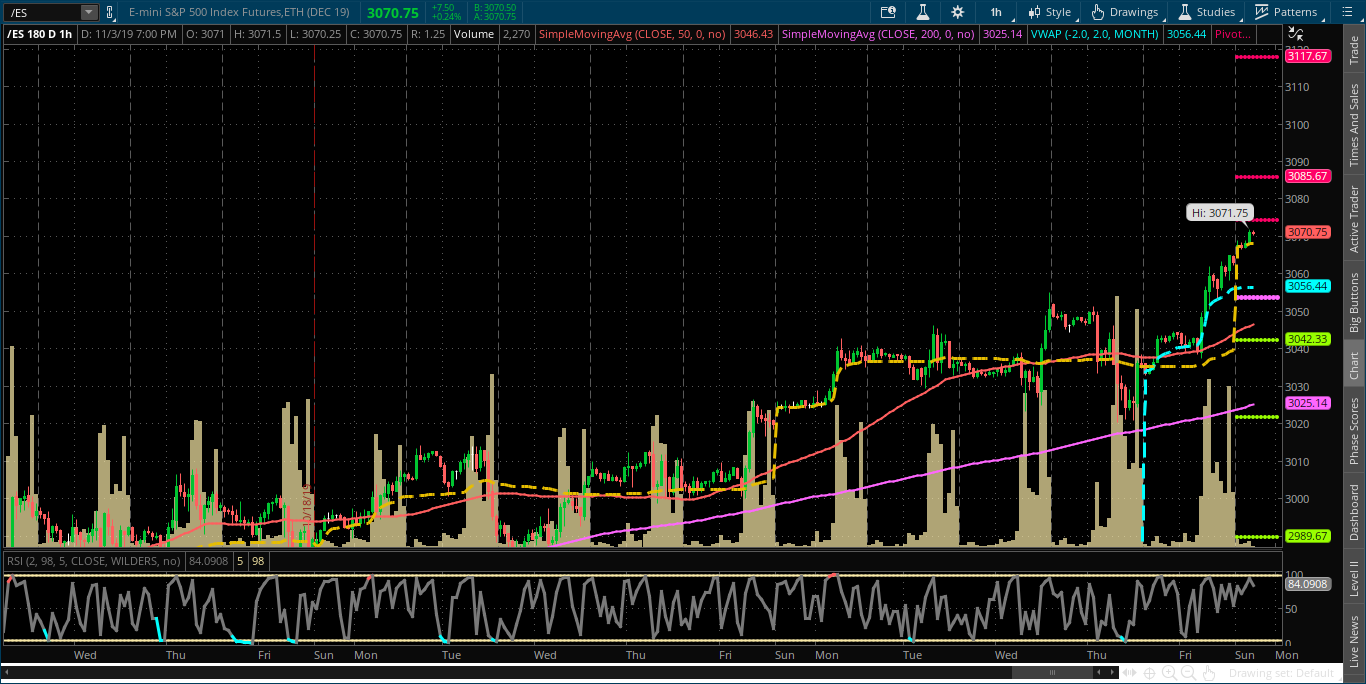

To keep this simple and brief, Monday, Nov.4's intraday Pivot Point targets for the S&P Emini Futures Index (ES) are (as shown on the following 60 min chart):

R3 = 3117.67

R2 = 3085.67

R1 = 3074.33

PP = 3053.67

S1 = 3042.33

S2 = 3021.76

S3 = 2989.67

Weekly VWAP = 3068.22

Monthly VWAP = 3056.45

50 MA = 3046.43

200 MA = 3025.14

All of these levels represent short-term support and resistance levels.

The following monthly chart of the S&P 500 Index (SPX) contains a Fibonacci channel which begins at the March 2009 lows.

Its next Fibonacci target sits around the 3125 level (1.618% external Fibonacci level), which happens to coincide with Monday's R3 Pivot Point level.

Inasmuch as the Balance of Power lies currently with the bulls on this timeframe, we may see this level hit, if not on Monday, then perhaps sometime this week...particularly if 3050 (or, at least, 3040) holds as near-term support.

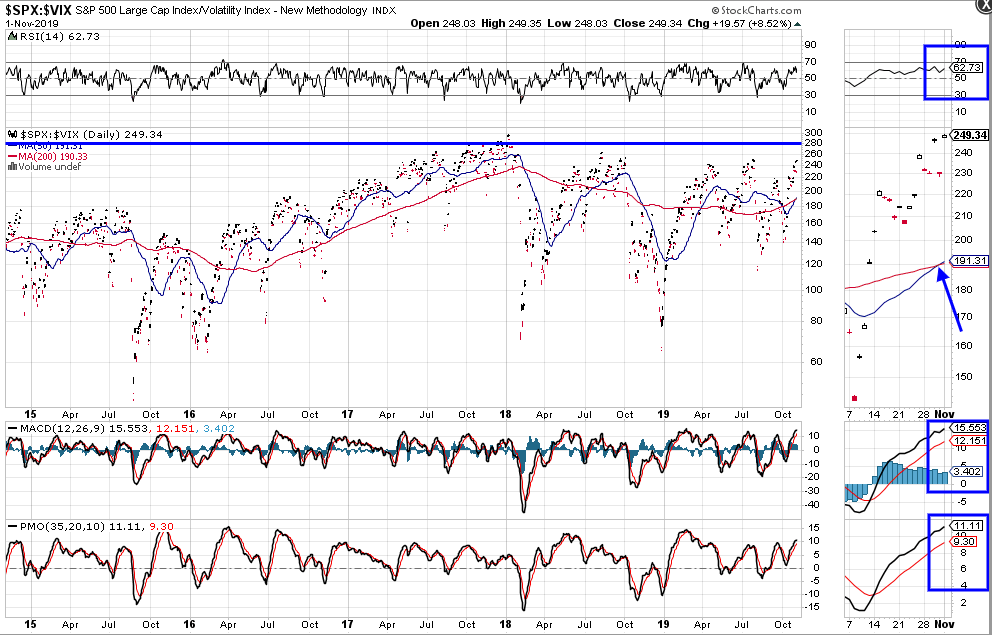

Finally, the following daily ratio chart of the SPX:VIX ratio shows that a bullish moving average Golden Cross has just reformed on rising RSI, MACD and PMO indicators...hinting of lower volatility and higher SPX prices.

If these hold, I expect that the SPX may just reach 3125ish in short order.