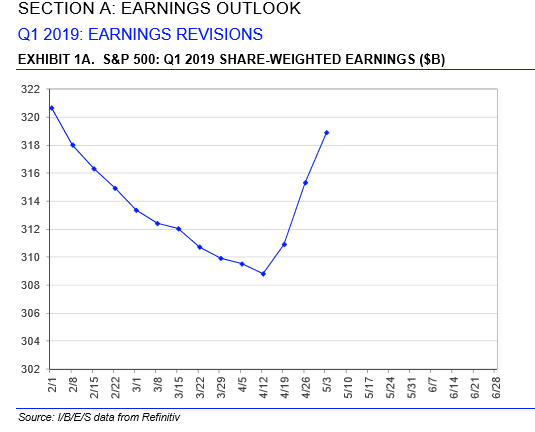

This graph, which appears weekly on the first page of I/B/E/S by Refinitv’s “This Week’s in Earnings” sometimes tells a better story than the written word, so it is posted this week to show readers that the share-weighted earnings (in US dollars) recovery is real and it shouldn’t be too long before the S&P 500 dollar earnings exceed the February 1 ’19 level.

S&P 500 earnings are digging out of a Q4 ’18 / Q1 ’19 hole but I expect the full-year 2019 S&P 500 earnings to be at least high-single-digits by the time we get to the back-half of 2019.

Q1 ’19 earnings – quick recap:

- The S&P 500 is currently expecting 1% y/y growth for S&P 500 earnings as a whole, as of Friday, May 3rd, 2019;

- The sectors that have shown further downward revisions since reporting are Energy, Communications Services and Utilities;

- Health Care (rather than the Financial sector) now has the highest expected earnings growth for Q1 ’19 at +9.9%, more than double it’s expected growth rate of +4.5% as of Q1 ’19.

- Technology earnings expected growth for Q1 ’19 jumped from -6.1% as of April 1 to -2.2% as of May 3rd, 2019

Here is how Technology sector earnings look for Q2, Q3 and Q4 ’19:

- Q2 ’19: -7.4% vs -5.8% as of April 1

- Q3 ’19: -4% vs -3.5% as of April 1

- Q4 ’19: +6.3% vs +6.1% as of April 1 ’19;

- 2019 as a whole ? Tech’s earnings growth rate is expected to remain negative at -1.5% vs -1.9% as of April 1;

Summary / conclusion: Apple’s forward earnings curve (the EPS for each quarter the next 6 quarters out) saw slightly lower EPS revisions following the fiscal Q2 ’19 report, but really not enough to be material, and similar to Amazon’s forward estimates which were also revised slightly lower. (Long a lot more Apple (NASDAQ:AAPL) than Amazon (NASDAQ:AMZN), trimming Apple significantly in the last 12 months.)

One of the ways for users to use this site over the long run (which has been written about before) is to note which sectors are seeing upward revisions to estimates while the S&P 500 as a whole might be seeing flat or lower expected growth. Here is how expected sector growth rates have changed for full-year 2019 growth rates since April 1:

- Cons Disc: +7.4% vs 6.8% as of April 1;

- Energy: -7.8% vs -11% as of April 1;

- Financials: +9.1% vs +8.8% as of April 1 (Berkshire’s earnings release will impact this expected growth rate next week – BRKA is the largest financial stock in the S&P 500)

- Health Care: +6.1% vs +5.5% as of April 1;

- Real Estate: +4% vs +3.8% as of April 1;

- Technology: -1.5% vs -1.9% as of April 1;

- S&P 500: +3.1% vs +3.3%

The Financial sector is still expecting the strongest rate of earnings growth of the 11 S&P 500 sectors for calendar 2019.

DataTrek Research is a neat little blog I’ve stumbled upon in the last few months. Here is what this blog had to stay about Technology last week:

“Disruption: Last year’s S&P sector reclassifications make it difficult to know the true weighting of Technology in global equity market indices. We ran the numbers; the S&P 500 is actually 31%, Tech (not the official 22%) and Emerging Markets are close behind at 29% (not 14.5%). U.S. small caps (Russell 2000) have a 16.5% “real Tech” weight and EAFE equities are underweight at just 7.0%. We still believe that U.S. large cap Tech is the primary driver of global equity outperformance so we favor the S&P 500 over all these other options. It is, however, very much a concentrated bet and only getting more so with time.”

Here is what DataTrek had to say about the rest of the S&P 500 performance as of the end of April ’19:

Financials Lead Way. For Now.

With just one day left in April, it’s time to get a jump-start on some month-end performance analysis and see what it says about current market narratives. The scope of today’s discussion includes global equities, US small and large caps, and the 11 major sectors of the S&P 500.

We’ll start with the good stuff: what’s worked in April:

- After Google’s disappointing report today after the close, it looks like Communication Services will not be the best performing group in April, although it had a great run this month.At today’s close Communication Services was +9.5% for April, besting all comers. If Google’s 7% decline after hours holds until tomorrow’s close, it would lop 1.7 points off that MTD result, putting Comm Services at a +7.5% April return assuming nothing else goes awry.

- That means large cap Financials – yes, Financials – will likely end up as the S&P 500’s best performing group for April since as of today’s close the group was +8.8% on the month. Even better: that means the sector is now back to even with the S&P for the year with a 17.5% gain.

- As far as other S&P sectors go, Technology is a solid third (+6.2% MTD), with Consumer Discretionary (+5.6%) / Industrials (+3.6% MTD) rounding out the winners. Don’t get too excited about that CD return, though: almost 40% of it (38% really) is Amazon’s 24% weight and 8.9% gain for the month.

- As far as geographies go, the US (S&P 500 +3.8%, Russell 2000 +3.8%) continued to outperform both Emerging Markets (+2.5% in dollar terms) and EAFE (2.9% in dollar terms). For the year the S&P 500 is +17.4%, well ahead of EM (+12.6%) and EAFE (+13.5%).

And here’s what did not work in April:

- Three large cap S&P sectors had outright price losses: Health Care (-3.2% MTD), Real Estate (-1.7%) and Utilities (-0.70%).

- Three sectors were positive on the month but underperformed the S&P: Energy (+0.6%), Consumer Staples (+1.7%) and Materials (+2.6%).

Lastly, here is one notable “tie”:

- There was no discernable difference in April between US large cap Growth and Value styles although Value still lags by 3.1 percentage points YTD versus Growth’s 19.0% price gain.

- The outperformance of Financials is the central reason the S&P 500 Value Index managed to keep pace with Growth in April. The sector’s weight in Value is 22% where it is just 5% in Growth.

- In small caps, Value has actually beaten Growth by 32 basis points MTD (we’ll call that a tie as well, though). And the reason is the same as in large caps: a 25% Financials weighting and a group +5.0% on the month.

Our key takeaway from all this: April’s outperformance in Financials is a welcomed shift from sluggishness earlier in the year but we’re concerned about the staying power of this move. Yes, the group is cheap at 12.0x forward earnings versus 16.8x for the S&P 500. And yes, investor psychology for the sector is better when the yield curve steepens. Which is what’s happening, as we note in the next section.

But… It is hard to believe in a sustained move for Financials so late in an economic cycle. This is a group that does its best work when economic conditions are bottoming, not when they are humming along nicely (as they are now). Moving into May and June, other sectors like Technology, Communication Services and Industrials – all more typically late-cycle plays – will have to shoulder more of the load if US stocks are to continue their rally.

It’s a neat little blog. It’s a quick read packed with useful info as far as i can tell. I’d encourage readers to take a two-week trial and see what you think. (No affiliation with the blog whatsoever.)