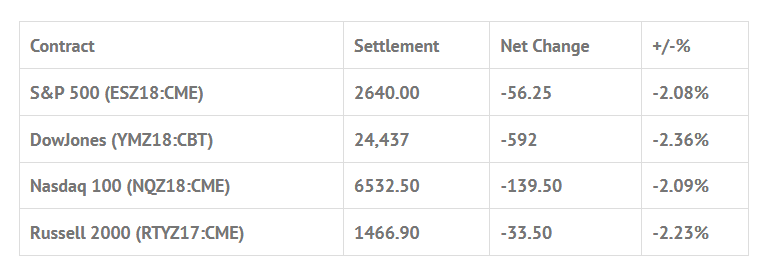

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 11 markets closed higher: Shanghai Comp +0.21%, Hang Seng +0.51%, Nikkei -0.35%

- In Europe 12 out of 13 markets are trading higher: CAC +0.56%, DAX +0.92%, FTSE +1.06%

- Fair Value: S&P +0.52, NASDAQ +8.72, Dow -6.66

- Total Volume: 2.52mil ESZ & 861 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Durable Goods Orders 8:30 AM ET, Jobless Claims 8:30 AM ET, Consumer Sentiment 10:00 AM ET, Existing Home Sales 10:00 AM ET, Leading Indicators 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, EIA Natural Gas Report 12:00 PM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

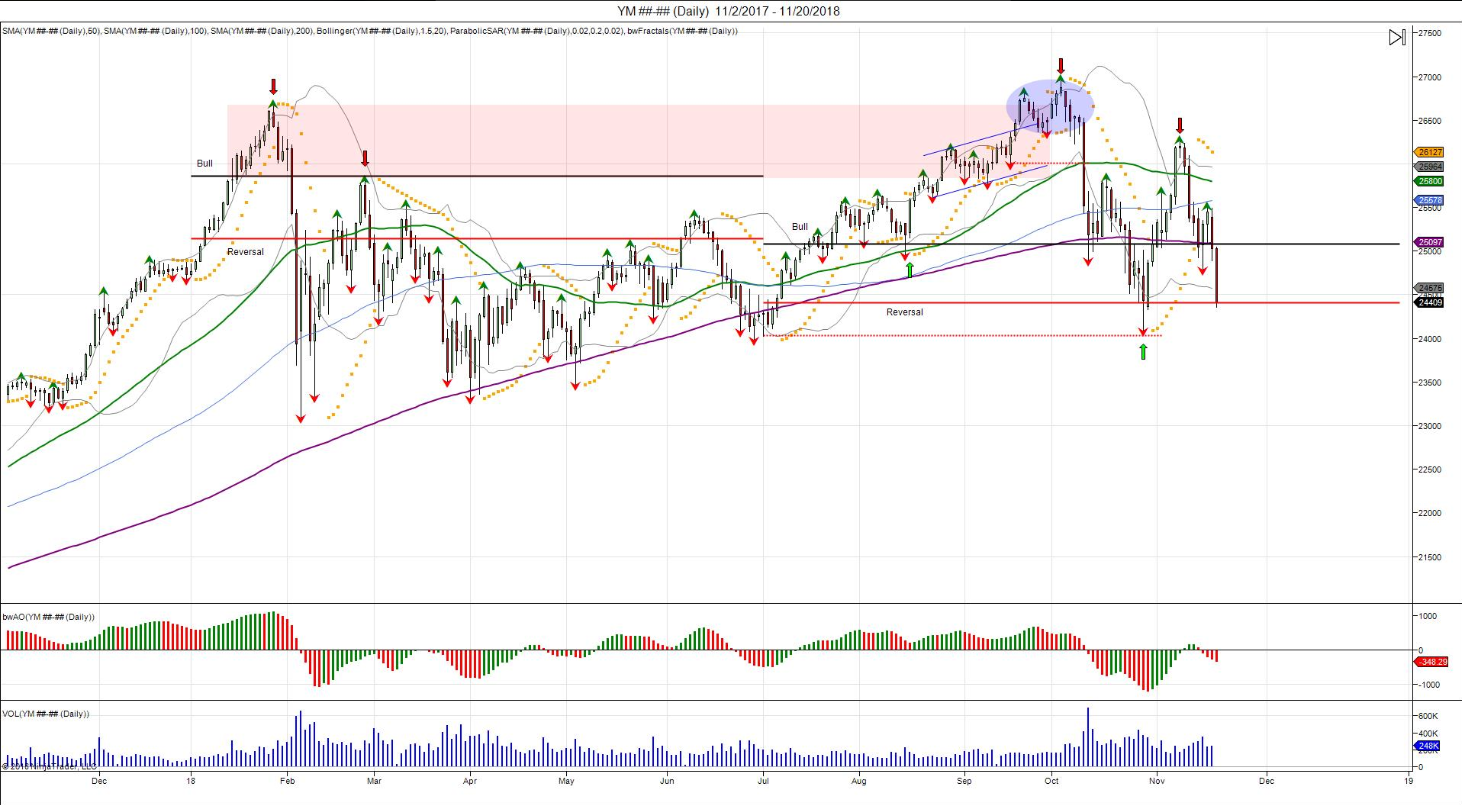

Chart courtesy of @Chicagostock – $YM_F Last month the Dow successfully tested and held the July low as buyers defended the 6M reversal window to keep the 6M bull bias intact. Buyers failed to overcome the Sep trap, putting in a lower high. Failure to hold reversal window opens door to stops

After selling off in Monday’s overnight session and into yesterday’s early morning, trading as low as 2650.75, down -45.00 handles, the S&P 500 futures opened Tuesday’s regular session at 2654.25. The first move after the bell was down the early morning low at 2649.75 in the opening minutes, followed by a rally to the morning high at 2661.50 less than 15 minutes into the session. From there the markets turned and heavy, with sell programs pulling the benchmark equity futures down to 2641.00 just before 9:00, then after a 9.75 bounce, down to a new morning low at 2633.75 just after 9:15.

From there, strong sell programs turned into strong buys, as bulls found attractive levels to bid, and in short order the ES rallied up to 2661.25. After a five handle pullback, the ES relaunched to push up to 2668.25 for the mid morning high, and then drifted down to 2648.75, before rallying to what would be the high of day at 2760.75 at 11:00.

Midday saw a pullback that lasted into the late afternoon in a very choppy fashion that would see a lot of back and forth motion with lower highs and lower lows. Eventually the ES broke the lows and made it down to a new low of day at 2631.75 early in the final hour, before rallying up to 2651.25 for the late afternoon high, then printing 2642.50 on the 3:00 cash close, and settling the day at 2640.50, down -55.75 handles, or -2.05%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.