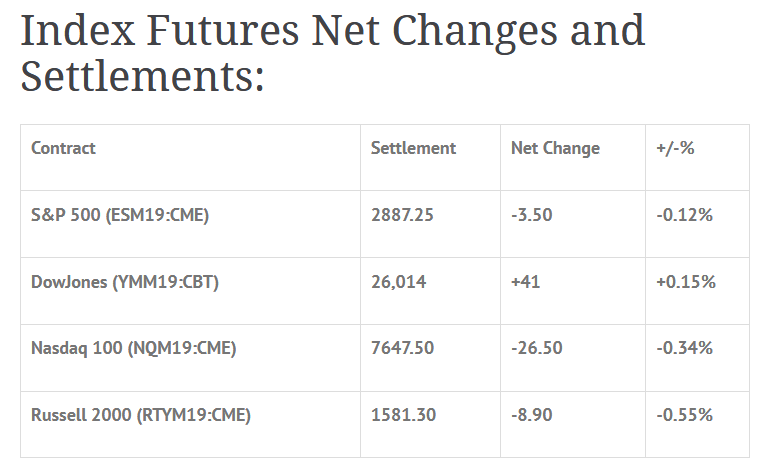

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -1.48%, Hang Seng -2.39%, Nikkei -0.93%

- In Europe 13 out of 13 markets closed lower: CAC -1.15%, DAX -0.79%, FTSE -0.26%

- Fair Value: S&P +0.47, NASDAQ +9.04, Dow -16.78

- Total Volume: 2.03 million ESM & 122 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes International Trade 8:30 AM ET, Jobless Claims 8:30 AM ET, PPI-FD 8:30 AM ET, Jerome Powell Speaks 8:30 AM ET, Wholesale Trade 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Raphael Bostic Speaks 10:45 AM ET, Charles Evans Speaks 1:15 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

Free Webinar, Limited SPOTS! News, News, News

Volatility and volume tend to shrink as we move into the summer months. That makes news movements even more poignant. Finding a source for market-moving news is tantamount for trading or hedging risk.

Signup Free Webinar

S&P 500 Futures: Headline Algo’s Take Over

During Tuesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2899.50, a low of 2868.75, and opened Wednesday’s regular trading hours at 2879.75.

After the 8:30 CT bell, the ES made a quick dip down to 2873.00, which would hold as the RTH low for the rest of the day, and started a slow steady grind higher. The only real action came after a few headlines hit the tape regarding China trade tariffs. Other than that, it was pretty textbook for the session after a trend day. Like we say here at MrTopStep, the S&P tends to go sideways to higher after a big down day.

By 10:00, the futures had traded up to 2898.75, just short of the Globex high, and then drifted sideways for the rest of the day. When the 2:45 cash imbalance reveal came out showing $435M to sell, the ES was trading at 2890.75. It would then go on to print 2880.25 on the 3:00 cash close, and 2886.50 on the 3:15 futures close.

In the end, the overall tone of the ES was firm. In terms of the days overall trade, total volume was high, with just over 2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.