Last year’s coronavirus stock market crash turned into a big opportunity for active investors to buy stocks at deep discounts – especially COVID-friendly stocks.

Since the March 2020 crash low, stocks have rallied sharply for 11 months. And this rally has a couple of important stock market indices testing important resistance levels.

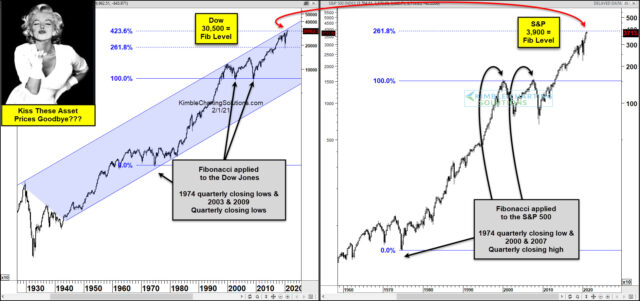

In today’s chart, we examine these stock indices: the Dow Jones Industrial Average and S&P 500 Index. And we apply Fibonacci principles to long-term historical charts.

As you can see, when we use Fibonacci analysis on the 1974 and 2003/2009 lows, we get a 423.6% Fibonacci extension level at 30,500. This is a huge stretch breakout/resistance level. And it’s being tested right now.

At the same time, the S&P 500 is testing a key Fibonacci level. When using the 1974 low and 2000/2007 closing high, you get a 261.8 Fibonacci extension level at 3900. And, it’s being tested right now, too.

I’ve never seen fib levels from such key long-term highs and lows potentially come together like this.

With the trend being up for stocks, these Fibonacci price levels become 45-year breakout tests.

If breakouts take place, look for much higher stock prices.