On analysis of the movements of S&P 500 futures, in different time frames, I find that S&P 500 looks ready to repeat the moves what it showed on September 30th, 2019 once again on October 30, 2019; which makes it a strong sell from the current levels for a target at 2947 before November 8, 2019. I find that Chinese haggling just before the final deal on tariff trade war front confirms a sliding move in U.S. equity indices till the weekly closing.

Trading Strategy: Short position

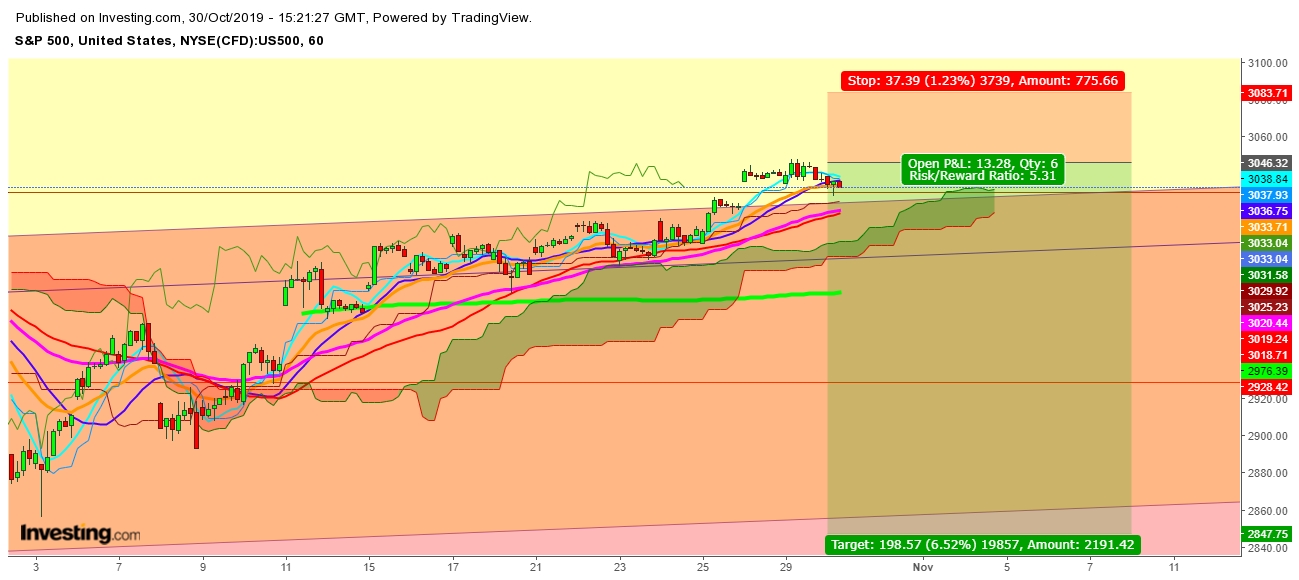

Entry Level : 3035 – 3045

Stop Loss : 3060 – 3080

Target (NYSE:TGT): 2935 – 2945

Risk : 20 points

Reward : 100 points

Risk/Reward : 1:5

Finally, I conclude that this delay in sealing a 15-month Sino-U.S. trade deal may result in heavy sell off amid growing skepticism over the success in finally sealing a trade deal; which will extend quantum of currently prevailing global economic slowdown fear, while the weak Chinese economic data confirms the continuity of this bearish trend in global equity markets. Watch my upcoming videos on S&P 500.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.